When it comes to managing money, most people like to believe they make decisions based purely on logic and reason. Yet, in reality, our financial choices are often shaped by emotions, habits, and psychological shortcuts—sometimes without us even realizing it. This is where behavioral finance comes into play. It’s a field that explores the intersection of finance and human psychology, uncovering the reasons why investors frequently deviate from rational behavior. From panic selling during market dips to overconfidence in stock-picking abilities, behavioral finance helps explain the hidden forces behind these actions. In today’s complex financial landscape, understanding these behavioral patterns is not just insightful—it’s essential. For wealth managers, this knowledge offers a powerful advantage, allowing them to guide clients toward smarter, more disciplined financial decisions that align with long-term goals.

What is Behavioral Finance?

Behavioral finance is a field of study that combines psychology and economics to explain why people often make irrational financial decisions. Unlike traditional finance, which assumes investors are logical, self-controlled, and always act in their best interest, behavioral finance recognizes that emotions, cognitive biases, and social influences frequently disrupt rational thinking. Whether it’s selling a stock out of fear, following the herd during market booms, or being overly confident in one’s investment choices, these behaviors can lead to suboptimal outcomes. By examining these tendencies, behavioral finance provides a deeper understanding of how and why people deviate from purely logical decision-making in the financial world.

Key Principles of Behavioral Finance

At its core, behavioral finance seeks to explain the psychological reasons behind why individuals often make irrational financial decisions. Instead of assuming that people always act in their best financial interests, this field highlights how biases, emotions, and mental shortcuts can lead to flawed judgment. By understanding the key principles of behavioral finance, investors and financial advisors can better recognize these patterns and take steps to avoid common pitfalls.

Here are the key principles of behavioral finance:

1. Mental Accounting – People tend to categorize money based on its source or intended use, leading to inconsistent financial behavior.

2. Loss Aversion – The pain of losing money is psychologically more powerful than the pleasure of gaining the same amount, often leading to risk-averse decisions.

3. Overconfidence – Many investors overestimate their knowledge or ability to predict market movements, resulting in excessive trading or poor risk assessment.

4. Anchoring – Individuals rely too heavily on initial information (like a stock’s past price), even when new, relevant data is available.

5. Herd Behavior – The tendency to mimic the actions of a larger group, which can lead to market bubbles or crashes.

6. Confirmation Bias – Investors often seek out information that confirms their existing beliefs, ignoring evidence to the contrary.

7. Framing Effect – The way choices are presented can significantly affect decisions, even if the underlying information remains the same.

8. Self-Attribution Bias – People tend to credit their successes to skill and blame failures on external factors, hindering learning from mistakes.

Common Behavioral Biases That Affect Financial Decisions

Even the most seasoned investors are not immune to the subtle yet powerful influence of behavioral biases. These biases can distort our perception of risk, cloud judgment, and lead to decisions that don’t align with our financial goals. Recognizing these mental shortcuts is the first step toward making smarter, more objective financial choices. Below is a table outlining some of the most common behavioral biases that affect how people manage money.

| Bias | Description | Impact on Financial Decisions |

| Overconfidence | Overestimating one’s knowledge or ability to predict market trends | Leads to excessive trading and underestimating risk |

| Loss Aversion | Feeling losses more intensely than equivalent gains | Causes people to hold losing investments too long or avoid necessary risk |

| Confirmation Bias | Seeking information that supports existing beliefs | Can lead to ignoring warning signs or alternative investment options |

| Anchoring | Relying too heavily on initial information or reference points | Prevents adjustment to new data, such as changing stock valuations |

| Herd Mentality | Following the crowd rather than making independent decisions | Can result in buying at market highs or selling during panics |

| Framing Effect | Decisions influenced by how information is presented rather than facts | Alters perception of risk or value depending on wording or context |

| Self-Attribution Bias | Attributing successes to skill and failures to luck | Prevents learning from mistakes and promotes unrealistic confidence |

| Recency Bias | Giving more weight to recent events over historical trends | May lead to short-term thinking and impulsive financial moves |

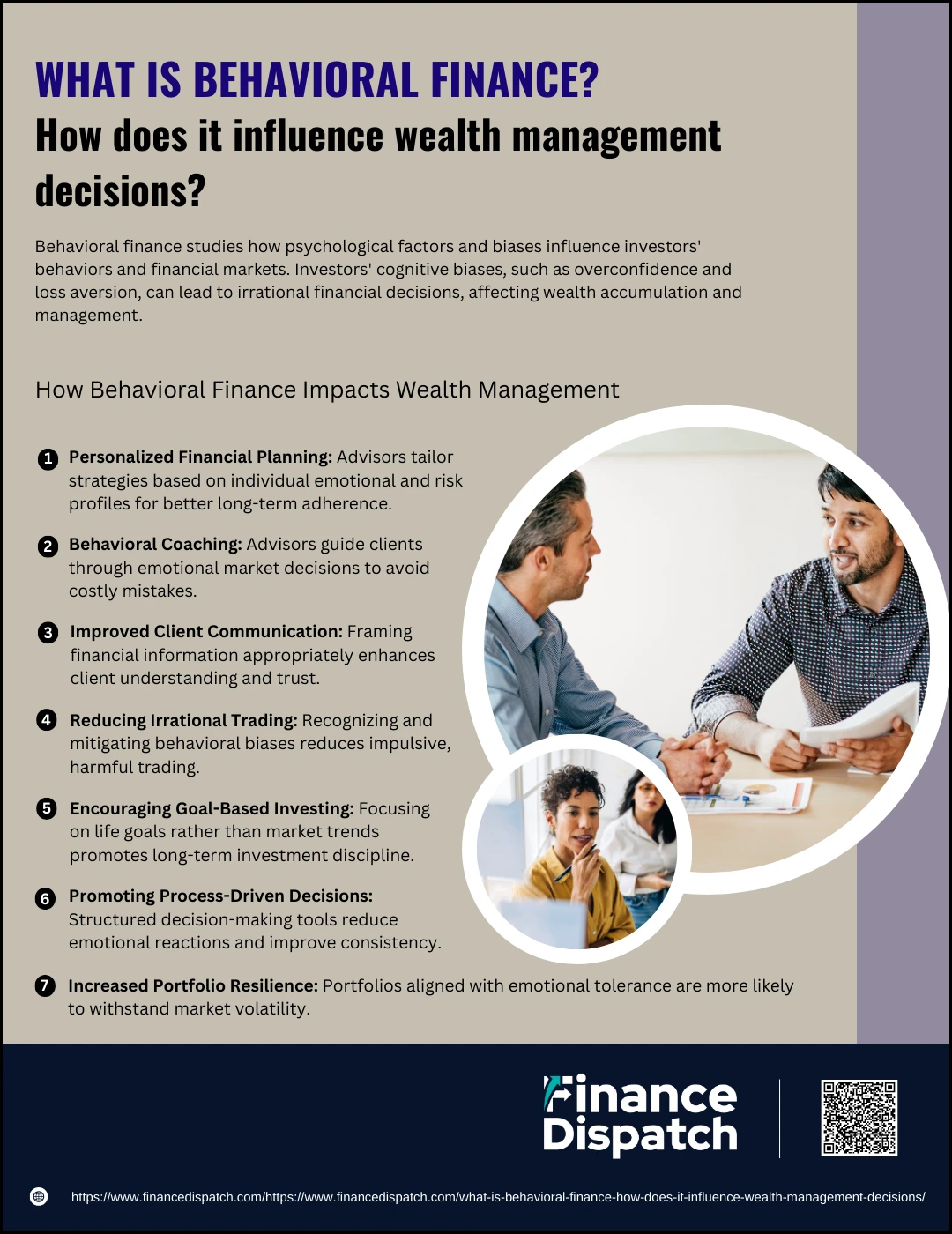

How Behavioral Finance Impacts Wealth Management

How Behavioral Finance Impacts Wealth Management

Behavioral finance plays a transformative role in the world of wealth management by uncovering the psychological patterns behind client decision-making. Wealth managers who understand these behavioral tendencies are better equipped to build trust, tailor financial strategies, and help clients stay focused on their long-term goals. Instead of relying solely on numbers and forecasts, advisors can use behavioral insights to manage emotions, reduce biases, and guide clients through uncertain markets with greater clarity and confidence.

Here are key ways behavioral finance impacts wealth management:

1. Personalized Financial Planning

Behavioral finance helps wealth managers understand that no two clients think or feel about money the same way. Some may fear loss more than they value gain, while others may take excessive risks due to overconfidence. By identifying these psychological tendencies through questionnaires, interviews, or past behaviors, advisors can craft tailored investment strategies. This personalization not only improves performance but also increases the likelihood that clients stick to the plan during turbulent times.

2. Behavioral Coaching

One of the most valuable roles a wealth manager plays is that of a behavioral coach. Markets can be emotionally overwhelming—clients may want to sell everything during a crash or chase hot stocks during a rally. A well-informed advisor uses behavioral finance to recognize these emotional triggers and coach clients toward calm, rational responses. This guidance is especially critical during periods of market stress when poor decisions can have long-lasting effects.

3. Improved Client Communication

The way financial information is presented significantly impacts how clients perceive it. Behavioral finance introduces concepts like the framing effect, where the same data can lead to different decisions depending on how it’s worded. Wealth managers who understand this can communicate more effectively—framing investment outcomes in a way that encourages thoughtful responses rather than fear or greed. This clarity builds trust and helps clients feel more in control of their finances.

4. Reducing Irrational Trading

Biases such as overconfidence, herd mentality, and anchoring often drive clients to make frequent, impulsive trades—moves that usually hurt long-term returns. Behavioral finance enables wealth managers to identify these patterns early and educate clients on the risks of irrational trading. Advisors can set up guardrails, like agreed-upon trading rules or “cooling off” periods, to reduce the chance of decisions made in the heat of the moment.

5. Encouraging Goal-Based Investing

Rather than chasing market trends, behavioral finance encourages aligning investments with specific life goals—such as retirement, education, or a home purchase. This approach shifts the focus from short-term market noise to long-term progress, helping clients stay committed even when markets dip. By consistently reminding clients of their personal “why,” advisors reinforce discipline and reduce emotional decision-making.

6. Promoting Process-Driven Decisions

Behavioral finance differentiates between reflexive (emotional, fast) and reflective (logical, slow) thinking. Many financial mistakes come from reflexive decisions—such as panic selling. Wealth managers can introduce structured, step-by-step processes for decision-making that encourage clients to engage their reflective thinking. These systems include investment policy statements, scheduled reviews, and decision checklists that guide clients to make more thoughtful and consistent choices.

7. Increased Portfolio Resilience

A portfolio built with behavioral insights in mind accounts not just for financial risk, but also emotional tolerance. For example, a client who panics during market downturns might need a more conservative mix than someone who remains calm. By integrating behavioral data into asset allocation and rebalancing strategies, wealth managers can design portfolios that clients are more likely to stick with—making them resilient not only in market terms but also in human terms.

Advantages and Disadvantages of Using Behavioral Finance in Wealth Management

Advantages and Disadvantages of Using Behavioral Finance in Wealth Management

Behavioral finance brings a deeper understanding of the psychological factors that influence investment behavior. For wealth managers, incorporating these insights can enhance client relationships, improve investment outcomes, and foster long-term financial discipline. However, the approach is not without its challenges. When not carefully managed, behavioral finance can lead to overcomplication, misinterpretation, or misplaced confidence in psychological theories. Let’s explore both sides of the coin.

Advantages

1. More Personalized Investment Strategies

Behavioral finance helps wealth managers go beyond traditional risk assessments by understanding a client’s unique fears, preferences, and decision-making patterns. This results in custom-tailored investment strategies that align not only with financial goals but also with psychological comfort zones—making clients more likely to stick with the plan during turbulent times.

2. Improved Client Retention and Trust

Clients who feel seen and understood on a behavioral level often develop stronger trust in their advisor. By recognizing emotional triggers and responding with empathy, advisors create a safe space where clients feel supported—even during downturns. This emotional bond can lead to long-lasting advisor-client relationships.

3. Enhanced Risk Management

Knowing how a client reacts to market stress allows wealth managers to anticipate and plan for emotionally-driven decisions like panic selling. Portfolios can be structured with built-in safety buffers or conservative allocations to reduce the likelihood of reactionary losses.

4. Better Communication and Education

Behavioral finance teaches advisors how to communicate complex concepts in a way that resonates with a client’s mindset. For instance, reframing risk in terms of “achieving long-term goals” rather than “losing money” can ease anxiety and lead to clearer, more confident decision-making.

5. Increased Long-Term Discipline

One of the greatest benefits is behavioral coaching. Clients learn to recognize their own biases—such as herd mentality or loss aversion—and resist acting on them. Over time, this encourages a disciplined, goal-focused investment behavior that can significantly improve financial outcomes.

Disadvantages

1. Subjectivity in Assessing Biases

Behavioral analysis often depends on qualitative factors like body language, storytelling, or personality traits, which are open to interpretation. Advisors may misread cues or apply the wrong behavioral label, leading to misguided strategies.

2. Overcomplication of Financial Planning

While personalization is beneficial, it can also introduce unnecessary complexity. Integrating multiple behavioral considerations can overwhelm both the client and the advisor, leading to confusion and reluctance to act.

3. Not Universally Applicable

Some clients may prefer a numbers-driven approach and feel uncomfortable with psychological profiling. Others may not believe in behavioral finance or may dismiss it as “soft science,” making it harder to apply effectively.

4. Limited Predictive Power

Behavioral finance explains why people tend to act irrationally, but it cannot always predict exactly when someone will act emotionally. This unpredictability makes it difficult to proactively counter every bias before it surfaces.

5. Risk of Advisor Bias

Advisors are human too—and just as susceptible to overconfidence, framing errors, or confirmation bias. Without ongoing education and self-awareness, they may inadvertently allow their own biases to influence client recommendations.

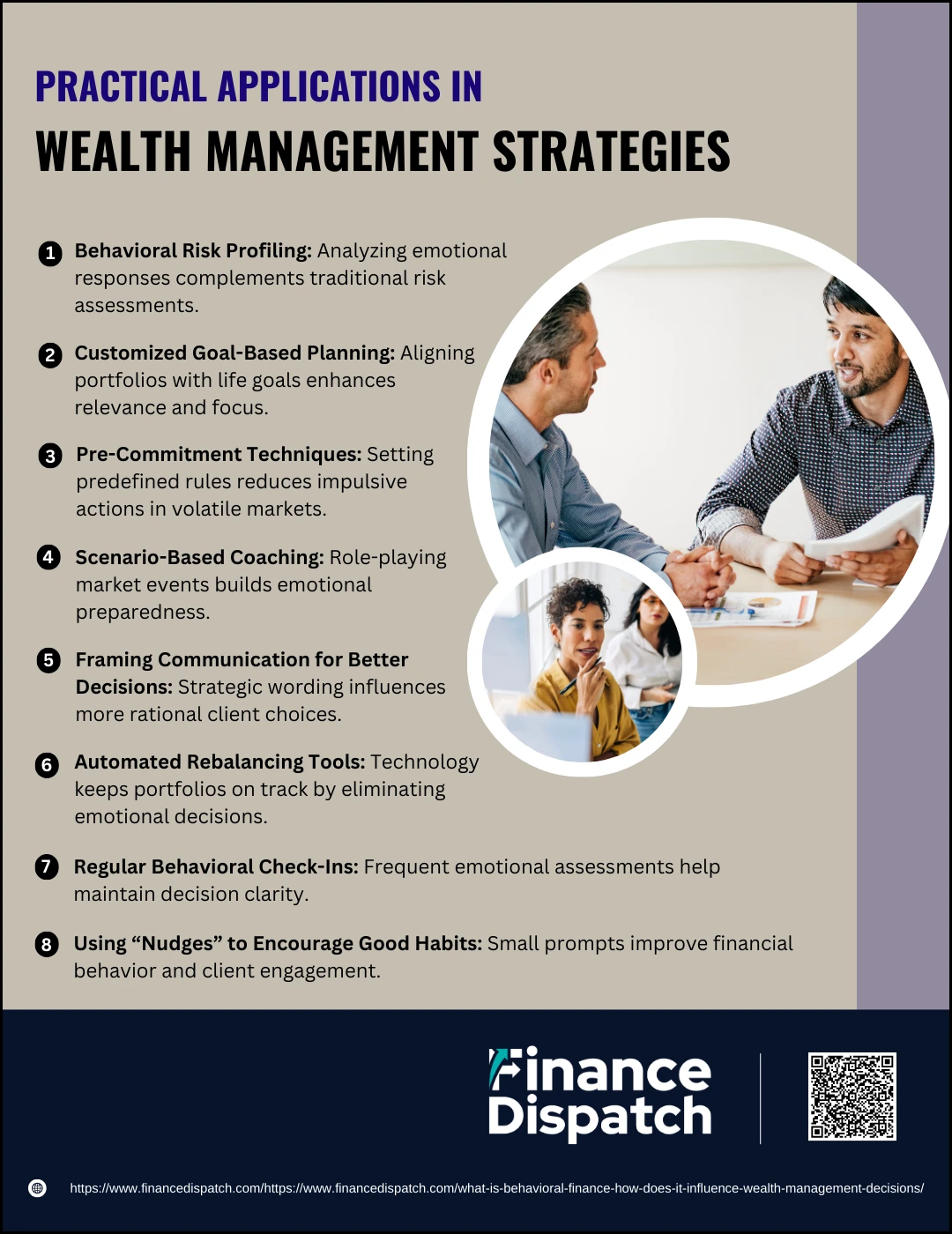

Practical Applications in Wealth Management Strategies

Practical Applications in Wealth Management Strategies

Integrating behavioral finance into wealth management is not just about understanding investor psychology—it’s about applying that understanding in real-world strategies that guide clients toward better financial outcomes. Advisors who harness behavioral insights can design plans that are not only financially sound but also psychologically sustainable. These applications go beyond theory and directly influence how portfolios are structured, communicated, and managed over time.

Here are some practical applications in wealth management strategies:

1. Behavioral Risk Profiling

Advisors assess clients’ emotional responses to market scenarios to build a behavioral risk profile. This complements traditional risk assessments by identifying how a client might actually behave during downturns, allowing for more realistic portfolio design.

2. Customized Goal-Based Planning

Rather than focusing solely on performance metrics, wealth managers align investment strategies with personal life goals—like retirement, education, or legacy planning—making financial decisions more meaningful and less driven by market noise.

3. Pre-Commitment Techniques

Advisors can help clients set rules in advance, such as automatic contributions, withdrawal thresholds, or rebalancing triggers. These mechanisms reduce the likelihood of emotional decisions in stressful market conditions.

4. Scenario-Based Coaching

Using hypothetical situations or past market events, advisors walk clients through how they might react emotionally—and what a better decision could look like. This builds awareness and reduces overreactions during real events.

5. Framing Communication for Better Decisions

Presenting the same data in different ways can lead to different client reactions. Behavioral finance teaches advisors to frame information—like gains versus losses—in a way that promotes rational responses.

6. Automated Rebalancing Tools

Leveraging technology, wealth managers implement automated rebalancing systems that remove emotional judgment from the process. This ensures portfolios stay aligned with long-term goals, even during volatile markets.

7. Regular Behavioral Check-Ins

Beyond financial reviews, advisors conduct behavioral reviews—checking in on emotional triggers, mindset shifts, or stress levels that might influence decision-making. This helps maintain clarity and discipline.

8. Using “Nudges” to Encourage Good Habits

Small, timely suggestions or reminders—like saving more after a raise or reviewing goals annually—can improve financial behaviors without being intrusive, increasing client engagement over time.

Role of Financial Advisors in Managing Behavioral Biases

Financial advisors today are more than just investment planners—they are behavioral coaches who help clients navigate the emotional ups and downs of investing. Understanding that clients are prone to biases such as loss aversion, overconfidence, and herd mentality, advisors play a crucial role in identifying these patterns and guiding clients toward more rational decisions. By blending financial expertise with emotional intelligence, advisors can significantly improve the chances of long-term financial success.

Key roles financial advisors play in managing behavioral biases:

1. Identifying Client Biases Early: Advisors observe behavioral patterns and use tools or assessments to uncover biases like risk aversion or overconfidence before they affect investment decisions.

2. Providing Behavioral Coaching during Market Volatility: In times of uncertainty, advisors help clients stay calm, reminding them of their goals and discouraging panic-driven decisions.

3. Framing Investment Information Effectively: By presenting data in a clear and relatable way, advisors can influence how clients perceive risk and opportunity, reducing emotional reactions.

4. Encouraging Long-Term Thinking: Advisors keep clients focused on their long-term objectives, helping them look beyond short-term market fluctuations and daily headlines.

5. Using Pre-Commitment Strategies: They help clients set rules or boundaries—such as automatic investments or sell triggers—to reduce the impact of impulsive behavior.

6. Customizing Portfolios Based on Behavioral Insights: Advisors design investment strategies that align with both the financial goals and psychological profiles of their clients.

7. Conducting Regular Reviews and Emotional Check-Ins: Beyond numbers, advisors discuss life changes or emotional stressors that may affect financial decision-making.

8. Educating Clients about Common Biases: By teaching clients about heuristics and biases, advisors empower them to recognize and challenge their own flawed thinking.

9. Acting as a Sounding Board: Before clients make hasty financial moves, advisors provide a rational second opinion, offering perspective and alternative options.

10. Building Trust Through Empathy and Communication: A strong advisor-client relationship, grounded in empathy, increases client confidence and encourages more transparent, honest conversations.

Differences between Traditional Finance vs. Behavioral Finance

The world of finance has long been dominated by traditional theories that assume investors are rational, informed, and always act in their best interest. However, real-world behavior often tells a different story—one filled with emotion, bias, and inconsistency. That’s where behavioral finance comes in. It challenges the foundational assumptions of traditional finance by recognizing that human psychology plays a central role in decision-making. The comparison below highlights the key differences between traditional finance and behavioral finance across several critical dimensions.

| Aspect | Traditional Finance | Behavioral Finance |

| Investor Assumption | Investors are rational and logical | Investors are “normal” and subject to emotional and cognitive biases |

| Decision-Making | Based on logical analysis and perfect information | Influenced by heuristics, emotions, and limited self-control |

| Market Behavior | Markets are efficient and prices reflect all available information | Markets can be inefficient due to irrational investor behavior |

| Risk Assessment | Risk is measured objectively using models like CAPM | Perceived risk is subjective and varies based on emotional responses |

| Goal Orientation | Focus on utility maximization and wealth accumulation | Includes emotional satisfaction and mental accounting |

| Information Processing | Investors process all information correctly and consistently | Investors often misinterpret or ignore information due to biases |

| Key Theories | Efficient Market Hypothesis (EMH), Modern Portfolio Theory (MPT) | Prospect Theory, Mental Accounting, Framing Effect |

| Investment Behavior | Long-term, consistent strategies driven by data | Short-term reactions driven by fear, greed, or social influence |

Conclusion

Behavioral finance has reshaped the way we understand financial decision-making, highlighting that investing is not just about numbers—it’s deeply personal and psychological. While traditional finance assumes rationality, behavioral finance acknowledges the emotional and cognitive biases that often derail even the most well-intentioned plans. For wealth managers and individual investors alike, incorporating these insights can lead to smarter, more resilient strategies. By recognizing common behavioral pitfalls and applying practical tools to manage them, financial professionals can guide clients toward more informed, consistent, and goal-aligned decisions. Ultimately, embracing behavioral finance enhances not just portfolio performance, but the entire wealth management experience.