In today’s fast-paced retail world, a new way to pay is quietly revolutionizing how people shop—both online and in stores. It’s called Buy Now, Pay Later (BNPL), and chances are you’ve already seen it at checkout or even used it yourself. This flexible payment option allows shoppers to split their purchases into smaller, manageable installments, often without interest. What began as a simple alternative to credit cards has rapidly grown into a global trend, reshaping consumer behavior and prompting retailers to rethink their sales strategies. In this article, we’ll explore what BNPL is, how it works, and how it’s fundamentally changing the way consumers approach spending.

What is Buy Now, Pay Later (BNPL)?

Buy Now, Pay Later (BNPL) is a modern payment method that allows consumers to make purchases and defer the full cost by paying in smaller, scheduled installments over time. Unlike traditional credit cards or loans, BNPL services typically offer interest-free plans when payments are made on time, making it an appealing option for budget-conscious shoppers. At the point of checkout—online or in-store—shoppers can select a BNPL provider such as Klarna, Afterpay, Affirm, or Zip to finance their purchase. The repayment terms usually involve a fixed number of payments, such as four equal installments paid bi-weekly, with the first payment often due immediately. BNPL combines convenience and flexibility, giving consumers a sense of control over their spending without the long-term commitment of traditional credit.

How Does BNPL Work?

How Does BNPL Work?

Buy Now, Pay Later (BNPL) services offer consumers a convenient way to spread out the cost of their purchases without relying on traditional credit cards. This payment model has gained popularity because of its simplicity, speed, and often, zero-interest repayment terms. Instead of paying the full price upfront, you can break down the amount into smaller, scheduled installments—making it easier to manage your budget. Whether you’re buying clothes, electronics, or even groceries, BNPL can be accessed with just a few clicks during checkout.

Here’s a more detailed look at how BNPL typically works:

1. Select BNPL at Checkout

When making a purchase online or in-store, you’ll often see a BNPL option next to credit and debit card choices. By selecting this option, you begin the process of financing your purchase in installments.

2. Fill Out a Quick Application

You’ll need to enter basic personal details like your name, date of birth, phone number, and sometimes the last four digits of your Social Security number. This information helps the provider verify your identity and assess eligibility.

3. Get Instant Approval

Most BNPL providers perform a soft credit check (which doesn’t impact your credit score) or assess your financial history with their platform. Approval is typically granted in seconds, allowing you to complete your transaction immediately.

4. Make Your First Payment

Many BNPL plans require the first installment—usually 25% of the purchase amount—at the time of checkout. The remaining balance is then split over the coming weeks or months.

5. Repay in Scheduled Installments

Payments are automatically withdrawn from your chosen payment method (e.g., debit card, bank account, or credit card) based on a set schedule—often bi-weekly or monthly. You’ll receive reminders, and some apps allow you to manage your repayment plan or change your payment method.

6. Watch for Fees and Penalties

While most BNPL services are interest-free if payments are made on time, late or missed payments can trigger fees. Some providers cap these fees, while others may add interest if the balance isn’t paid within the promotional period.

7. Track and Manage Payments via App

BNPL providers usually offer user-friendly mobile apps or online dashboards where you can view current balances, due dates, and transaction history. Some even offer the ability to reschedule payments or pay off purchases early.

How BNPL is Changing Consumer Purchasing Habits

How BNPL is Changing Consumer Purchasing Habits

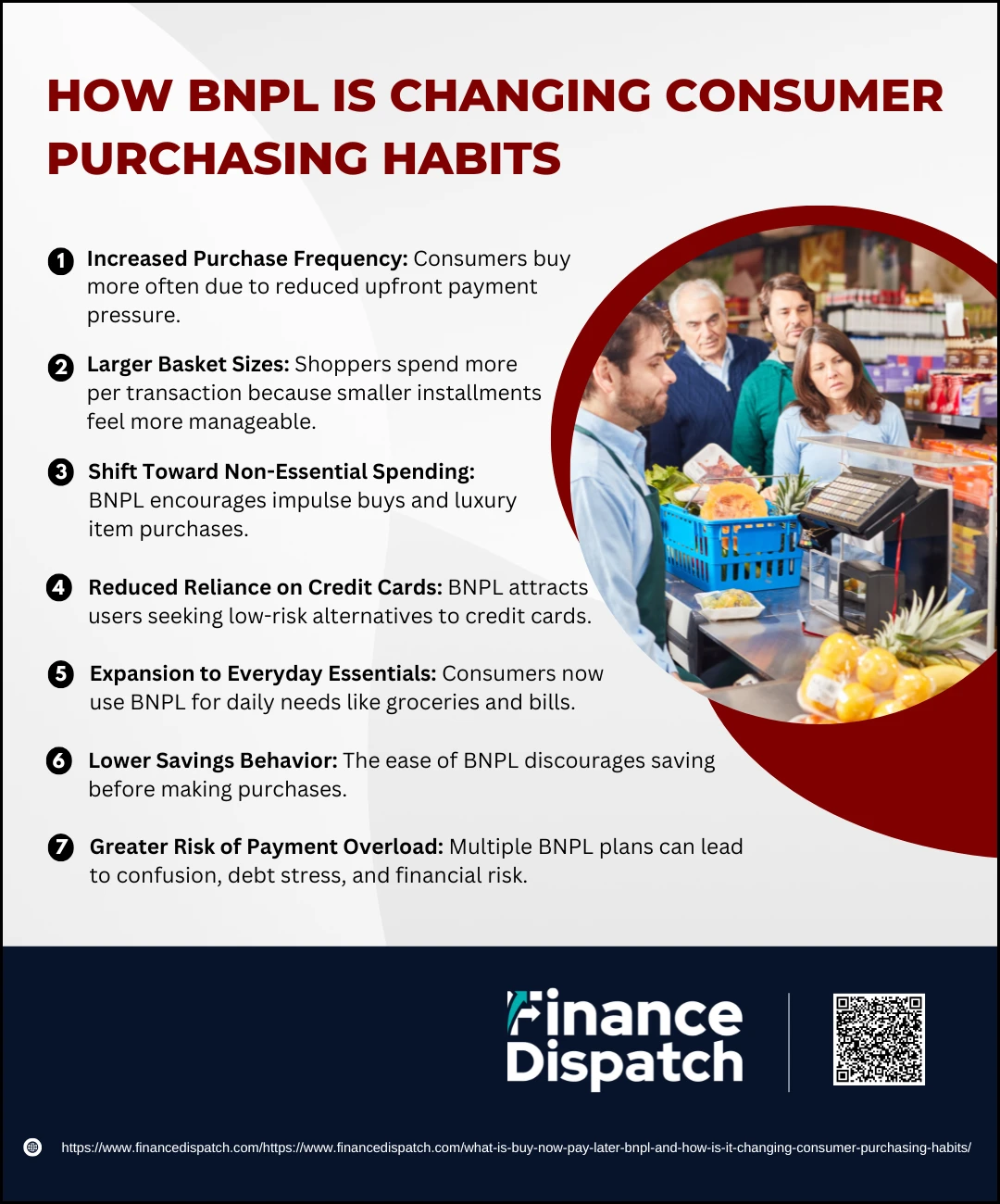

Buy Now, Pay Later (BNPL) isn’t just a convenient checkout option—it’s quietly transforming the way people think about spending. By breaking down costs into manageable installments, often with no interest, BNPL makes purchases feel more affordable in the moment. As a result, many consumers are changing how often they shop, what they buy, and how they manage their finances. These shifts go beyond convenience—they reflect deeper changes in behavior driven by the psychology of smaller payments and immediate gratification.

Here’s how BNPL is influencing consumer purchasing habits:

1. Increased Purchase Frequency

Shoppers are making purchases more often because they don’t have to pay the full amount upfront. BNPL lowers the mental barrier to spending, especially for mid-range purchases, leading to more frequent transactions across fashion, electronics, and home goods.

2. Larger Basket Sizes

When payments are broken into smaller chunks, consumers feel more comfortable adding extra items to their cart. Research shows that basket sizes can grow by 10% or more with BNPL, as the immediate financial impact appears smaller—even though the total cost remains the same.

3. Shift Toward Non-Essential Spending

The flexibility of BNPL enables impulse purchases and encourages spending on wants rather than needs. Shoppers who might have delayed a purchase or saved up for it now go through with it instantly, often for luxury or trendy items.

4. Reduced Reliance on Credit Cards

BNPL appeals to shoppers who either don’t have credit cards or prefer to avoid the high interest rates they charge. Because BNPL often doesn’t require a hard credit check and doesn’t report to credit bureaus (unless payments are missed), it feels like a safer, lower-risk option.

5. Expansion to Everyday Essentials

With the rising cost of living, more people are using BNPL for groceries, household necessities, and even utility bills. What started as a tool for retail splurges is now becoming a financial lifeline for many consumers with tight monthly budgets.

6. Lower Savings Behavior

By offering immediate access to goods without requiring upfront savings, BNPL discourages traditional budgeting and saving habits. Many users admit they’re less likely to save up for items and more likely to buy now simply because the option is available.

7. Greater Risk of Payment Overload

While BNPL can make spending feel easier, juggling multiple BNPL plans can quickly lead to payment confusion and debt stress. Missed payments, overdraft fees, and mounting installments can catch consumers off guard—especially those already financially vulnerable.

Key Players in the BNPL Market

The rapid growth of Buy Now, Pay Later (BNPL) services has led to the rise of several dominant players in the global market. These companies have shaped the way BNPL operates, offering different payment models, approval processes, and user experiences. Each provider has carved out its niche by focusing on specific regions, merchant partnerships, or types of repayment plans. Understanding the differences among the major BNPL providers can help both consumers and businesses make informed choices based on their needs, shopping habits, or sales goals.

Here’s a comparison of some of the most prominent BNPL providers:

| Provider | Popular Regions | Repayment Models | Interest & Fees | Unique Features |

| Affirm | USA, Canada | Pay in 4, Monthly financing (up to 36 months) | No late fees; Interest may apply on longer terms | No hidden fees, large merchant network |

| Afterpay (Clearpay in UK) | USA, Australia, UK, NZ | Pay in 4 bi-weekly installments | No interest; Late fees apply | Popular for fashion and lifestyle; in-store and online |

| Klarna | Europe, USA, UK | Pay in 4, Pay in 30 days, Monthly financing | No interest (short term); interest on longer terms | Multiple payment options; strong app interface |

| Zip | Australia, USA, NZ | Weekly, Bi-weekly, or Monthly payments | Interest-free (short term); fees may apply | Two tiers: Zip Pay (small purchases), Zip Money (large purchases) |

| PayPal Pay Later | Global | Pay in 4, Monthly plans | No interest (Pay in 4); interest on longer terms | Integrated with PayPal accounts; broad acceptance |

| Sezzle | USA, Canada | Pay in 4 bi-weekly | No interest if on time; late fees may apply | Focus on ethical finance and credit-building features |

Why BNPL Appeals to Consumers

Why BNPL Appeals to Consumers

Buy Now, Pay Later (BNPL) has quickly become a favorite payment option for millions of shoppers around the world—and for good reason. It offers the flexibility to purchase what you need (or want) today without having to pay the full amount upfront. With simple terms, fast approvals, and often zero interest, BNPL feels more approachable than traditional credit. It caters to both those who want to avoid high-interest credit cards and those who simply prefer manageable, bite-sized payments. Here are the top reasons why BNPL is winning over consumers:

1. Easy, Instant Approval

With minimal personal information and a soft credit check, most BNPL users are approved within seconds. There’s no paperwork, no waiting period, and no damage to your credit score just for applying.

2. No Interest on Short-Term Plans

The most popular BNPL plans—like “Pay in 4” over six weeks—charge no interest, as long as payments are made on time. This makes it a highly attractive option compared to credit cards or installment loans that can carry high APRs.

3. Budget-Friendly Payments

BNPL breaks purchases into smaller, fixed payments, which can be easier to fit into tight monthly budgets. This allows shoppers to plan ahead and avoid putting a strain on their finances.

4. No Credit Card required

Unlike traditional financing, BNPL doesn’t require a credit card. It’s especially helpful for younger consumers or those with low credit scores who still want access to flexible payment options.

5. Seamless and Convenient Checkout

BNPL options are integrated directly into checkout pages of popular retailers, making them easy to use. Whether shopping online or in-store, the process is fast and smooth, without needing to leave the site or store.

6. Appealing to Younger Generations

Millennials and Gen Z are driving the BNPL trend. Many of them prefer alternatives to traditional credit and value financial tools that offer more control, less risk, and a modern user experience through mobile apps.

7. Transparent Terms and Fewer Surprises

BNPL providers generally offer clear payment schedules and disclose any fees upfront. Consumers know exactly when payments are due and how much they’ll owe—helping build trust in the service.

8. Helps with Financial Planning (If Used Responsibly)

When used for planned purchases—like work tools, appliances, or travel—BNPL can help spread costs over time without incurring extra charges, making it easier to manage multiple priorities in a single month.

Pros and Cons of Using BNPL

Pros and Cons of Using BNPL

Buy Now, Pay Later (BNPL) services are gaining popularity for their simplicity, speed, and flexibility—but they aren’t without drawbacks. They’ve opened the door to interest-free financing for consumers who want more control over their spending or can’t qualify for traditional credit. At the same time, the convenience of BNPL can mask the fact that it’s still a form of debt. Without proper budgeting and awareness, users may find themselves managing multiple installment plans and struggling to keep up. Understanding both the advantages and the potential pitfalls of BNPL is essential to making smart financial decisions.

Here’s a closer look at the key pros and cons of using BNPL:

Pros

1. Interest-Free Payments

Many BNPL services offer “pay in 4” or short-term plans that come with no interest at all—provided payments are made on time. This makes them more affordable than credit cards or personal loans, which often charge high APRs.

2. Quick and Easy Approval

BNPL applications are short and straightforward, often requiring only a few personal details. Since most providers perform only a soft credit check, even people with low or limited credit can get approved almost instantly.

3. Budget-Friendly Installments

Instead of paying a lump sum upfront, BNPL allows consumers to split costs into predictable, smaller payments—making higher-ticket items feel more manageable and reducing the financial strain of big purchases.

4. No Credit Card Required

For consumers without access to a credit card, BNPL offers a flexible way to finance purchases without taking on revolving debt. It’s especially appealing to younger shoppers who are wary of traditional credit systems.

5. Seamless Checkout Experience

Integrated directly into major online and in-store checkout processes, BNPL lets users select the payment plan, get approved, and complete the transaction—all in a matter of seconds.

Cons

1. Encourages Overspending

BNPL’s flexibility can make purchases seem more affordable than they really are. This can lead to impulsive shopping behavior and buying items consumers might not be able to afford if they had to pay the full amount upfront.

2. Late Fees and Penalties

Missing a payment can result in late fees, which vary by provider. Some may also charge additional fees for rescheduling payments, and repeated defaults could lead to account restrictions or collections.

3. Potential Credit Damage

While most BNPL services don’t report to credit bureaus, some do—especially if an account is sent to collections. In these cases, missed payments can negatively impact your credit score and stay on your report for years.

4. Not a Credit-Building Tool

On-time payments generally aren’t reported to credit bureaus, meaning BNPL doesn’t help you build credit. For consumers hoping to strengthen their credit profile, traditional loans or secured credit cards may be more beneficial.

5. Complicated Returns and Refunds

If you return an item purchased using BNPL, you may have to continue making payments while the return is processed. Coordinating between the merchant and BNPL provider can be confusing and delay your refund.

BNPL and Credit Score Impact

One of the most important yet often misunderstood aspects of Buy Now, Pay Later (BNPL) services is how they affect your credit score. In most cases, BNPL providers conduct only a soft credit check during the application process, which does not impact your credit score. Additionally, many BNPL providers do not report on-time payments to credit bureaus, meaning you won’t build credit by using these services responsibly. However, the situation changes if payments are missed or the account goes into default. In such cases, some providers may report the delinquency or send the account to collections, which can negatively affect your credit report and lower your score. As BNPL becomes more regulated and widely used, industry experts anticipate that these services may be included more consistently in credit reporting and scoring models. Until then, it’s crucial to treat BNPL as seriously as any other loan—missing payments can have lasting consequences, even if the approval process feels casual or low-risk.

Risks and Concerns around BNPL

Risks and Concerns around BNPL

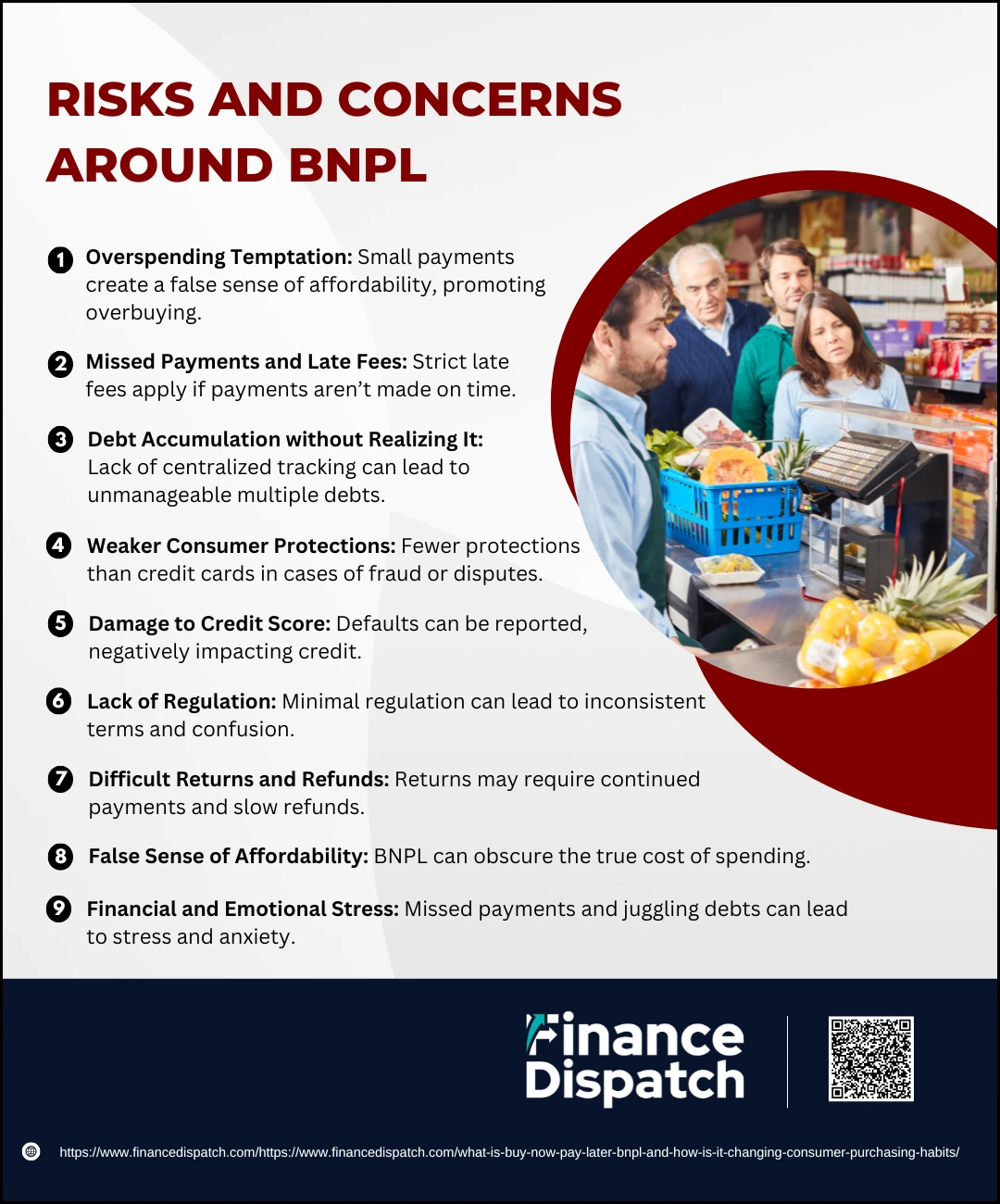

Buy Now, Pay Later (BNPL) may seem like a stress-free way to afford purchases without immediately dipping into your wallet, but its ease of use can sometimes be misleading. Beneath the surface, BNPL carries many of the same risks as traditional credit—just packaged in a more attractive, user-friendly format. Because these services often avoid interest (at first glance), don’t always require strong credit, and are readily available at checkout, consumers may underestimate the long-term implications of their choices. As BNPL becomes more popular, especially among younger and financially vulnerable users, it’s important to understand the hidden concerns and financial consequences that can come with overusing or mismanaging this type of short-term credit.

Here are some key risks and concerns associated with BNPL:

1. Overspending Temptation

BNPL makes purchases feel less expensive by splitting them into smaller payments. This can lead to impulse buying and spending beyond one’s means, especially when users see “just $25 today” instead of the full price.

2. Missed Payments and Late Fees

While many plans don’t charge interest, they often include strict late fees for missed payments. These fees can stack up and become expensive, particularly if you’re juggling multiple BNPL purchases.

3. Debt Accumulation Without Realizing It

Because there’s no central dashboard to track all BNPL transactions across providers, it’s easy to lose track of upcoming payments. Over time, this can result in overlapping payment plans and growing financial pressure.

4. Weaker Consumer Protections

BNPL doesn’t always offer the same protections that come with credit cards, such as chargebacks for fraud or easier dispute resolution for undelivered items. This can leave consumers stuck in disputes with limited support.

5. Damage to Credit Score

While many providers don’t report BNPL activity to credit bureaus, some do—especially in cases of default. If a missed payment leads to a collection, it could hurt your credit score and stay on your report for years.

6. Lack of Regulation

BNPL is still lightly regulated compared to other financial products. Without consistent industry standards, some providers may use unclear terms, inconsistent fee structures, or confusing repayment processes.

7. Difficult Returns and Refunds

If a product is returned, you may still be responsible for scheduled payments while the refund is processed. Coordinating between the retailer and BNPL provider can delay or complicate getting your money back.

8. False Sense of Affordability

BNPL may feel like a harmless way to manage cash flow, but it can disguise how much you’re really spending. This creates a psychological disconnect between your purchase and your actual financial capacity.

9. Financial and Emotional Stress

Research has shown that users who struggle with BNPL payments experience not only financial strain but also emotional distress. Constant reminders, fees, and balancing due dates can contribute to anxiety and poor mental health.

Business Perspective: Why Retailers Love BNPL

From a retailer’s point of view, Buy Now, Pay Later (BNPL) isn’t just a convenient option for customers—it’s a powerful sales tool. BNPL helps businesses boost conversion rates by reducing friction at checkout and giving hesitant shoppers a reason to complete their purchase. It’s particularly effective for increasing average order value, as customers are more likely to spend more when they can pay in smaller installments. Retailers also benefit from reduced cart abandonment and immediate full payment from BNPL providers, who take on the repayment risk. Moreover, BNPL appeals to a wider audience, including younger consumers and those without access to traditional credit, helping merchants reach new markets. With no need to manage loans or collections, retailers can focus on growth while their BNPL partner handles the rest. This combination of increased revenue, broader customer reach, and lower financial risk makes BNPL a win for many businesses—especially in competitive e-commerce environments.

Regulatory Outlook and Future Trends

As Buy Now, Pay Later (BNPL) services continue to grow in popularity, regulators are beginning to take a closer look at how they operate—and how they impact consumers. In several countries, including the U.S., U.K., and Australia, government agencies have started drafting or implementing guidelines to ensure greater transparency, consumer protection, and fair lending practices. One major shift is the classification of BNPL providers as credit issuers, which may require them to offer similar safeguards as traditional credit card companies, such as clear dispute resolution processes and standardized disclosures. Looking ahead, the BNPL industry is expected to expand beyond retail into sectors like healthcare, education, travel, and even rent payments. Technology will also play a bigger role, with innovations in AI and data analytics helping providers assess risk more accurately and personalize repayment options. However, with growth comes increased responsibility, and the future of BNPL will likely hinge on striking a balance between innovation and accountability—ensuring that both consumers and businesses benefit safely and sustainably.

Conclusion

Buy Now, Pay Later (BNPL) has emerged as a transformative force in the world of consumer finance and retail. By offering flexible, interest-free installment plans, it provides shoppers with a convenient way to manage purchases—especially in a time when financial flexibility is more important than ever. At the same time, BNPL has become a valuable tool for retailers, driving sales, increasing order values, and reaching broader customer segments. However, this growing trend also brings new challenges, from overspending and debt accumulation to concerns about transparency and regulation. As BNPL continues to evolve, both consumers and businesses must stay informed and cautious—using the service responsibly while adapting to changing financial landscapes and emerging regulatory frameworks. When used wisely, BNPL can offer real benefits—but like any form of credit, it demands careful consideration and planning.