Artificial Intelligence (AI) has emerged as a transformative force in the financial technology (FinTech) industry, revolutionizing how businesses manage operations, mitigate risks, and make critical decisions. By harnessing advanced algorithms and data-driven insights, AI enables financial institutions to analyze vast amounts of information, detect patterns, and automate complex tasks with remarkable precision. In the fast-evolving world of FinTech, AI not only enhances efficiency but also personalizes customer experiences, strengthens security, and improves the accuracy of financial decision-making. This article delves into the role of AI in FinTech, exploring its applications, benefits, and how it empowers businesses and individuals to make smarter, data-driven financial choices.

What is AI in FinTech?

Artificial Intelligence (AI) in FinTech refers to the integration of intelligent technologies into financial services to enhance efficiency, accuracy, and personalization. AI encompasses machine learning, natural language processing, and predictive analytics, allowing financial institutions to automate processes, analyze vast datasets, and derive actionable insights. By leveraging AI, FinTech companies can optimize operations such as fraud detection, credit scoring, customer service, and risk management. This technology not only streamlines workflows but also enables businesses to deliver tailored financial solutions, improving decision-making and customer satisfaction in a rapidly digitizing financial landscape.

Benefits of AI in FinTech for Financial Decision-Making

Artificial Intelligence (AI) has become a game-changer in the FinTech industry, empowering businesses to enhance decision-making processes and deliver more efficient, accurate, and customer-centric solutions. By integrating advanced data analysis and automation capabilities, AI is reshaping financial operations, enabling organizations to unlock greater potential in risk management, personalization, and scalability.

1. Improved Accuracy

AI enables FinTech companies to analyze vast and complex datasets with precision, reducing the likelihood of human errors. This capability is particularly critical in areas like credit scoring, fraud detection, and investment decision-making, where even minor inaccuracies can have significant consequences. For instance, AI algorithms can identify trends and anomalies that might be overlooked by traditional methods, ensuring more informed and reliable financial decisions.

2. Cost Efficiency

One of the most tangible benefits of AI in FinTech is its ability to reduce operational costs. By automating repetitive tasks such as data entry, customer onboarding, and compliance checks, AI minimizes the need for extensive manual labor. This not only decreases costs but also frees up human resources to focus on strategic initiatives, improving overall productivity and profitability.

3. Enhanced Fraud Detection

AI plays a crucial role in combating fraud by analyzing transaction patterns and identifying irregularities in real time. Advanced machine learning models are trained to detect suspicious behaviors, such as unauthorized access or unusual spending habits, and flag potential threats before they escalate. This proactive approach enhances the security of financial transactions, building trust among customers and stakeholders.

4. Personalized Financial Services

AI enables financial institutions to provide hyper-personalized services by analyzing customer data, such as spending patterns, financial goals, and risk tolerance. This allows FinTech companies to recommend tailored products and solutions, like customized investment strategies or savings plans, improving customer satisfaction and fostering loyalty.

5. Faster Decision-Making

In the fast-paced world of finance, timely decisions are crucial. AI’s ability to process real-time data allows institutions to quickly adapt to changing market conditions and customer needs. For example, AI-driven systems can assess loan applications, perform credit risk evaluations, or execute trades within seconds, significantly speeding up traditionally time-consuming processes.

6. Risk Mitigation

AI excels in identifying potential risks through predictive analytics. By analyzing historical data and current market trends, AI can forecast potential financial challenges, enabling organizations to take preemptive measures. This ability to anticipate risks enhances decision-making in areas such as investment planning, market entry strategies, and portfolio management.

7. Scalability

As businesses grow, managing increasing volumes of data and transactions can be challenging. AI-powered systems are inherently scalable, capable of handling large datasets and high transaction volumes without compromising speed or accuracy. This ensures consistent performance and allows businesses to meet the demands of a growing customer base.

8. Regulatory Compliance

Navigating the complex and ever-changing landscape of financial regulations is a significant challenge for FinTech companies. AI simplifies this process by automating compliance checks, monitoring transactions for adherence to regulations, and generating detailed reports. These capabilities not only ensure compliance but also reduce the risk of costly penalties and legal issues.

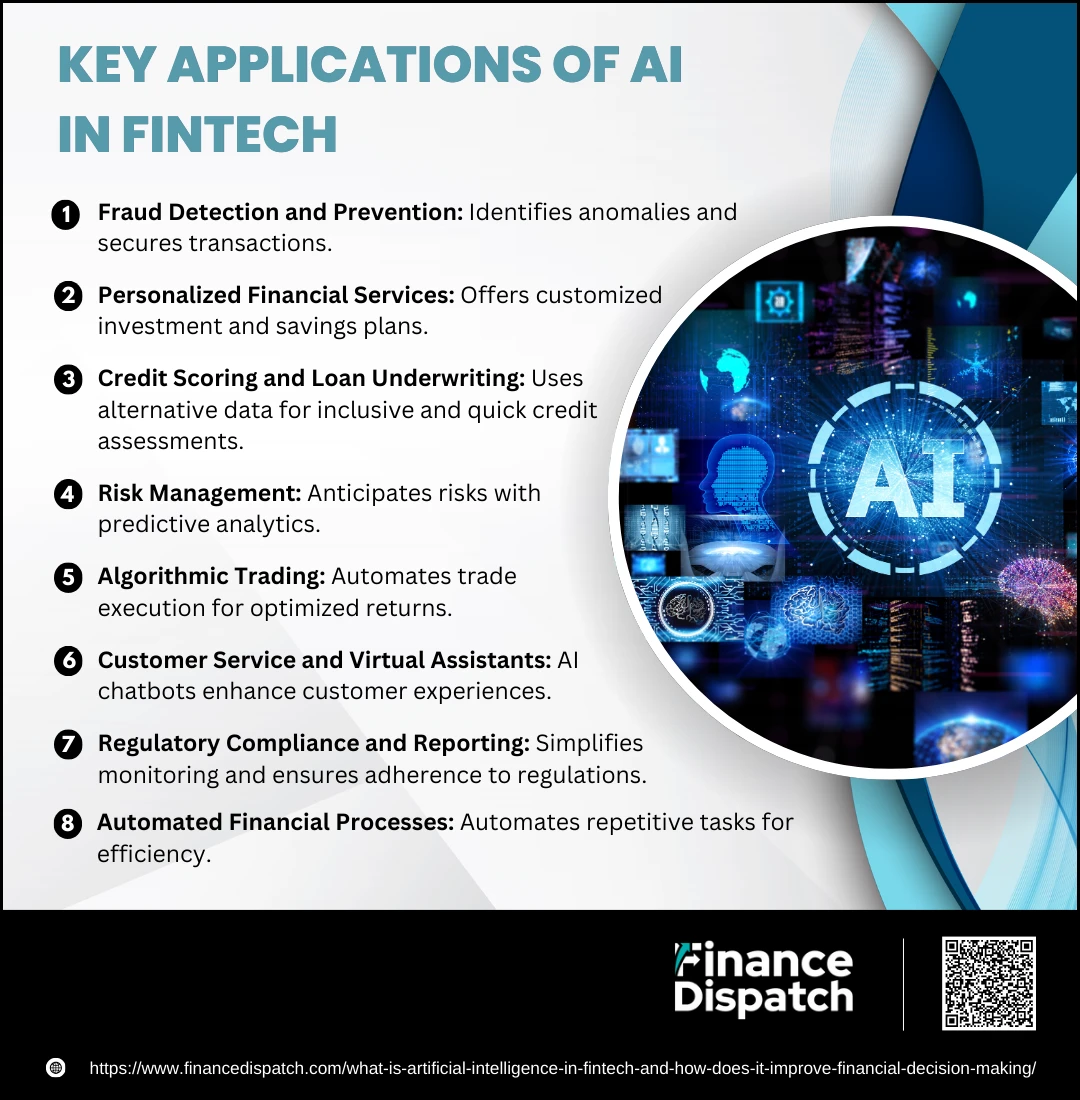

Key Applications of AI in FinTech

Artificial Intelligence (AI) has emerged as a cornerstone of innovation in the financial technology (FinTech) sector, enabling businesses to streamline operations, enhance decision-making, and provide superior customer experiences. By leveraging AI’s ability to process vast amounts of data and automate complex tasks, financial institutions are revolutionizing the way they operate, paving the way for smarter and more efficient financial ecosystems.

Key Applications of AI in FinTech

1. Fraud Detection and Prevention

AI algorithms excel at identifying patterns and anomalies in financial transactions that indicate fraudulent activities. For instance, machine learning models can detect unusual account behaviors, such as large withdrawals from unknown locations, and immediately flag them for review. This real-time fraud detection not only reduces financial losses but also strengthens customer trust by ensuring secure transactions.

2. Personalized Financial Services

Through data analysis, AI provides highly personalized financial solutions tailored to individual needs. For example, AI-powered systems analyze customer spending habits, financial goals, and risk tolerance to recommend investment portfolios or savings plans. This level of customization enhances customer satisfaction and loyalty, creating a more engaging user experience.

3. Credit Scoring and Loan Underwriting

Traditional credit scoring models rely on limited data, often excluding many potential borrowers. AI, however, uses alternative data sources—like utility payments, online behavior, and employment history—to assess creditworthiness. This broadens access to credit for underserved populations while streamlining the loan approval process, reducing processing time from days to minutes.

4. Risk Management

Predictive analytics, powered by AI, helps financial institutions anticipate and mitigate risks. AI systems analyze historical data and current market trends to identify potential threats, such as fluctuating market conditions or customer defaults. This enables businesses to take proactive measures, ensuring better stability and strategic planning.

5. Algorithmic Trading

AI-driven trading platforms use sophisticated algorithms to analyze financial markets and execute trades at optimal times. These systems process vast datasets in real-time, capturing opportunities that human traders might miss. By reducing emotional decision-making and increasing speed, AI improves trading efficiency and maximizes returns.

6. Customer Service and Virtual Assistants

AI chatbots and virtual assistants are transforming customer support in FinTech. These tools provide 24/7 assistance, answer queries, and offer guidance on financial products or services. By leveraging natural language processing (NLP), AI-driven assistants can understand and respond to customer concerns with precision, reducing wait times and improving user satisfaction.

7. Regulatory Compliance and Reporting

Financial institutions operate in a highly regulated environment, requiring strict adherence to laws and standards. AI simplifies compliance by monitoring transactions, identifying irregularities, and automating the generation of detailed reports. This ensures businesses remain compliant while reducing the time and effort involved in manual reporting.

8. Automated Financial Processes

Robotic Process Automation (RPA), combined with AI, automates routine and repetitive tasks such as account reconciliation, invoice processing, and data entry. This not only boosts efficiency but also minimizes human errors, allowing financial professionals to focus on strategic and value-driven activities.

Challenges of AI in FinTech

Challenges of AI in FinTech

Artificial Intelligence (AI) is revolutionizing the FinTech industry, offering transformative benefits in efficiency, accuracy, and decision-making. However, the integration of AI also brings significant challenges that financial institutions must address to fully realize its potential. From ensuring data privacy to managing regulatory compliance, these challenges highlight the complexities of adopting AI in a highly sensitive and regulated industry.

Key Challenges of AI in FinTech

1. Data Privacy and Security

Financial institutions handle vast amounts of sensitive customer data, making them prime targets for cyberattacks. AI systems must be designed with robust security measures to prevent data breaches, unauthorized access, and misuse of information. Meeting stringent data protection laws like GDPR and CCPA adds to the complexity.

2. Regulatory Compliance

The rapidly evolving nature of AI often outpaces existing regulatory frameworks, creating uncertainty for financial institutions. Organizations must navigate complex and region-specific regulations to ensure compliance, which can be resource-intensive and costly.

3. Bias in AI Models

AI algorithms can inadvertently reflect biases present in their training data, leading to unfair or discriminatory outcomes in processes such as credit scoring or loan approvals. Identifying and mitigating bias is a critical challenge for ethical AI implementation.

4. Lack of Explainability

Many AI models, especially those based on deep learning, operate as “black boxes,” making it difficult to explain how decisions are made. This lack of transparency can erode trust among customers and regulators and complicate compliance efforts.

5. Integration with Legacy Systems

Financial institutions often rely on outdated systems that are incompatible with modern AI technologies. Integrating AI into these legacy systems can be costly and time-consuming, requiring significant upgrades and technical expertise.

6. Evolving Cyber Threats

AI systems themselves can become targets of sophisticated cyberattacks, such as data poisoning or adversarial machine learning. Securing AI models and the underlying infrastructure against these threats is a growing challenge.

7. High Implementation Costs

Deploying AI technologies requires substantial investment in infrastructure, skilled personnel, and ongoing maintenance. Smaller FinTech companies may struggle to afford these costs, limiting their ability to compete with larger players.

8. Ethical Concerns

The use of AI in financial decision-making raises ethical questions, including job displacement, data surveillance, and the potential misuse of predictive analytics. Balancing innovation with ethical considerations is essential for sustainable adoption.

9. Dependence on Quality Data

AI models require vast amounts of high-quality data to function effectively. Incomplete, outdated, or biased datasets can lead to inaccurate predictions and poor decision-making, undermining the benefits of AI.

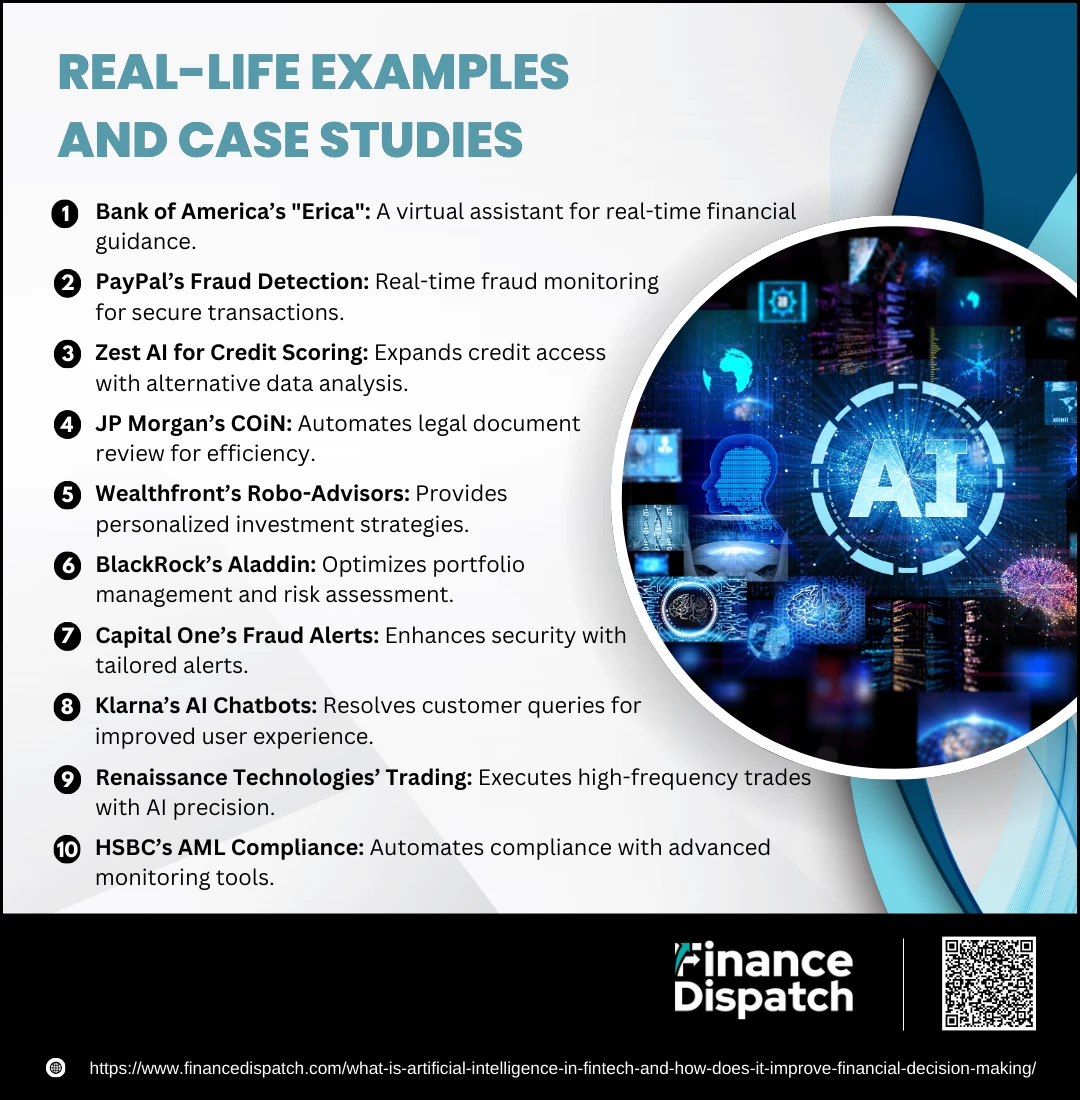

Real-Life Examples and Case Studies

Real-Life Examples and Case Studies

Artificial Intelligence (AI) has revolutionized the FinTech landscape, with numerous companies implementing innovative AI-driven solutions to enhance efficiency, security, and customer satisfaction. From fraud detection to personalized financial services, these real-life examples and case studies highlight how AI is transforming financial operations and driving growth in the industry.

Notable Real-Life Examples and Case Studies

1. Bank of America’s Virtual Assistant “Erica”

A cutting-edge AI-powered virtual assistant that provides real-time financial advice, transaction updates, and budgeting insights. Erica has processed over 800 million customer requests, improving engagement and satisfaction.

2. PayPal’s Fraud Detection System

PayPal uses AI to monitor transactions in real-time, identifying anomalies and fraudulent activities. This system processes thousands of transactions per second, significantly reducing fraud-related losses.

3. Zest AI for Credit Scoring

Zest AI employs machine learning models to analyze alternative data for assessing creditworthiness. This approach expands credit access to underserved populations and improves loan approval accuracy.

4. JP Morgan’s COiN (Contract Intelligence)

An AI-powered platform that reviews legal documents and extracts relevant data, reducing document review time from thousands of hours to seconds. This innovation enhances operational efficiency and cost savings.

5. Wealthfront’s Robo-Advisors

Wealthfront leverages AI-driven robo-advisors to provide personalized investment strategies based on individual financial goals and risk tolerance, democratizing access to investment management.

6. BlackRock’s Aladdin Platform

Aladdin uses AI to manage risk, analyze portfolios, and optimize investment strategies for asset managers. Its predictive capabilities ensure more informed and profitable financial decisions.

7. Capital One’s Fraud Alerts and Recommendations

Capital One combines AI with customer data to provide real-time fraud alerts and tailored financial recommendations, enhancing security and customer loyalty.

8. Klarna’s AI Chatbots

Klarna uses natural language processing (NLP) in its chatbots to resolve customer queries related to payments, refunds, and account management, improving user experience and reducing support costs.

9. Renaissance Technologies’ Algorithmic Trading

A hedge fund utilizing AI and machine learning to execute high-frequency trades with unparalleled precision, optimizing profitability through data-driven strategies.

10. HSBC’s AI-Driven AML Compliance System

HSBC employs AI to automate anti-money laundering (AML) compliance, identifying suspicious transactions and generating detailed reports, reducing operational burden and regulatory risks.

Future Trends in AI-Driven FinTech

The integration of Artificial Intelligence (AI) in FinTech is set to reshape the financial landscape further, driving innovation and enhancing efficiency. Emerging trends focus on advanced automation, predictive analytics, and seamless customer experiences, enabling businesses to stay ahead in an increasingly competitive industry. These developments promise to unlock new opportunities while addressing ongoing challenges like security and compliance.

Future Trends in AI-Driven FinTech

| Trend | Description | Potential Impact |

| AI-Powered Predictive Analytics | AI systems predicting market trends, customer behaviors, and potential risks with greater accuracy. | Improved decision-making and proactive risk management, leading to better financial outcomes. |

| Blockchain and AI Integration | Combining AI with blockchain for enhanced transaction security and transparent, tamper-proof data management. | Increased trust and efficiency in areas like payments, smart contracts, and identity verification. |

| Personalized Financial Services | AI-driven solutions offering hyper-personalized advice and recommendations based on real-time customer data. | Enhanced customer satisfaction and loyalty through tailored financial experiences. |

| RegTech Solutions | AI automating compliance and regulatory processes, including monitoring, reporting, and risk assessments. | Reduced compliance costs and faster adaptation to regulatory changes. |

| Voice and Chat-Based Banking | Advancements in natural language processing enabling seamless, voice-activated banking and financial management. | Greater accessibility and convenience, especially for underserved and non-tech-savvy users. |

| AI-Driven Fraud Prevention | AI leveraging real-time monitoring and anomaly detection to identify and mitigate sophisticated cyber threats. | Strengthened financial security and reduced fraud-related losses. |

| Green Finance and Sustainability | AI analyzing investment impacts and promoting environmentally responsible financial practices. | Encouragement of sustainable investments and alignment with global ESG (Environmental, Social, Governance) goals. |

| Embedded Finance | Seamless integration of financial services into non-financial platforms using AI for enhanced user experiences. | Broader accessibility of financial services and improved customer convenience. |

| Generative AI for Financial Insights | Using generative AI to create detailed, scenario-based forecasts and insights for decision-makers. | Improved strategic planning and financial forecasting for businesses and investors. |

Conclusion

Artificial Intelligence (AI) is undeniably revolutionizing the FinTech industry, driving innovation, efficiency, and customer-centric solutions. By enabling advanced automation, personalized services, and robust risk management, AI is transforming financial operations and decision-making processes. However, the journey is not without challenges, such as ensuring data privacy, mitigating biases, and adhering to evolving regulations. As AI technology continues to advance, the FinTech sector must balance innovation with ethical considerations and compliance to unlock its full potential. The future of AI-driven FinTech promises smarter, more inclusive, and secure financial ecosystems, empowering businesses and individuals to make informed financial decisions in a rapidly changing world.