When it comes to growing your savings, understanding the concept of compound interest is crucial. Unlike simple interest, compound interest allows your money to grow exponentially by earning interest on both the initial deposit and the interest accumulated over time. This snowball effect can significantly boost your financial goals, making even modest contributions grow into substantial amounts. Whether you’re saving for a rainy day, planning for retirement, or building long-term wealth, compound interest is a powerful tool that works in your favor—if you know how to harness it. This article will explore what compound interest is, how it works, and the transformative impact it can have on your savings journey.

What is Compound Interest?

Compound interest is a financial phenomenon where you earn interest not only on your initial deposit, known as the principal, but also on the interest that accumulates over time. It essentially means “earning interest on interest,” creating a multiplying effect that accelerates the growth of your money. Unlike simple interest, which is calculated solely on the principal amount, compound interest factors in the previously earned interest, allowing your savings to grow faster. This effect becomes more pronounced over time, making it a cornerstone concept for effective saving and investing strategies. By understanding compound interest, you can make smarter financial decisions that maximize the potential of your savings.

How Does Compound Interest Work?

Compound interest works by calculating interest not just on your initial deposit but also on the interest that accumulates over time. This creates a snowball effect, where your savings grow at an accelerating rate. The longer your money remains in an account earning compound interest, the more significant the growth becomes, making it a powerful tool for building wealth.

- Principal: The initial amount of money you save or invest.

- Interest Rate: The percentage at which your money earns interest, typically expressed annually.

- Compounding Frequency: How often the interest is calculated and added to your account—daily, monthly, quarterly, or annually.

- Time: The length of time your money stays in the account. The longer it stays, the more opportunities it has to grow through compounding.

- Growth Pattern: Interest is added to your balance during each compounding period, and the new total becomes the base for the next period’s interest calculation.

How to calculate compound interest

Calculating compound interest involves understanding how your savings or investment grows over time by earning interest on both the initial amount (principal) and the accumulated interest. The process is guided by a simple formula and a few key factors, making it easy to predict how much your money can grow. Here’s what you need to know to calculate compound interest effectively:

- Formula: Use the formula: A = P (1 + r/n)^(n*t)

-

- A: Future value of the investment or loan, including interest.

- P: Initial principal amount.

- r: Annual interest rate (in decimal form).

- n: Number of times interest is compounded per year.

- t: Time the money is invested or borrowed for, in years.

- Identify the Compounding Frequency: Determine how often the interest is compounded—daily, monthly, quarterly, or annually.

- Convert the Interest Rate: Express the annual interest rate as a decimal (e.g., 5% becomes 0.05).

- Calculate for Each Time Period: Apply the formula for the desired timeframe, adjusting the rate and frequency accordingly.

- Utilize Online Tools: Simplify the process using online compound interest calculators that provide quick results.

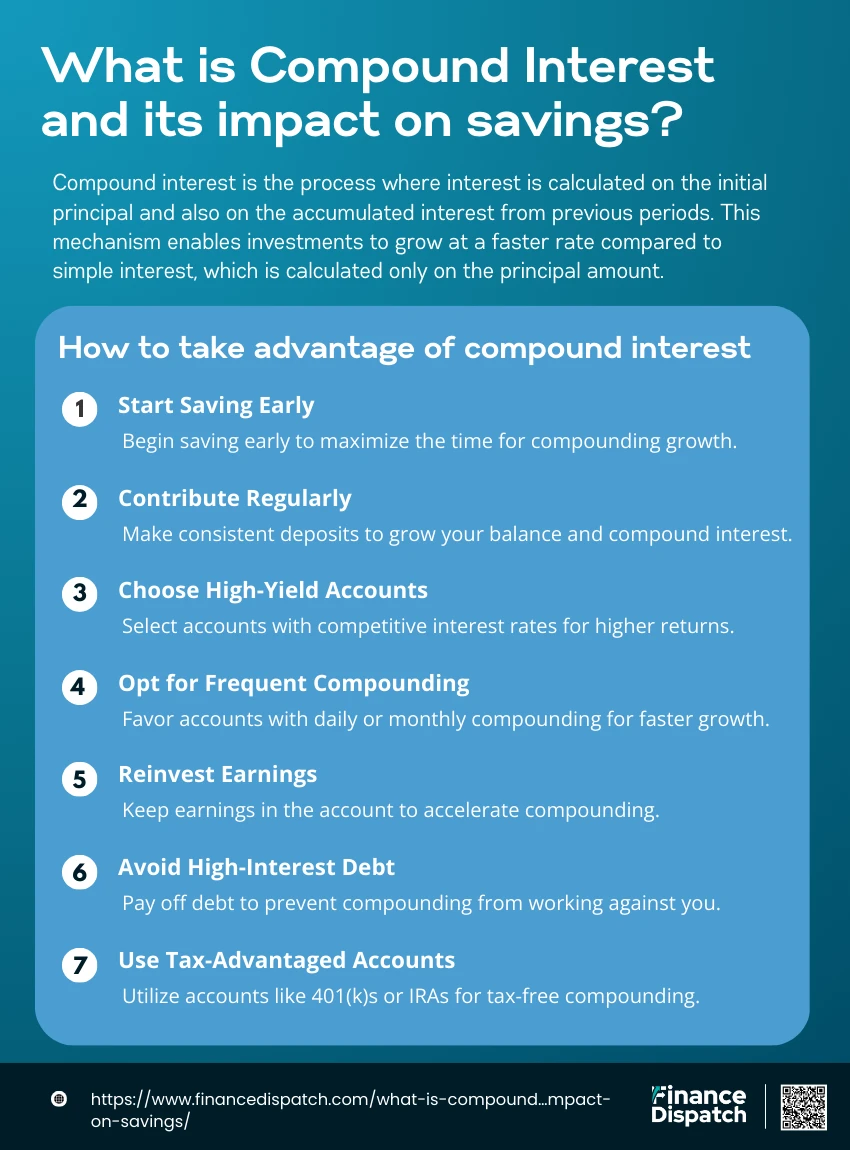

How to take advantage of compound interest

Compound interest is your secret weapon for growing your wealth over time. To fully unlock its potential, it’s important to have a strategy that ensures you’re maximizing its benefits. Here’s how you can take advantage of compound interest in more detail:

1. Start Saving Early

The earlier you begin saving or investing, the longer your money has to grow through compounding. Time is the most critical factor in leveraging compound interest. For instance, saving $100 a month starting in your 20s can result in significantly higher returns by retirement compared to starting the same habit in your 40s. Even small amounts saved early can grow exponentially because the interest has more time to build upon itself.

2. Contribute Regularly

Making consistent contributions to your savings or investment accounts ensures that your balance continues to grow. Regular deposits, no matter how small, increase the principal amount on which interest is calculated. Over time, these steady contributions, coupled with compounding, can turn into substantial wealth.

3. Choose High-Yield Accounts

Not all savings accounts are created equal. To maximize compound interest, look for accounts or investment options that offer competitive interest rates, such as high-yield savings accounts or certificates of deposit (CDs). The higher the interest rate, the more your money grows over time.

4. Opt for Frequent Compounding

Accounts that compound interest more frequently—daily or monthly rather than annually—will grow faster. This is because interest is calculated and added to your balance more often, giving you a larger base amount for future interest calculations. When comparing financial products, prioritize those with frequent compounding periods for better returns.

5. Reinvest Earnings

To truly benefit from compound interest, let your earnings remain in the account instead of withdrawing them. By reinvesting the interest you earn, you allow it to generate even more interest in the next compounding period, creating a snowball effect that accelerates growth.

6. Avoid High-Interest Debt

Just as compound interest can grow your savings, it can also multiply your debts. High-interest loans, like credit card debt, can spiral out of control if not managed properly. Paying off these debts quickly prevents compounding from working against you, allowing you to focus on building wealth.

7. Use Tax-Advantaged Accounts

Tax-advantaged accounts, such as 401(k)s, IRAs, or Roth IRAs, allow your savings to grow without being taxed annually. This means your money compounds faster because you’re not losing a portion of your returns to taxes each year. These accounts are especially beneficial for long-term savings, such as retirement.

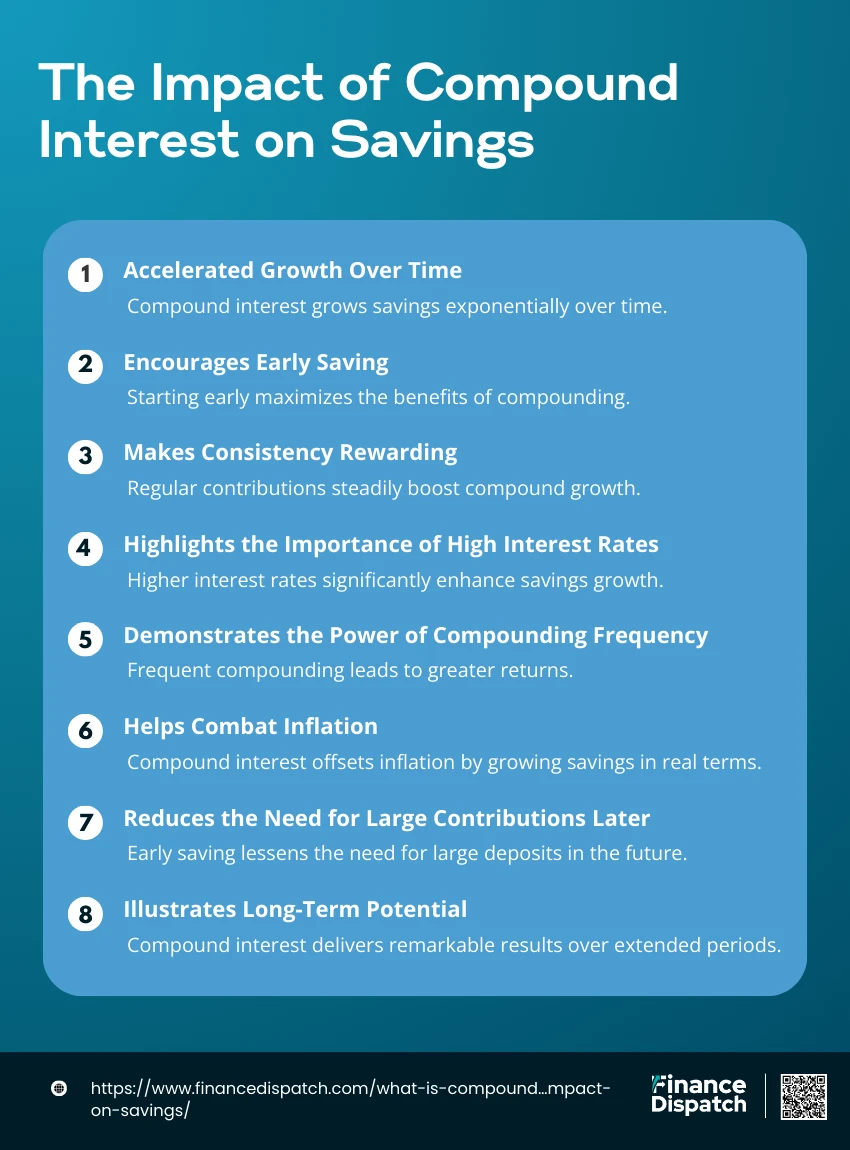

The Impact of Compound Interest on Savings

Compound interest is a powerful force that can significantly enhance the growth of your savings. By earning interest on both your initial deposit and the accumulated interest, your money grows at an accelerating pace. To truly harness its potential, it’s important to understand its effects and the strategies you can use to maximize its benefits.

1. Accelerated Growth Over Time

Compound interest works exponentially rather than linearly, meaning your savings grow faster as time progresses. This is because interest is calculated not just on your original deposit but also on the interest that has accumulated over previous periods. For example, a $10,000 deposit earning 5% annual interest compounded monthly can grow to over $16,000 in 10 years, showcasing how compounding accelerates wealth-building.

2. Encourages Early Saving

The earlier you start saving, the greater the benefit from compound interest. Time is the most critical factor in compounding, as it allows your savings to grow for longer periods. For instance, saving $100 a month starting at age 25 will yield significantly more by retirement than starting the same habit at age 40, even if the total contributions are similar. Early saving gives your money a longer runway to compound and grow.

3. Makes Consistency Rewarding

Regular contributions amplify the effects of compounding by steadily increasing your principal. Consistency, even with small amounts, ensures that your savings keep growing over time. For example, adding $100 monthly to a savings account with compound interest can result in tens of thousands of dollars more in the long term than an irregular or one-time deposit.

4. Highlights the Importance of High Interest Rates

The rate at which your money compounds plays a significant role in the overall growth of your savings. Accounts or investments offering higher interest rates can produce significantly greater returns over time. For example, an account with a 5% interest rate will grow much faster than one offering only 1%. Therefore, it’s crucial to shop for high-yield accounts to maximize your returns.

5. Demonstrates the Power of Compounding Frequency

How often interest is compounded—daily, monthly, or annually—directly impacts your savings. The more frequent the compounding, the higher your returns. For instance, an account that compounds interest daily will generate slightly more growth than one compounding annually, even if the interest rate is the same. Always opt for accounts with more frequent compounding periods for maximum benefit.

6. Helps Combat Inflation

Inflation reduces the purchasing power of money over time, meaning you’ll need more money in the future to buy the same goods and services. Compound interest helps offset this effect by growing your savings at a rate that can outpace inflation. High-yield savings accounts or investments with competitive returns ensure your money retains its value and grows in real terms.

7. Reduces the Need for Large Contributions Later

By starting early and taking advantage of compound interest, you can achieve substantial savings with smaller initial contributions. For example, saving $200 a month from age 25 can lead to more significant savings than starting at age 40 with $500 a month. Early compounding reduces the pressure to save large sums later in life to meet your financial goals.

8. Illustrates Long-Term Potential

The true power of compound interest reveals itself over the long term. While the initial growth might seem slow, the accumulation accelerates significantly as time passes. For example, a savings account with compound interest might show modest growth in the first few years, but after 20 or 30 years, the results can be astonishing, turning disciplined saving into substantial financial security.

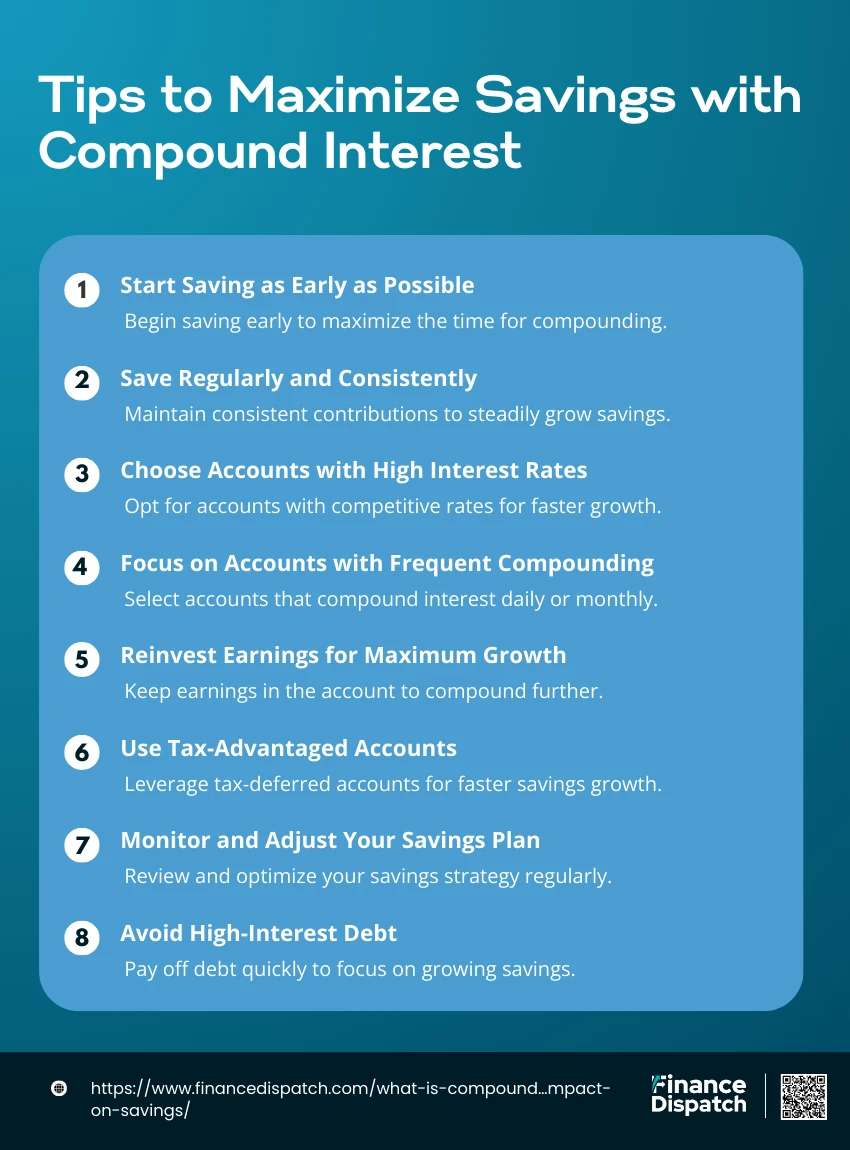

Tips to Maximize Savings with Compound Interest

Compound interest is an exceptional financial tool that can significantly enhance your savings over time. However, to truly maximize its potential, you need to implement strategies that ensure steady growth. Below, we’ll delve deeper into the essential tips to help you make the most of compounding:

1. Start Saving as Early as Possible

The earlier you start saving, the longer your money has to grow. Compound interest thrives on time, allowing even small initial deposits to multiply over decades. For example, saving $50 a month starting at age 20 will yield far more by retirement than starting the same habit at age 35. The sooner you begin, the more you benefit from the snowball effect of compounding.

2. Save Regularly and Consistently

Consistency is key when it comes to maximizing compound interest. Regular deposits ensure your account balance grows steadily, providing a larger base for interest to accumulate. Even if you can only contribute a small amount, maintaining a steady saving habit over time creates significant results.

3. Choose Accounts with High Interest Rates

The interest rate on your savings plays a critical role in how quickly your money grows. Higher interest rates mean more substantial returns. When comparing financial products, focus on accounts or investments with competitive rates to get the most out of your savings.

4. Focus on Accounts with Frequent Compounding

Interest compounded daily or monthly grows faster than interest compounded annually. Accounts with more frequent compounding periods give your savings more opportunities to grow. For instance, a daily compounding account will generate more interest in a year than a similar account compounding annually, even at the same rate.

5. Reinvest Earnings for Maximum Growth

To maximize compounding, leave the interest you earn in your account. By reinvesting earnings, you allow them to generate even more interest during the next compounding period. This continuous cycle of reinvestment is the heart of compound interest.

6. Use Tax-Advantaged Accounts

Tax-deferred accounts like 401(k)s, IRAs, or Roth IRAs shield your earnings from annual taxation, allowing them to grow faster. These accounts are particularly valuable for long-term goals like retirement, where the compounded growth can be substantial.

7. Monitor and Adjust Your Savings Plan

Regularly reviewing your savings plan ensures you’re on track to meet your financial goals. If your income increases, consider boosting your contributions. Additionally, if you find accounts with better rates or terms, don’t hesitate to switch for better returns.

8. Avoid High-Interest Debt

High-interest debt can negate the benefits of compound interest. Interest on debts like credit cards or payday loans compounds against you, making it harder to save. Paying off such debts quickly ensures you can focus on building your savings without the burden of growing liabilities.

Compound Interest: A Long-Term Strategy

Compound interest is more than just a financial term—it’s a strategy for building wealth over time. By reinvesting the interest you earn, compound interest creates a snowball effect that allows your savings or investments to grow exponentially. While the benefits may seem small at first, the true power of compound interest becomes evident over the long term, making it an essential tool for achieving financial security and reaching your goals.

Key Strategies for Leveraging Compound Interest:

- Start Early

Time is the most critical factor in compound interest. The earlier you begin saving or investing, the more time your money has to grow, amplifying the effects of compounding. - Be Consistent

Regular contributions, no matter how small, help maintain steady growth. Consistency ensures your savings grow year after year, even during economic fluctuations. - Reinvest Earnings

Instead of withdrawing interest or dividends, leave them in your account. Reinvesting ensures that your returns earn additional returns, accelerating growth. - Choose High-Yield Accounts

Seek out accounts or investments with competitive interest rates. Higher rates amplify the power of compounding, helping your money grow faster. - Opt for Frequent Compounding

Accounts that compound interest more frequently—daily or monthly—yield higher returns compared to those that compound annually. Always prioritize accounts with more frequent compounding. - Leverage Tax-Advantaged Accounts

Tax-deferred accounts like 401(k)s or Roth IRAs protect your earnings from annual taxes, allowing your money to compound uninterrupted over time. - Stay Patient and Focused

Compound interest requires time to show significant results. Stay disciplined, avoid premature withdrawals, and let the compounding process work its magic. - Avoid High-Interest Debt

Debt with high interest rates can counteract your savings efforts. Pay off high-interest loans promptly to ensure your money works for you, not against you.

Why is Compound Interest Important?

Compound interest is important because it serves as a powerful financial tool for growing wealth over time. Unlike simple interest, which only earns returns on the initial principal, compound interest generates earnings on both the principal and accumulated interest. This creates a multiplier effect, allowing your money to grow exponentially. Its importance lies in its ability to make even small, regular contributions turn into substantial sums over the long term, making it an essential strategy for achieving financial goals like retirement savings, wealth building, or education funding. By understanding and leveraging compound interest, you can maximize the value of your savings and investments, ensuring financial security and stability.

Conclusion

In conclusion, compound interest is a remarkable financial principle that underscores the value of time, consistency, and strategic planning in building wealth. Whether you’re saving for short-term goals or investing for long-term security, understanding and leveraging compound interest can significantly accelerate your financial growth. Its exponential nature turns modest contributions into substantial savings, rewarding those who start early and stay disciplined. By making informed choices about interest rates, compounding frequency, and reinvesting earnings, you can harness the full potential of this powerful tool. Ultimately, compound interest is not just a method for growing money—it’s a cornerstone of financial success.