When you apply for insurance—whether it’s for your car, home, health, or life—the approval and pricing of your policy are not random decisions. Behind the scenes, an insurance underwriter plays a crucial role in determining whether you qualify for coverage, how much risk you pose to the insurer, and what premium you should pay. Underwriters carefully evaluate various factors, such as your health history, financial standing, driving record, and even geographic location, to assess the likelihood of a claim being made. By using specialized software, actuarial data, and risk models, they help insurance companies strike a balance between offering fair coverage to policyholders and maintaining profitability. This article explores the role of insurance underwriters, their risk assessment process, and how they set premiums to keep the insurance industry stable and sustainable.

What is an Insurance Underwriter?

An insurance underwriter is a professional responsible for evaluating the risks associated with insuring individuals, businesses, or assets. Their primary role is to determine whether an applicant qualifies for insurance coverage and, if so, under what terms. By analyzing various risk factors—such as health history for life insurance, driving records for auto insurance, or property conditions for homeowners insurance—underwriters assess the likelihood of a claim being made. They use actuarial data, statistical models, and specialized underwriting software to make informed decisions about policy approvals, exclusions, and premium pricing. Essentially, underwriters act as gatekeepers for insurance companies, ensuring that policies are issued at rates that reflect the true level of risk while maintaining the financial stability of the insurer.

The Role of an Insurance Underwriter

Insurance underwriters serve as the decision-makers in the insurance approval process. They assess applications, analyze risk factors, and determine whether an insurance company should provide coverage and at what cost. Their work ensures that insurers remain financially stable while offering fair premiums to policyholders. By carefully balancing risk and profitability, underwriters play a crucial role in the sustainability of the insurance industry.

Key Responsibilities of an Insurance Underwriter

1. Evaluating Applications: Reviewing policy applications to assess the level of risk involved.

2. Analyzing Risk Factors: Considering factors like age, medical history, credit score, or driving records.

3. Using Underwriting Software: Leveraging data analytics and actuarial models to make risk assessments.

4. Approving or Denying Coverage: Deciding whether to offer insurance or modify terms based on risk evaluation.

5. Setting Premiums: Calculating appropriate pricing to balance risk and profitability.

6. Collaborating with Actuaries and Agents: Working with other insurance professionals to refine risk models and adjust policies.

7. Monitoring Policy Renewals: Reviewing existing policies to reassess risk and adjust premiums as necessary.

8. Ensuring Compliance: Adhering to industry regulations and company guidelines when evaluating risks.

Types of Insurance Underwriting

Types of Insurance Underwriting

Insurance underwriting is a crucial process that helps insurers assess risk before issuing policies. It ensures that the insurance company maintains a sustainable balance between covering risks and staying profitable. Different types of underwriting exist, each tailored to specific insurance products such as life, health, auto, and commercial policies. Underwriters use a combination of historical data, actuarial models, and technology to evaluate applicants and determine appropriate coverage, terms, and premiums. Below are the key types of insurance underwriting and how they work.

1. Life Insurance Underwriting

Life insurance underwriting focuses on assessing an applicant’s life expectancy and risk factors that could lead to premature death. Underwriters evaluate age, medical history, lifestyle habits (such as smoking, drinking, or extreme sports), and family health background. Policies may require medical exams, blood tests, or detailed questionnaires. Some insurers offer simplified or guaranteed issue policies that skip medical exams but come with higher premiums due to the unknown risks.

2. Health Insurance Underwriting

Health insurance underwriters assess an individual’s medical condition, history of illnesses, and risk of future medical expenses. While the Affordable Care Act (ACA) prohibits denying coverage due to pre-existing conditions, underwriting still plays a role in determining premium rates and plan structures. Factors such as age, lifestyle, and medical usage patterns help underwriters set fair pricing while ensuring the insurer can cover claims effectively.

3. Property Insurance Underwriting

This type of underwriting applies to homeowners, renters, and commercial property insurance. Underwriters evaluate the condition, age, and location of a property to assess its vulnerability to damages from natural disasters, fires, or other perils. Homes in high-risk zones (such as flood-prone areas) may face higher premiums or require additional coverage. The presence of safety features like fire alarms, sprinkler systems, and secure locks can help lower risks and premiums.

4. Auto Insurance Underwriting

Auto insurance underwriters assess the likelihood of a driver filing a claim based on several factors, including driving history, past accidents, traffic violations, credit score, and even vehicle type. New technologies like telematics allow insurers to track driving behavior in real time, rewarding safe drivers with lower premiums while increasing rates for risky drivers.

5. Commercial Insurance Underwriting

Businesses face unique risks depending on their industry, size, and operations. Underwriters evaluate factors such as workplace hazards, financial health, claims history, and compliance with safety regulations. This type of underwriting is crucial for policies such as general liability, workers’ compensation, and business property insurance. High-risk industries, such as construction or manufacturing, may have stricter underwriting requirements and higher premiums.

6. Reinsurance Underwriting

Reinsurance underwriting helps insurance companies manage their own risks by spreading large or catastrophic claims across multiple insurers. Reinsurance underwriters evaluate the financial health of primary insurers, their risk portfolios, and historical claims data. By taking on part of the risk, reinsurance helps insurers stay solvent in the event of massive losses, such as those caused by hurricanes, wildfires, or economic downturns.

How Insurance Underwriters Assess Risk

Insurance underwriters use a systematic approach to evaluate the level of risk associated with each applicant before approving coverage. They analyze various factors such as health conditions, financial stability, property conditions, and driving history to determine the likelihood of future claims. By leveraging actuarial data, statistical models, and advanced software, underwriters make informed decisions about policy approvals, premium rates, and coverage terms. The goal is to ensure that insurers maintain profitability while offering fair and adequate coverage to policyholders. Below is a table outlining key risk factors considered in different types of insurance underwriting.

Risk Assessment Factors in Insurance Underwriting

| Type of Insurance | Key Risk Factors Considered | Impact on Premiums & Coverage |

| Life Insurance | Age, medical history, family health background, lifestyle habits (e.g., smoking, drinking), occupation, risky hobbies (e.g., skydiving) | Higher risk factors lead to increased premiums or limited coverage. |

| Health Insurance | Pre-existing conditions, age, medical records, frequency of doctor visits, medications, occupation, lifestyle habits | Chronic conditions may result in higher premiums or policy exclusions. |

| Auto Insurance | Driving history, accident records, traffic violations, vehicle type, usage (personal/commercial), credit score, location | Safe drivers receive lower premiums, while high-risk drivers face higher costs. |

| Property Insurance | Home age, location (flood/fire-prone areas), construction materials, security features, prior claims, neighborhood crime rate | Homes in high-risk areas or with poor maintenance may face higher premiums or policy limitations. |

| Commercial Insurance | Industry risk, business financials, claims history, safety measures, employee risk exposure | High-risk businesses (e.g., construction) may require specialized coverage at higher rates. |

| Reinsurance | Portfolio risk exposure of primary insurer, historical claims data, financial stability of insurer | Helps spread risk among multiple insurers to prevent financial strain from major claims. |

The Process of Underwriting and Setting Premiums

The underwriting process begins when an applicant submits an insurance application, triggering a detailed risk assessment by the underwriter. The underwriter reviews personal, financial, and historical data relevant to the type of insurance being applied for, such as medical records for life insurance, driving history for auto insurance, or property condition for homeowners insurance. Using a combination of actuarial models, statistical data, and automated underwriting software, they evaluate the likelihood of a claim being filed. Based on this assessment, the underwriter decides whether to approve or deny coverage, impose exclusions, or adjust policy terms. Once the risk level is determined, they calculate the premium—ensuring it reflects the applicant’s risk profile while maintaining the insurer’s profitability. Factors such as credit score, claim history, lifestyle habits, and even geographic location can influence premium rates. The final policy is then issued with clearly defined terms, conditions, and pricing, balancing fair coverage for the policyholder and sustainable risk management for the insurer.

The Tools and Technologies Used in Underwriting

Insurance underwriting has evolved significantly with the advancement of technology, enabling underwriters to assess risks more accurately and efficiently. Modern tools and technologies help automate data analysis, improve decision-making, and enhance risk prediction. From artificial intelligence and predictive analytics to automated underwriting software, these innovations allow insurers to process applications faster and set premiums more precisely. Below are some of the key tools and technologies used in underwriting today.

Key Tools and Technologies in Underwriting

1. Automated Underwriting Software: Uses algorithms to instantly assess risk based on predefined criteria, reducing manual workload and speeding up policy approvals.

2. Artificial Intelligence (AI) & Machine Learning: AI-driven models analyze large datasets, identify patterns, and make data-driven underwriting decisions.

3. Predictive Analytics: Uses historical data to forecast future claims and refine risk assessment models.

4. Big Data & Data Analytics: Helps underwriters analyze vast amounts of structured and unstructured data, improving accuracy in risk evaluation.

5. Telematics & IoT (Internet of Things): Collects real-time data from smart devices, such as telematics for auto insurance, to customize premiums based on actual behavior.

6. Credit Scoring & Financial Analysis Tools: Assesses the financial stability of applicants to determine their likelihood of maintaining premium payments and filing claims.

7. Geospatial & Environmental Risk Mapping: Analyzes location-based risks like flood zones, wildfire-prone areas, or earthquake susceptibility for property underwriting.

8. Blockchain Technology: Enhances data security and transparency by creating immutable records of underwriting decisions and policyholder information.

9. Robotic Process Automation (RPA): Automates repetitive underwriting tasks, such as document verification and application screening, improving efficiency.

10. Cloud Computing & Digital Platforms: Provides seamless access to underwriting tools and enables data sharing across different insurance teams.

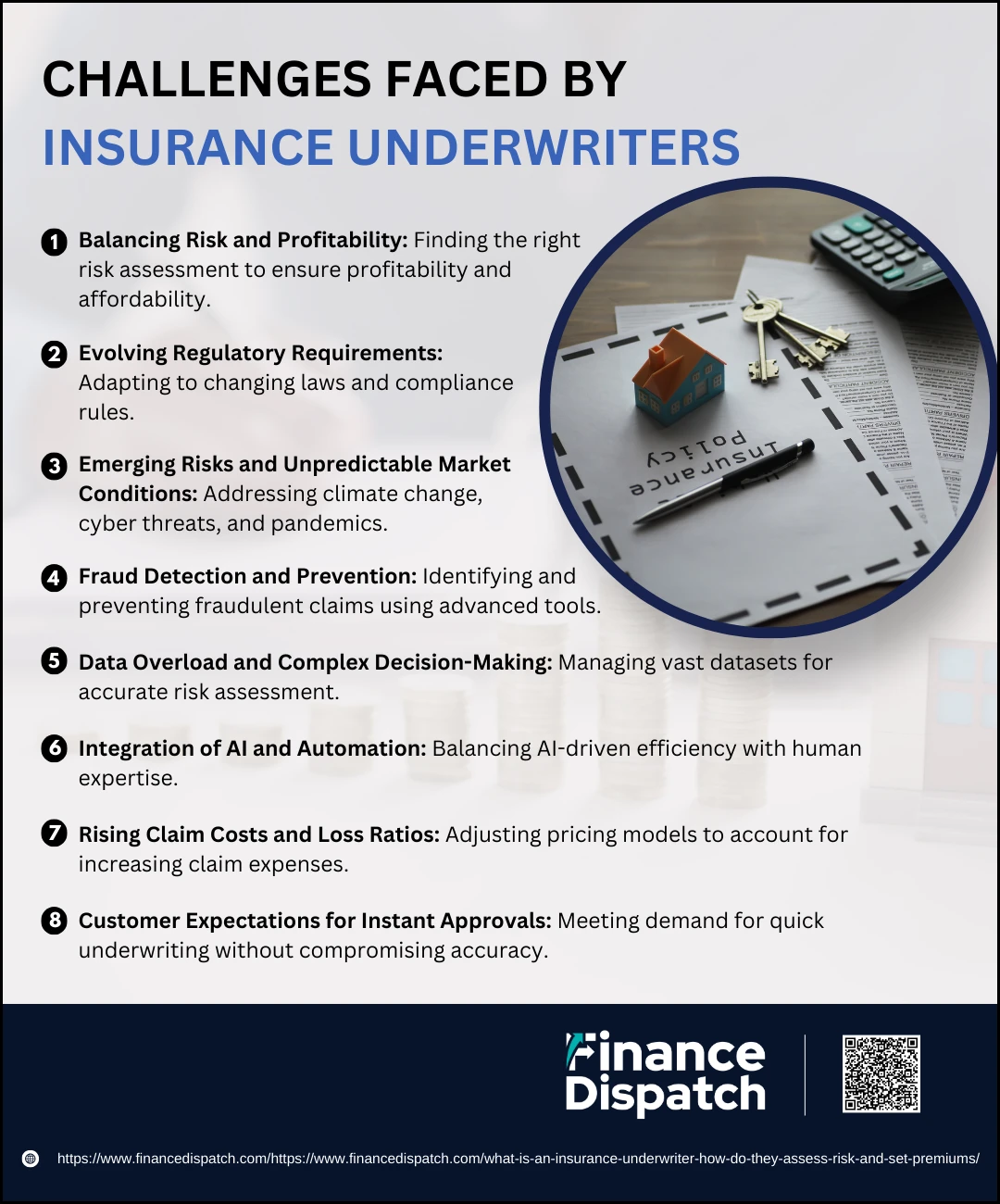

Challenges Faced by Insurance Underwriters

Challenges Faced by Insurance Underwriters

Insurance underwriting is a complex and dynamic profession that requires a balance between risk assessment, regulatory compliance, and technological adaptation. Underwriters must evaluate potential policyholders accurately while ensuring that insurance companies remain profitable and competitive. However, with evolving risks, fraud concerns, and customer expectations for fast approvals, underwriters face several challenges that impact their decision-making processes. Below are the key challenges that insurance underwriters encounter in today’s fast-changing insurance landscape.

1. Balancing Risk and Profitability

One of the primary responsibilities of an insurance underwriter is to assess risk and determine whether to approve, deny, or modify an insurance application. If the risk is underestimated, the insurer may face financial losses due to high claim payouts. On the other hand, overestimating risk can lead to excessively high premiums that discourage customers from purchasing policies. Underwriters must find the right balance to maintain both profitability and customer satisfaction.

2. Evolving Regulatory Requirements

Insurance laws and regulations are continuously changing, requiring underwriters to stay updated with new compliance guidelines. Governments and regulatory bodies impose strict rules to ensure fair underwriting practices, prevent discrimination, and protect consumers. Failure to comply with these regulations can lead to legal repercussions, fines, and reputational damage for insurance companies. Keeping up with these changes while ensuring compliance in underwriting decisions is a constant challenge.

3. Emerging Risks and Unpredictable Market Conditions

Traditional underwriting models are being challenged by new and emerging risks. Climate change has increased the frequency and severity of natural disasters, while cyber threats have created new concerns for businesses seeking insurance coverage. Additionally, pandemics like COVID-19 have highlighted the need for underwriters to reevaluate how they assess health and business interruption risks. Underwriters must continuously adapt their risk assessment strategies to keep up with these evolving threats.

4. Fraud Detection and Prevention

Insurance fraud remains a significant issue, costing insurers billions of dollars annually. Fraudulent claims, misrepresentation of information, and staged accidents can lead to financial losses for insurance companies. Underwriters must use sophisticated fraud detection tools, including artificial intelligence and big data analytics, to identify red flags and prevent fraudulent policies from being issued. Despite these tools, fraudsters continue to find new ways to exploit the system, making fraud prevention an ongoing challenge.

5. Data Overload and Complex Decision-Making

The availability of vast amounts of data has revolutionized underwriting, but it also presents challenges. Underwriters must sift through large datasets, including customer demographics, financial history, medical records, and property details, to make informed decisions. While data analytics tools help streamline the process, interpreting complex information and applying it effectively requires significant expertise. Making sense of vast amounts of data while ensuring accuracy in risk assessment is a challenge underwriters face daily.

6. Integration of AI and Automation

The rise of artificial intelligence (AI) and automation has transformed the underwriting process by reducing manual work and increasing efficiency. However, while automation speeds up decision-making, it also raises concerns about accuracy and fairness. AI models rely on historical data, which may include biases that can affect underwriting outcomes. Additionally, underwriters must learn to work alongside automated systems and ensure that human judgment is applied where necessary. Striking the right balance between AI-driven automation and human expertise remains a challenge.

7. Rising Claim Costs and Loss Ratios

Insurance companies have been experiencing rising claim costs due to inflation, increased medical expenses, higher vehicle repair costs, and frequent natural disasters. The loss ratio—the percentage of claims paid out compared to premiums collected—can increase significantly if underwriting decisions do not accurately account for these costs. Underwriters must continuously analyze industry trends and adjust pricing models to reflect the true cost of insuring policyholders while maintaining competitive rates.

8. Customer Expectations for Instant Approvals

In the digital age, customers expect quick and seamless insurance processes, including underwriting approvals. However, complex policies—such as those involving high-risk applicants or large commercial businesses—require detailed evaluations. While automation helps speed up simple underwriting decisions, complex cases still require manual reviews. Meeting the demand for faster approvals without compromising risk assessment quality is a constant challenge for underwriters.

Career Path & Qualifications for Insurance Underwriters

A career in insurance underwriting offers a structured path with opportunities for growth and specialization. Most insurance underwriters start with a bachelor’s degree in fields like finance, business, economics, or risk management, though some enter the industry with relevant experience or industry certifications. Entry-level underwriters typically undergo on-the-job training under the supervision of senior professionals, learning how to assess risk, use underwriting software, and interpret actuarial data. Many professionals pursue certifications such as the Chartered Property Casualty Underwriter (CPCU), Associate in Commercial Underwriting (AU), or Chartered Life Underwriter (CLU) to enhance their expertise and career prospects. As they gain experience, underwriters can advance to senior underwriting positions, specialize in areas like life, health, or commercial insurance, or move into leadership roles such as underwriting managers or risk analysts. The profession requires strong analytical skills, attention to detail, and decision-making abilities, along with the ability to adapt to evolving technology and regulations. With the increasing use of AI and predictive analytics in underwriting, professionals who stay updated with industry trends and digital tools will have a competitive edge in this dynamic field.

Conclusion

Insurance underwriting is a critical function that ensures the financial stability of insurance companies while providing fair coverage to policyholders. Underwriters play a key role in assessing risk, setting premiums, and maintaining a balance between profitability and competitive pricing. As the industry evolves, professionals must adapt to technological advancements, regulatory changes, and emerging risks such as cyber threats and climate change. A successful underwriting career requires a strong foundation in risk assessment, analytical skills, and continuous learning through certifications and industry experience. With automation and AI shaping the future of underwriting, professionals who embrace innovation and refine their expertise will continue to be valuable assets in the insurance sector. Ultimately, under writers serve as the gatekeepers of the industry, ensuring that both insurers and policyholders are protected in an ever-changing financial landscape.