In today’s fast-paced, digitally connected world, the way we pay for goods and services is rapidly evolving. One of the most significant shifts in recent years has been the rise of contactless payment—a modern solution that combines speed, security, and simplicity. Whether you’re tapping a card, waving your smartphone, or using a smartwatch at the checkout, contactless payment eliminates the need for physical cash or card insertion. What started as a niche convenience has now become a preferred payment method across industries, offering a seamless experience that meets the growing demand for hygiene, efficiency, and instant transactions. This article explores what contactless payment is, how it works, and the many ways it’s making everyday purchases more convenient than ever.

What Is Contactless Payment?

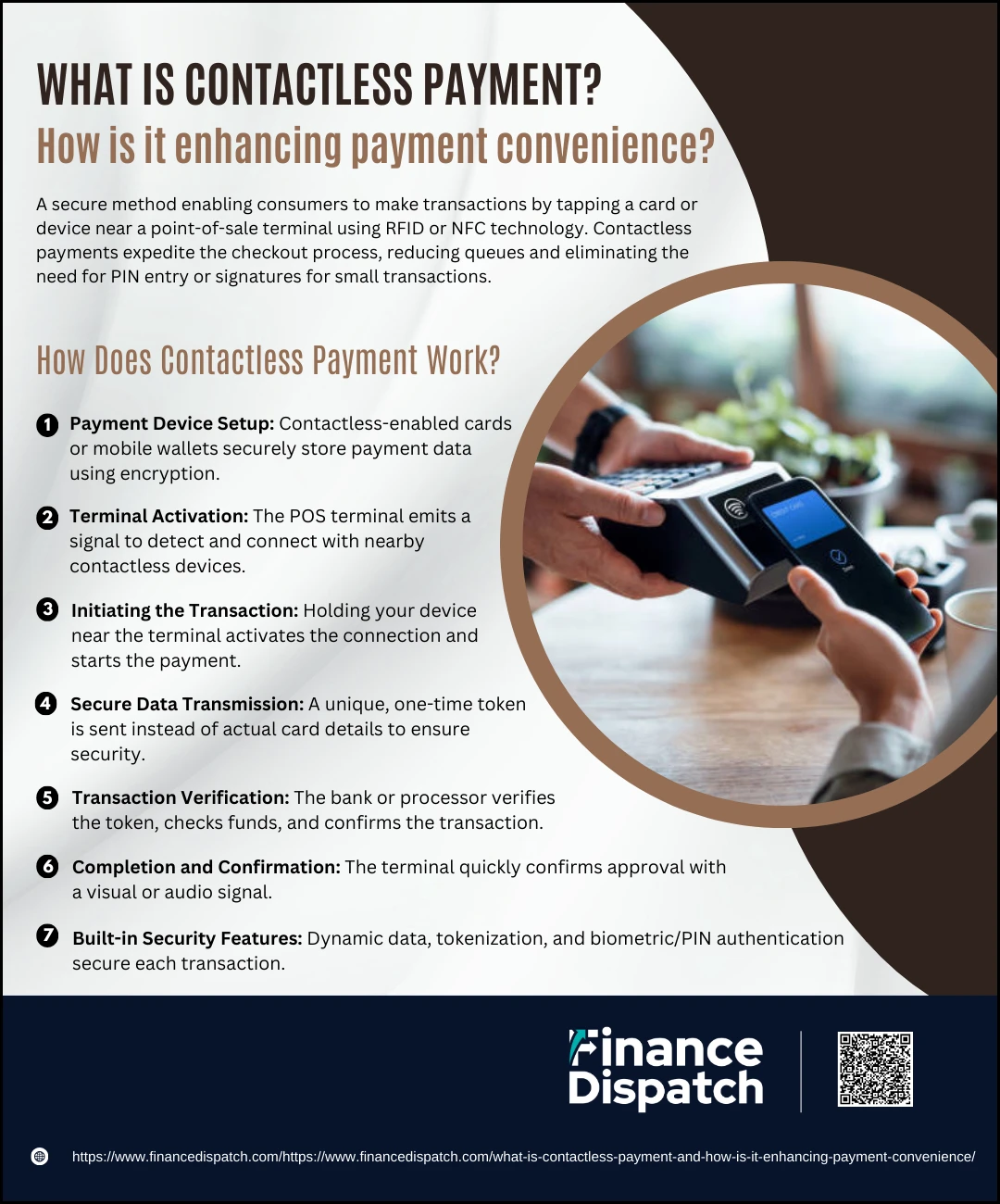

Contactless payment is a secure and convenient method that allows you to make purchases without swiping your card, inserting it into a terminal, or handling cash. Instead, you simply tap or wave your contactless-enabled card, smartphone, or wearable device near a point-of-sale terminal to complete a transaction. This process relies on Near Field Communication (NFC) or Radio Frequency Identification (RFID) technology to transmit encrypted payment data wirelessly and instantly. The transaction is completed in seconds, often without the need for a PIN or signature for smaller purchases. Designed to simplify everyday payments, contactless technology is now integrated into most modern debit and credit cards as well as mobile wallets like Apple Pay, Google Pay, and Samsung Pay.

A Brief History of Contactless Payment

The journey of contactless payment began in the mid-1990s, when Seoul’s transit system introduced one of the first contactless card solutions for commuters. Shortly after, companies like Mobil launched innovations such as the Speedpass in 1997, allowing users to pay for fuel with a simple tap. Over the years, contactless technology evolved from niche applications in transportation and fuel to broader adoption in retail and everyday transactions. In 2011, mobile wallets like Google Wallet and Android Pay emerged, followed by Apple Pay in 2014, which helped bring contactless payments to smartphones. The adoption significantly accelerated during the COVID-19 pandemic, as the need for safer, touch-free transactions became essential. Today, contactless payment is a global standard, integrated into cards, phones, and even wearable devices, revolutionizing the way people pay across the world.

How Does Contactless Payment Work?

How Does Contactless Payment Work?

Contactless payment simplifies the checkout experience by allowing you to make purchases without inserting your card or entering a PIN—just a tap or wave is enough. This technology uses near-field communication (NFC) or radio frequency identification (RFID) to enable wireless data exchange between your payment device and the merchant’s terminal. The process is not only quick and convenient but also designed with layers of security, such as encryption and tokenization, to protect your financial details. Whether you’re using a contactless-enabled card, smartphone, or wearable device, each transaction is designed to be as seamless and secure as possible.

Here’s how the process works, step by step:

1. Payment Device Setup

The process begins with a contactless-enabled device—this could be a credit or debit card with an NFC chip, or a smartphone or smartwatch using a mobile wallet like Apple Pay, Google Pay, or Samsung Pay. These devices store your card information in a secure, encrypted format.

2. Terminal Activation

At the checkout counter, the point-of-sale (POS) terminal emits a low-power radio signal continuously, waiting to detect any nearby contactless-enabled devices. This allows it to “wake up” the payment chip when it’s brought close.

3. Initiating the Transaction

When you’re ready to pay, simply hold your device or card near the terminal—typically within 2 to 4 centimeters. The device doesn’t need to touch the terminal, just be close enough to establish an NFC connection.

4. Secure Data Transmission

As the terminal detects your device, it triggers the NFC chip to send payment data. However, instead of transmitting your actual card number, a one-time-use token (a random, unique code) is sent to represent your account information. This protects your real card details from being exposed.

5. Transaction Verification

The terminal forwards this tokenized data to the payment processor or issuing bank, which verifies the transaction. This includes checking for funds, validating the token, and confirming the merchant information—all in real-time.

6. Completion and Confirmation

Within seconds, the transaction is either approved or declined. If approved, the terminal confirms the payment with a beep, green light, or on-screen message, and your purchase is complete.

7. Built-in Security Features

Contactless payments are designed with multiple security layers. Every transaction uses dynamic data, so even if it’s intercepted, it can’t be reused. Additionally, for higher-value purchases, biometric authentication (like fingerprint or face recognition) or a PIN may be required, especially on mobile devices.

Types of Contactless Payments

Contactless payment methods have expanded far beyond just tapping a credit card. Today, consumers have a range of convenient and secure options to make payments without physical contact. From traditional contactless cards to advanced mobile wallets and wearable tech, these solutions offer flexibility and speed across various settings—retail stores, public transport, restaurants, and more. Each method operates using near-field communication (NFC), RFID, or QR code technology, allowing users to complete transactions with just a tap or wave.

Here’s a comparison of the most common types of contactless payments:

| Payment Type | Description | Technology Used | Devices/Examples | Key Benefits |

| Contactless Cards | Debit or credit cards with embedded NFC chips that enable tap-to-pay. | NFC | Visa, Mastercard, Amex contactless cards | Fast, easy to use, widely accepted |

| Mobile Wallets | Digital wallets on smartphones that store card details securely. | NFC, Tokenization | Apple Pay, Google Pay, Samsung Pay | Extra security, biometric authentication |

| Wearable Devices | Smartwatches and fitness trackers with payment features. | NFC | Apple Watch, Fitbit Pay, Garmin Pay | Convenient, hands-free payments |

| Tap-on-Mobile Solutions | Smartphones turned into POS devices for merchants to accept payments. | NFC | Worldline Tap on Mobile, SoftPOS solutions | Ideal for small businesses, portable |

| QR Code Payments | Payments made by scanning a QR code through a mobile app. | QR Code | Paytm, PhonePe, BharatPe, Google Pay (India) | No NFC required, accessible on any phone |

Popular Methods and Devices for Contactless Payment

With the rapid evolution of digital technology, contactless payments are now supported across a variety of methods and devices, making it easier than ever to pay without cash or physical contact. Whether you’re using a bank-issued card, a smartphone app, or even a smartwatch, these tools all enable secure, fast transactions through NFC or similar wireless technology. Here are some of the most popular ways people are embracing contactless payment in their daily lives:

1. Contactless Credit and Debit Cards

These are standard bank cards embedded with NFC chips that allow you to tap and pay at terminals marked with the contactless symbol. No need for swiping, inserting, or entering a PIN for small purchases.

2. Apple Pay

Built into iPhones and Apple Watches, Apple Pay lets users make secure payments by holding their device near a terminal. It also supports biometric security features like Face ID or Touch ID.

3. Google Pay

Available on Android devices, Google Pay allows users to store card details and pay using their smartphones or smartwatches. It uses tokenization for added security during transactions.

4. Samsung Pay

Samsung’s mobile wallet functions similarly to Apple Pay and Google Pay, but also supports Magnetic Secure Transmission (MST), allowing it to work with older payment terminals as well.

5. Fitbit Pay and Garmin Pay

Fitness wearables have joined the payment revolution. Fitbit and Garmin devices now support contactless payment, letting users pay on the go without carrying a phone or wallet.

6. QR Code-Based Payments

Common in many parts of Asia, QR code payments allow users to scan a merchant’s QR code using apps like Paytm, PhonePe, or even WhatsApp to complete a transaction—no tap required.

7. Tap-on-Mobile for Merchants

Small businesses can now use their Android smartphones as POS terminals, thanks to tap-on-mobile apps. This eliminates the need for dedicated hardware and supports contactless card or phone payments.

How Contactless Payment Enhances Convenience?

How Contactless Payment Enhances Convenience?

In a world where speed and simplicity are essential, contactless payment has emerged as a game-changer in everyday transactions. By replacing traditional methods like cash handling, card swiping, or PIN entry with a simple tap or wave, contactless technology minimizes friction during checkout. It enhances the overall user experience by offering faster, safer, and more flexible ways to pay—whether you’re grabbing a coffee, commuting, or shopping online. This not only benefits consumers looking for ease and efficiency but also helps businesses improve service flow and customer satisfaction. Below are some key ways contactless payment enhances convenience in our daily lives:

1. Faster Checkout Times

One of the most noticeable benefits is the speed. Contactless payments typically take just a few seconds to process, compared to traditional chip or swipe methods that require PINs or signatures. This significantly reduces waiting time at checkout lines, particularly in busy environments like supermarkets, coffee shops, and public transport stations.

2. No Need to Carry Cash or Coins

With contactless cards and digital wallets, you don’t need to worry about digging for exact change or visiting an ATM. Everything you need is already on your phone, smartwatch, or card, making spontaneous purchases easier and less stressful.

3. Hands-Free and Hygienic Transactions

Especially during health-conscious times, like the COVID-19 pandemic, contactless payments became essential for limiting physical contact. Since there’s no need to touch buttons, handle bills, or share pens, it provides a safer and cleaner transaction method for both customers and staff.

4. Seamless Public Transportation Access

Many transit systems worldwide now accept tap-and-go payments, allowing you to pay fares simply by tapping your card or phone. This removes the need to wait in line for tickets or reload travel cards, making commuting more efficient and less stressful.

5. Integrated Loyalty and Rewards Programs

Mobile wallets often sync with loyalty cards and store apps, allowing automatic application of points, discounts, or special offers without the hassle of remembering to scan multiple cards. It streamlines the customer experience and encourages repeat business.

6. Support for Wearable Devices

Wearables like Apple Watch, Samsung Galaxy Watch, and fitness trackers like Fitbit offer tap-to-pay functionality. This is incredibly convenient when you’re out for a run, at the gym, or simply don’t want to carry a bag or wallet.

7. Enhanced In-Store Shopping Experience

The simplicity of tapping to pay adds to the overall shopping experience. Customers can enjoy browsing without the stress of lengthy checkout procedures. For retailers, this means faster turnover and happier customers.

8. Flexible Usage Across Channels

Contactless payment isn’t limited to physical stores. Many platforms support in-app and online purchases with just a few taps, making it easier to shop from anywhere without manually entering card details each time.

Advantages of Contactless Payments

Advantages of Contactless Payments

Contactless payments have transformed the way people pay for goods and services by offering a faster, safer, and more user-friendly alternative to traditional payment methods. Whether you’re using a tap-enabled card, mobile phone, or smartwatch, the ability to pay with just a wave or tap brings unmatched convenience. But beyond speed, contactless technology offers a range of benefits for both consumers and businesses—making transactions more efficient, secure, and seamless. Here are some of the key advantages of using contactless payments:

1. Speed and Efficiency

Contactless payments are significantly faster than swiping cards or handling cash. Most transactions are completed in under a few seconds, which reduces wait times at checkout counters and helps businesses serve more customers in less time.

2. Enhanced Security

With built-in security features like encryption and tokenization, contactless payments protect sensitive financial information. Each transaction generates a unique code that can’t be reused, minimizing the risk of data theft or card cloning.

3. Improved Hygiene and Safety

As contactless payments don’t require touching keypads, handing over cash, or inserting cards, they help reduce physical contact—making them a safer option, especially during health crises like the COVID-19 pandemic.

4. Convenience and Accessibility

Contactless payment methods—whether through cards, smartphones, or wearables—make it easy to pay on the go. You don’t need to carry cash, count change, or even pull out your wallet.

5. Better Customer Experience

The quick and easy checkout process improves overall customer satisfaction. Shoppers appreciate the smooth and hassle-free experience, which can lead to increased brand loyalty and return visits.

6. Reduced Operational Costs for Businesses

Faster transactions mean quicker checkouts and shorter lines, allowing businesses to serve more customers with fewer resources. It also reduces the need to handle and manage cash, which lowers the risk of errors and theft.

7. Integration with Loyalty Programs

Many contactless systems can link directly to loyalty and rewards programs. Customers can automatically earn or redeem points at the point of sale without additional cards or steps.

8. Environmentally Friendly

By reducing the need for paper receipts, cash handling, and plastic cards, contactless payments contribute to a more eco-friendly and sustainable payment system.

Is Contactless Payment Safe?

Yes, contactless payment is widely considered a safe and secure method for completing transactions. It uses advanced security technologies such as encryption and tokenization to protect your financial information. Instead of transmitting your actual card number during a transaction, contactless systems use a unique, one-time code (or token), which makes it extremely difficult for fraudsters to intercept or misuse your data. Additionally, the short range of Near Field Communication (NFC)—typically just a few centimeters—minimizes the risk of unauthorized access. For added protection, mobile wallets often require biometric authentication like fingerprint or facial recognition before processing a payment. Financial institutions also monitor for suspicious activity and provide fraud protection policies, ensuring that contactless payments remain not only convenient but highly secure.

How Contactless Payments Enhance Business Operations

Contactless payments are not just beneficial for consumers—they also offer powerful advantages for businesses. By streamlining the checkout process, improving transaction speed, and reducing reliance on cash handling, contactless technology can significantly enhance daily operations. These benefits translate into better customer service, improved efficiency, and more insightful data for strategic decision-making. For businesses aiming to modernize and stay competitive, adopting contactless payments is more than a convenience—it’s a smart operational upgrade.

1. Faster Transactions

Contactless payments reduce the time spent on each transaction, allowing businesses to serve more customers, especially during peak hours.

2. Reduced Cash Handling

Less cash means fewer errors, reduced risk of theft, and lower labor costs associated with counting and managing money.

3. Improved Customer Satisfaction

A quick and seamless checkout process creates a better shopping experience, encouraging repeat business and customer loyalty.

4. Better Hygiene and Safety

Minimizing contact at the point of sale supports health and safety, which can be a key differentiator in customer trust—especially in food service, healthcare, and high-traffic environments.

5. Lower Operational Costs

Digital transactions can reduce the need for physical receipts, paper-based processes, and maintenance of outdated POS systems.

6. Data Collection and Insights

Contactless payments generate digital records that can help businesses analyze consumer behavior, monitor sales patterns, and tailor marketing strategies.

7. Integration with Loyalty Programs

Businesses can easily link contactless payments to rewards systems, offering incentives that keep customers engaged and returning.

8. Enhanced Brand Image

Embracing modern payment technologies positions businesses as forward-thinking and customer-focused, improving their brand reputation in a competitive market.

Overcoming Challenges of Contactless Payment

While contactless payment offers numerous advantages, its adoption doesn’t come without challenges. Businesses and consumers alike may face hurdles related to technology, security concerns, infrastructure, and user awareness. However, these challenges can be effectively managed with the right strategies, tools, and education. By addressing these issues early, businesses can unlock the full potential of contactless payment systems while building trust with their customers.

1. Initial Setup Costs

Upgrading point-of-sale (POS) systems to support NFC or QR-based contactless technology can require a significant upfront investment, especially for small businesses.

2. Consumer Hesitancy and Awareness

Some customers may still be unfamiliar or uncomfortable with contactless payment, worrying about its security or ease of use. Education and reassurance are key to overcoming this resistance.

3. Device Compatibility Issues

Not all devices or cards support contactless technology, which can lead to inconsistent customer experiences. Businesses should ensure compatibility across a range of payment options.

4. Transaction Limits

Many financial institutions impose limits on contactless transactions to reduce fraud risk. For higher-value purchases, requiring a PIN or signature can reintroduce some friction.

5. Security Concerns

Although contactless payment is highly secure, concerns about unauthorized charges or card theft persist. Promoting the use of tokenization, biometric authentication, and fraud monitoring helps ease these fears.

6. Connectivity and System Reliability

Contactless systems rely on stable network connections and functioning POS terminals. Downtime or poor connectivity can disrupt service and frustrate customers.

7. Regulatory Compliance

Businesses must stay informed about data privacy laws and payment regulations to ensure they’re handling transactions in a legally compliant way.

8. Lack of Standardization

Varying technologies, transaction limits, and user experiences across countries and service providers can complicate global adoption and consistency.

The Future of Contactless Payments

The future of contactless payments is poised to be more seamless, secure, and integrated into everyday life than ever before. As technology continues to evolve, we can expect to see broader adoption of biometric authentication methods such as fingerprint and facial recognition, making transactions not only faster but also more secure. Wearable devices like smartwatches and fitness trackers will play an even greater role in mobile commerce, offering payment capabilities right from your wrist. Additionally, innovations such as digital currencies, blockchain technology, and AI-driven payment systems are likely to reshape how contactless transactions are processed and verified. The integration of contactless payment into Internet of Things (IoT) devices—such as smart cars, home assistants, and vending machines—will further embed this technology into our daily routines. As consumers increasingly prioritize convenience, safety, and personalization, contactless payments will continue to lead the charge in the transformation of global commerce.

Conclusion

Contactless payment has rapidly become a cornerstone of modern commerce, offering a fast, secure, and convenient alternative to traditional payment methods. Whether through cards, smartphones, or wearable devices, it simplifies transactions and enhances both the customer and business experience. From reducing checkout times and improving hygiene to enabling smarter data-driven operations, the benefits are clear and far-reaching. As technology continues to advance, contactless payments will only grow more powerful, personalized, and accessible—shaping the future of how we shop, travel, and interact with the world around us. Embracing this evolution means embracing a smarter, more efficient way to pay.