Have you ever noticed how the same product can have different prices in different stores or online marketplaces? Imagine buying a smartphone for $500 in one country and selling it for $600 in another. That price difference represents a profit opportunity, and this concept is the foundation of arbitrage. In financial markets, arbitrage is a trading strategy where investors buy an asset in one market at a lower price and sell it in another market where the price is higher, capturing the difference as profit. Traders, known as arbitrageurs, use this technique across various assets, including stocks, currencies, commodities, and even cryptocurrencies. But how do they find these price gaps, and what strategies do they use to take advantage of them? In this article, we’ll break down the fundamentals of arbitrage, explore the different ways traders exploit price differences, and examine the risks and rewards of this time-sensitive strategy.

What is Arbitrage?

Arbitrage is a trading strategy that involves taking advantage of price differences for the same asset across different markets. It occurs when an asset, such as a stock, currency, or commodity, is priced lower in one market and higher in another, allowing traders to buy at the lower price and sell at the higher price to make a profit. This price discrepancy exists due to temporary inefficiencies in the market caused by factors like supply and demand, liquidity, or geographical variations. Arbitrage plays a crucial role in financial markets by helping align prices and ensuring market efficiency. However, these opportunities are often short-lived, as traders quickly act on them, leading prices to adjust and eliminate the difference. With advancements in technology and algorithmic trading, arbitrage has become highly competitive, requiring traders to act within milliseconds to capitalize on fleeting price gaps.

How Do Traders Exploit Price Differences Across Markets?

How Do Traders Exploit Price Differences Across Markets?

Traders exploit price differences across markets through arbitrage, a strategy that allows them to profit from temporary inefficiencies in asset pricing. These price discrepancies occur due to factors such as differences in supply and demand, variations in trading hours, currency exchange rates, and market regulations. Arbitrage opportunities exist in various forms, including stock market arbitrage, currency arbitrage, and retail arbitrage, among others. However, these price differences are usually short-lived, as markets quickly adjust once traders start taking advantage of them. To stay ahead, traders use advanced strategies, automated trading systems, and quick execution techniques to ensure they capitalize on these fleeting opportunities before they disappear. Below are the key ways traders exploit price differences across markets:

1. Identifying Market Inefficiencies

Markets are not always perfectly efficient, meaning that the same asset can trade at different prices across various platforms. Traders constantly monitor stocks, commodities, cryptocurrencies, and other assets to find discrepancies. These inefficiencies can result from temporary liquidity imbalances, delayed information updates, or regional supply and demand differences.

2. Using High-Frequency Trading (HFT) Algorithms

With the rise of technology, many traders use high-frequency trading (HFT) algorithms to scan multiple markets simultaneously and detect minor price differences within milliseconds. These automated trading bots execute trades instantly, ensuring that traders capitalize on arbitrage opportunities before other market participants react.

3. Engaging in Cross-Border Arbitrage

Price differences often exist between markets in different countries due to currency exchange rates, taxation, and varying regulations. For example, a stock may trade at a lower price on a European exchange compared to the U.S. due to currency fluctuations. Traders exploit these differences by buying assets in the cheaper market and selling them in the higher-priced one.

4. Executing Simultaneous Buy & Sell Orders

To reduce risk, traders execute buy and sell orders simultaneously across different markets. This ensures that they lock in profits without being exposed to sudden price fluctuations. In financial arbitrage, traders use sophisticated platforms to place these trades instantly to avoid delays that could wipe out potential gains.

5. Factoring in Transaction Costs and Market Fees

Arbitrage opportunities might seem profitable at first glance, but transaction costs, brokerage fees, and currency conversion charges can significantly impact overall returns. Successful traders carefully calculate these costs to determine if a trade remains profitable after deducting all associated expenses.

6. Leveraging News-Based Arbitrage

Breaking news, earnings reports, economic data releases, and geopolitical events can cause temporary price differences in financial markets. News-based arbitrage traders act quickly to buy undervalued assets before the broader market adjusts prices to reflect the new information.

7. Exploiting Trading Hours and Market Gaps

Different stock exchanges around the world operate in different time zones, meaning that prices in one region can influence prices in another. For example, if a company announces positive earnings after the U.S. stock market closes, its shares might open at a significantly higher price in European or Asian markets. Traders who anticipate these changes can profit from the gap in pricing.

8. Participating in Statistical Arbitrage

Some traders rely on quantitative models and historical price data to predict temporary mispricing between correlated assets. Statistical arbitrage involves identifying pairs of securities that historically move together but temporarily deviate, allowing traders to bet on their prices realigning.

9. Utilizing Retail and Cryptocurrency Arbitrage

Retail arbitrage involves purchasing goods at lower prices in one market (such as a clearance sale in a physical store) and reselling them online for a profit. Similarly, cryptocurrency arbitrage takes advantage of price differences between different crypto exchanges, where Bitcoin, Ethereum, or other cryptocurrencies may trade at varying prices due to supply and demand fluctuations.

10. Managing Risk and Speed in Arbitrage Trading

Since arbitrage profits often rely on small price gaps, traders must execute large volumes of trades quickly. Delays, liquidity shortages, and sudden market corrections can eliminate profits or result in losses. To mitigate risks, experienced traders use risk management tools, hedging strategies, and diversification techniques to ensure consistent gains while avoiding potential pitfalls.

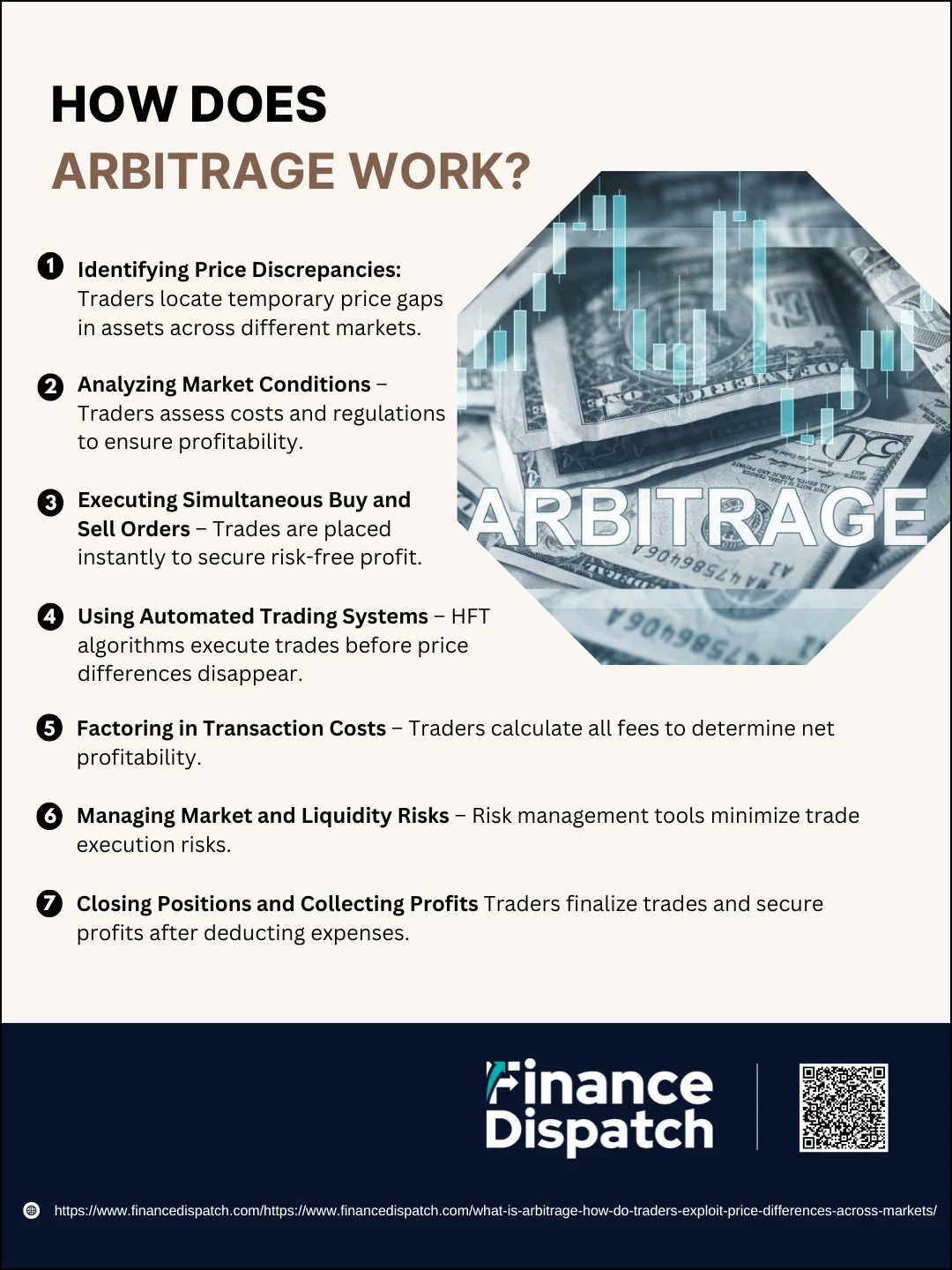

How Does Arbitrage Work?

How Does Arbitrage Work?

Arbitrage is a trading strategy that involves buying an asset in one market at a lower price and selling it in another market at a higher price to profit from the price difference. These opportunities arise due to temporary inefficiencies in markets, such as variations in supply and demand, exchange rates, or trading hours. However, arbitrage opportunities are usually short-lived as market forces quickly adjust the prices. Traders use advanced technology, automation, and precise execution strategies to capitalize on these fleeting differences. Below are the key steps that explain how arbitrage works.

1. Identifying Price Discrepancies

Arbitrage begins with identifying temporary price differences in the same asset across different markets. These discrepancies can exist due to trading delays, exchange rate fluctuations, or differences in market liquidity.

2. Analyzing Market Conditions

Before executing a trade, arbitrageurs analyze various factors, including transaction costs, taxes, and regulatory fees, to ensure that the price difference is large enough to generate a net profit.

2. Executing Simultaneous Buy and Sell Orders

To minimize risk, traders place simultaneous buy and sell orders in different markets. This ensures that they lock in a risk-free profit before the market corrects itself.

4. Using Automated Trading Systems

Many professional traders use high-frequency trading (HFT) algorithms and automated bots to execute arbitrage trades within milliseconds. These systems scan multiple markets in real time and execute trades before price differences disappear.

5. Factoring in Transaction Costs

Successful arbitrage requires considering all associated costs, such as brokerage fees, currency conversion fees, and transfer costs. If these costs outweigh the potential profit, the trade is not viable.

6. Managing Market and Liquidity Risks

Arbitrage trading is not entirely risk-free. Slippage, trade execution delays, and liquidity issues can impact profitability. Traders use risk management tools and hedging techniques to minimize exposure.

7. Closing Positions and Collecting Profits

Once the buy and sell trades are completed, the arbitrageur pockets the difference between the two prices after deducting transaction costs. This process is repeated multiple times across various assets and markets.

Types of Arbitrage

Types of Arbitrage

Arbitrage is a trading strategy that allows investors to profit from price differences in various markets. While the basic principle of arbitrage remains the same—buying an asset in one market at a lower price and selling it in another at a higher price—there are several types of arbitrage, each tailored to different financial instruments and market conditions. Below are the most common types of arbitrage traders use to exploit market inefficiencies.

1. Retail Arbitrage

Retail arbitrage involves purchasing products at a lower price from physical stores or online marketplaces and reselling them at a higher price on another platform. This is common in e-commerce, where resellers buy discounted goods from clearance sales and sell them at a profit on platforms like Amazon or eBay.

2. Spatial Arbitrage

This form of arbitrage takes advantage of price differences between geographically separated markets. Traders buy assets in regions where they are cheaper and sell them in areas where demand is higher, considering shipping and import/export costs.

3. Currency Arbitrage (Triangular Arbitrage)

Currency arbitrage occurs when traders exploit exchange rate differences between three different currencies. By converting currency A to currency B, then to currency C, and back to currency A, traders can generate risk-free profits from pricing inefficiencies in forex markets.

4. Statistical Arbitrage

This type of arbitrage relies on mathematical models and historical price data to predict short-term mispricing in assets. It often involves trading correlated securities and is widely used by hedge funds and institutional traders.

5. Merger Arbitrage (Risk Arbitrage)

Merger arbitrage occurs when traders speculate on the stock price movements of companies involved in mergers or acquisitions. The trader buys shares of a company being acquired (typically at a discount) and profits once the deal is finalized. However, if the merger fails, there is a risk of financial loss.

6. Latency Arbitrage

Latency arbitrage takes advantage of millisecond delays in market price updates. Traders with faster internet connections and access to high-frequency trading (HFT) algorithms execute trades before slower competitors, profiting from brief price discrepancies.

7. Convertible Arbitrage

This strategy involves buying a convertible bond (a bond that can be converted into stock) while simultaneously short-selling the company’s stock. The goal is to profit from price misalignments between the bond and the stock.

8. Futures Arbitrage

Futures arbitrage occurs when traders exploit price differences between spot prices and futures contract prices. If a commodity is selling for a lower price in the spot market than in the futures market, traders can buy the asset now and sell the futures contract at a profit.

9. Dividend Arbitrage

Dividend arbitrage is used in options trading. Traders buy a stock right before the ex-dividend date and simultaneously sell a call option to profit from the expected dividend payout.

10. Cryptocurrency Arbitrage

Due to variations in demand and liquidity, cryptocurrencies can trade at different prices across exchanges. Crypto arbitrage involves buying a digital asset like Bitcoin on one exchange where it’s cheaper and selling it on another where the price is higher.

Examples of Arbitrage in Action

Arbitrage is a widely used trading strategy that allows individuals and businesses to profit from temporary price differences across different markets. These opportunities exist in financial markets, retail, real estate, and even sports betting. While arbitrage is often associated with stock trading, it can be applied in various industries where price gaps occur due to inefficiencies. Below are some real-world examples of arbitrage in action.

- Retail Arbitrage – A reseller buys a popular toy at a local store for $10 and sells it on Amazon for $25, making a profit after deducting fees and shipping costs.

- Cryptocurrency Arbitrage – Bitcoin may be priced at $30,000 on one exchange but $30,500 on another. A trader can buy at the lower price and sell on the higher-priced exchange for a quick profit.

- Currency Arbitrage – A trader finds that 1 USD equals 0.85 EUR in one market but 0.86 EUR in another. By exchanging large sums of money strategically, they make a profit from this small discrepancy.

- Stock Market Arbitrage – A stock is trading at $50 on the New York Stock Exchange (NYSE) but at $50.20 on the London Stock Exchange. A trader buys the stock in New York and sells it in London to capture the price difference.

- Futures Arbitrage – The price of gold in the spot market is lower than its price in the futures market. A trader buys gold now and simultaneously sells a gold futures contract, locking in a risk-free profit.

- Merger Arbitrage – When a company announces an acquisition at a premium price, traders buy shares of the target company before the deal is finalized, profiting when the stock price moves closer to the acquisition price.

- Real Estate Arbitrage – A real estate investor purchases a property in a developing neighborhood for $200,000 and sells it for $250,000 a year later after the area gains popularity.

- Ticket Arbitrage – A sports event is selling tickets for $50, but demand increases, and resale platforms list them for $100. A ticket reseller buys at face value and sells at the higher price for a profit.

- Sports Betting Arbitrage – A bettor finds different odds for the same match across multiple bookmakers. By strategically placing bets on all possible outcomes, they guarantee a profit regardless of the result.

- Latency Arbitrage – High-frequency traders use advanced algorithms to execute trades faster than competitors, profiting from price discrepancies that exist for milliseconds before markets adjust.

Benefits of Arbitrage

Benefits of Arbitrage

Arbitrage is a key trading strategy that helps traders, investors, and businesses generate profits by exploiting price differences in different markets. Beyond financial gains, arbitrage also plays a crucial role in enhancing market efficiency and ensuring fair pricing across global markets. While arbitrage opportunities are often short-lived, those who act quickly and strategically can benefit significantly. Below are some of the major advantages of arbitrage.

1. Low-Risk Profit Opportunities

Unlike speculative trading, arbitrage typically involves simultaneous buying and selling, minimizing exposure to market fluctuations. This makes it one of the lowest-risk profit-making strategies in financial markets.

2. Market Efficiency Improvement

Arbitrage traders help eliminate pricing inefficiencies by taking advantage of temporary price differences. Their activities push prices toward equilibrium, ensuring assets are fairly valued across markets.

3. Increased Market Liquidity

Since arbitrage involves frequent trading, it contributes to higher liquidity in financial markets. Increased liquidity reduces bid-ask spreads, making it easier for all traders to buy and sell assets at fair prices.

4. Accessibility to Various Markets

Arbitrage is not limited to financial markets—it can be applied in retail, real estate, cryptocurrency, and even sports betting. This flexibility allows traders and businesses to explore multiple income streams.

5. Profitable Even in Volatile Markets

Unlike traditional investing, where market volatility can lead to losses, arbitrage can thrive in volatile environments. Price fluctuations create arbitrage opportunities that traders can exploit for consistent gains.

6. Leverages Advanced Technology

With the rise of algorithmic trading and AI-driven models, arbitrage has become more efficient. Automated systems can scan multiple markets and execute trades in milliseconds, maximizing profit potential.

7. Helps Traders Diversify Income

Since arbitrage opportunities exist across multiple asset classes—stocks, forex, commodities, cryptocurrencies, and derivatives—traders can diversify their strategies and reduce overall risk.

8. Can Be Scaled for Higher Returns

While arbitrage profits per transaction may be small, traders can scale up by increasing trade volumes, using leverage, or applying automated trading to capitalize on multiple opportunities at once.

9. Provides Hedging Opportunities

Some traders use arbitrage as a hedging strategy to offset risk in their primary investments. By engaging in arbitrage, they can balance their portfolio and minimize potential losses.

10. Encourages Fair Pricing in Global Markets

By eliminating price discrepancies, arbitrage ensures that no market remains underpriced or overpriced for too long, benefiting both traders and everyday consumers by stabilizing prices.

Risks and Challenges of Arbitrage

Risks and Challenges of Arbitrage

While arbitrage is often considered a low-risk trading strategy, it is not without its challenges. Traders must act quickly to capitalize on price discrepancies before markets adjust. Additionally, factors such as transaction costs, market volatility, and regulatory restrictions can significantly impact profitability. Understanding these risks is essential for anyone looking to engage in arbitrage successfully. Below are some of the key risks and challenges associated with arbitrage trading.

1. Market Corrections Happen Quickly

Arbitrage opportunities are short-lived because markets self-correct as more traders exploit price gaps. The faster a trader identifies and executes a trade, the greater the chance of making a profit.

2. Transaction Costs Can Eat Into Profits

Brokerage fees, exchange fees, and currency conversion costs can reduce or eliminate arbitrage profits. Successful traders must calculate these costs before executing trades.

3. High Competition from Institutional Traders

Large hedge funds and financial institutions use advanced algorithms and high-frequency trading (HFT) systems to detect arbitrage opportunities within milliseconds, making it harder for individual traders to compete.

4. Execution Risk Due to Trade Delays

Even a small delay in executing an arbitrage trade can result in missing the price difference. Network latency, software glitches, or slow order processing can lead to financial losses.

5. Liquidity Risks in Certain Markets

Arbitrage relies on the ability to buy and sell an asset quickly. If a market lacks liquidity, traders may struggle to execute one side of the trade at the desired price, leading to slippage or losses.

6. Regulatory and Legal Restrictions

Some countries impose restrictions on cross-border trading, currency transactions, and short-selling, which can prevent arbitrageurs from fully capitalizing on price differences. Compliance with regulations is crucial.

7. Unexpected Market Movements

Sudden price changes due to news events, economic data releases, or geopolitical issues can turn an arbitrage opportunity into a loss if trades are not executed simultaneously.

8. Currency and Exchange Rate Risks

For traders engaging in cross-border arbitrage, fluctuations in foreign exchange rates can affect profits. Changes in exchange rates may offset potential gains, leading to unexpected losses.

9. Need for Advanced Technology and Data Access

Arbitrage trading requires access to real-time market data, automated trading software, and high-speed internet connections. Without these tools, traders may struggle to execute trades before the market corrects itself.

10. Counterparty Risks in Arbitrage Transactions

In some cases, arbitrage trades involve third parties, such as exchanges or brokers. If a counterparty defaults or fails to honor the trade, it can lead to significant losses.

Role of Technology in Arbitrage

Technology has revolutionized arbitrage trading, making it faster, more efficient, and highly competitive. With the advent of high-frequency trading (HFT), artificial intelligence (AI), machine learning, and blockchain technology, traders can now execute arbitrage opportunities within milliseconds. Automated trading algorithms scan multiple markets in real time, identifying price discrepancies and executing trades instantly before markets self-correct. Additionally, cloud computing, big data analytics, and API integration have enhanced traders’ ability to access and process large volumes of financial data. Below is a table highlighting how different technologies impact arbitrage trading.

Technology’s Role in Arbitrage

| Technology | Impact on Arbitrage Trading |

| High-Frequency Trading (HFT) | Enables traders to execute arbitrage trades within milliseconds, reducing human intervention. |

| Artificial Intelligence (AI) | Uses predictive models to analyze historical price patterns and detect arbitrage opportunities. |

| Machine Learning | Continuously improves trade execution strategies by learning from past arbitrage trades. |

| Blockchain Technology | Reduces transaction delays and ensures transparency in cryptocurrency arbitrage. |

| Algorithmic Trading | Automates the arbitrage process, allowing instant buy/sell execution across multiple markets. |

| Cloud Computing | Provides scalable infrastructure for processing vast amounts of market data quickly. |

| Big Data Analytics | Helps traders analyze large datasets to identify market inefficiencies and potential price gaps. |

| API Trading Integration | Allows traders to connect directly to multiple exchanges, enabling real-time arbitrage execution. |

| Latency Optimization | Reduces network delays, ensuring that arbitrage trades are executed before price differences disappear. |

| Quantum Computing (Emerging Technology) | Expected to process complex arbitrage calculations at unprecedented speeds in the future. |

Is Arbitrage Legal and Ethical?

Arbitrage is generally legal in most financial markets, as it plays a crucial role in maintaining price efficiency and liquidity. Governments and financial regulators, such as the U.S. Securities and Exchange Commission (SEC) and the Financial Conduct Authority (FCA) in the UK, recognize arbitrage as a legitimate trading strategy that helps align prices across different exchanges. However, some forms of arbitrage, such as insider trading, front-running, and market manipulation, are illegal and can lead to severe penalties. Regulatory bodies monitor arbitrage activities to prevent unfair advantages and ensure transparency.

From an ethical standpoint, arbitrage exists in a gray area. While it corrects market inefficiencies and benefits the financial ecosystem, critics argue that high-frequency trading (HFT) arbitrage and latency arbitrage give institutional investors an unfair advantage over retail traders. Additionally, in retail arbitrage, brands and retailers may discourage resellers from profiting off discounted goods by implementing resale restrictions. Despite these concerns, most arbitrage strategies do not violate ethical standards as long as they adhere to market regulations and fair trading practices. Traders engaging in arbitrage should always ensure compliance with legal frameworks and ethical considerations to avoid regulatory scrutiny and reputational risks.

Conclusion

Arbitrage is a powerful trading strategy that allows individuals and institutions to capitalize on market inefficiencies and generate profits with relatively low risk. By buying assets in one market at a lower price and selling them in another where prices are higher, arbitrage traders help improve market efficiency, liquidity, and price alignment across global exchanges. While arbitrage is generally legal and plays a vital role in financial markets, traders must remain mindful of transaction costs, regulatory restrictions, and competition from high-frequency trading systems that can impact profitability. As technology continues to evolve, the landscape of arbitrage is becoming more sophisticated, requiring traders to leverage automation, AI, and big data analytics to stay ahead. Whether in financial markets, cryptocurrency, retail, or real estate, arbitrage remains a valuable tool for those who can identify and execute opportunities swiftly while staying compliant with ethical and legal standards.