In an era where technology drives almost every aspect of our lives, banking is no exception. Digital banking has emerged as a transformative force, redefining how individuals and businesses interact with financial services. Unlike traditional banking, which relies heavily on physical branches and face-to-face interactions, digital banking leverages technology to offer seamless, secure, and convenient banking solutions anytime, anywhere. From online transactions and mobile banking apps to AI-powered customer support, digital banking is not just an alternative but a necessity in today’s fast-paced world. This shift is not only enhancing customer experience but also streamlining operations for financial institutions, paving the way for a future where banking is fully integrated into our digital lives. In this article, we’ll explore what digital banking entails and how it’s revolutionizing traditional banking services.

What is Digital Banking?

Digital banking refers to the use of digital technologies and online platforms to deliver banking services and manage financial transactions. It eliminates the need for physical visits to bank branches by providing customers with secure and convenient access to their accounts through mobile apps, websites, and other digital channels. Digital banking encompasses a wide range of services, including online fund transfers, bill payments, loan applications, and even investment management. Unlike traditional banking, which is often limited by operational hours and location, digital banking offers 24/7 accessibility, empowering users to handle their finances anytime and from anywhere. By leveraging advanced technologies such as artificial intelligence, blockchain, and data analytics, digital banking not only enhances user experience but also improves operational efficiency and reduces costs for financial institutions.

Evolution of Banking: From Traditional to Digital

Banking has evolved significantly over the centuries, transitioning from traditional physical transactions to advanced digital platforms. In the early days, banking was limited to physical branches, paper-based records, and in-person interactions. With the rise of technology, banking services gradually shifted to online platforms, mobile applications, and AI-driven solutions, offering customers convenience, speed, and enhanced security. This transformation not only redefined customer experiences but also revolutionized financial operations worldwide. Below is a step-by-step overview of the key stages in the evolution of banking.

Key Stages in the Evolution of Banking

1. Barter System (Ancient Era)

The earliest form of trade involved the direct exchange of goods and services without a standardized medium of exchange.

2. Introduction of Coins and Currency (7th Century BC)

The invention of coins and later paper money provided a reliable and standardized medium for trade and transactions.

3. Emergence of Banking Institutions (15th–17th Century)

Formal banking systems emerged in Europe, offering money safekeeping, loans, and facilitating large-scale trade.

4. Cheque System (17th Century)

Cheques became a convenient alternative to carrying large amounts of cash, simplifying financial transactions.

5. Establishment of Central Banks (18th Century)

Central banks were introduced to regulate monetary policies, issue currency, and ensure financial stability.

6. Introduction of ATMs (1960s)

Automated Teller Machines allowed customers to access cash and account information without visiting a bank branch.

7. Online Banking (1990s)

The rise of the internet enabled banks to offer online services, including fund transfers, bill payments, and account management.

8. Mobile Banking (2000s)

The adoption of smartphones brought banking services to mobile applications, allowing customers to manage their finances on the go.

9. Digital Wallets and Fintech Platforms (2010s)

Platforms like PayPal, Apple Pay, and fintech startups revolutionized transactions with secure, cashless payment systems.

10. AI and Blockchain Technologies (2020s)

Artificial Intelligence improved customer service and fraud detection, while blockchain ensured transparent and secure financial transactions.

Key Services Offered by Digital Banking

Digital banking has fundamentally changed how customers interact with financial institutions, providing services that go far beyond simple account management. With the integration of advanced technologies such as artificial intelligence, blockchain, and mobile app solutions, digital banking has become synonymous with convenience, speed, and security. Whether it’s transferring funds, managing investments, or accessing customer support, digital banking allows users to handle their financial needs with just a few taps on their devices. This transformation not only reduces the dependency on physical bank branches but also empowers customers with 24/7 access to their finances, personalized financial insights, and enhanced security features. Below are some of the most impactful services offered by digital banking that are shaping the modern financial landscape.

Key Services of Digital Banking

- Online Fund Transfers: Digital banking enables seamless transfers of money between accounts, both locally and internationally. Services like NEFT, RTGS, and UPI facilitate quick and secure transactions, reducing the need for manual paperwork or physical branch visits.

- Mobile Payments and Digital Wallets: With digital wallets like Apple Pay, Google Pay, and Samsung Pay, users can make contactless payments securely using their smartphones or smartwatches. These platforms eliminate the need for carrying physical cash or cards, making transactions more efficient and secure.

- Automated Bill Payments: Digital banking platforms allow users to schedule recurring payments for utilities, rent, loans, and subscriptions. This automation ensures that bills are paid on time, eliminating the risk of late fees or missed payments.

- Account Management: Through digital banking apps and online portals, customers can check their account balances, view real-time transaction history, and download account statements effortlessly. This transparency empowers users to track their finances effectively.

- Instant Loans and Credit Approvals: Digital banking simplifies the loan application process with online forms, quick eligibility checks, and instant approvals. Customers can apply for personal, home, or car loans without stepping into a branch, making the process faster and more efficient.

- Investment and Wealth Management Tools: Many digital banking platforms offer integrated tools for investment planning, mutual fund purchases, and stock trading. AI-driven analytics provide insights into market trends, helping customers make informed financial decisions.

- Customer Support via Chatbots: AI-powered chatbots provide round-the-clock support, answering common questions, troubleshooting issues, and guiding customers through various banking processes. This reduces wait times and enhances user experience.

- Fraud Detection and Security Alerts: Digital banking platforms incorporate advanced fraud detection systems that monitor transactions for unusual activity. Real-time alerts are sent to customers in case of suspicious transactions, ensuring enhanced security and quick action against fraud.

- Digital Account Opening: Customers can open savings, checking, or investment accounts online without visiting a physical branch. Digital verification tools, such as e-KYC (Know Your Customer), make this process quick, secure, and hassle-free.

- Financial Planning and Budgeting Tools: Many digital banking apps now offer financial planning features that help users set budgets, monitor expenses, and save towards specific goals. These tools offer insights into spending habits and suggest areas for improvement.

How Digital Banking is Revolutionizing Traditional Banking Services

Digital banking has fundamentally transformed the traditional banking landscape by introducing innovative technologies, enhancing customer convenience, and streamlining financial operations. In the past, traditional banking relied heavily on in-person visits, physical documentation, and time-bound transactions. Today, digital banking offers 24/7 access to financial services, faster transaction processing, and personalized customer experiences through mobile apps, online platforms, and AI-driven tools. This revolution has not only improved the efficiency of banking operations but also bridged gaps in financial inclusion by reaching underserved regions. Below is a comparison table highlighting the key differences between traditional and digital banking services.

Comparison Between Traditional and Digital Banking Services

| Aspect | Traditional Banking | Digital Banking |

| Accessibility | Limited to branch hours | 24/7 access via apps/web |

| Transaction Speed | Slower, dependent on manual processing | Instant and real-time |

| Customer Interaction | In-person interactions | Chatbots, virtual assistants |

| Account Management | Manual passbook updates | Instant online updates |

| Loan Applications | Lengthy paperwork process | Online applications, quick approvals |

| Service Availability | Restricted to physical branches | Available worldwide via the internet |

| Security Measures | Traditional security checks | Multi-factor authentication, biometric verification |

| Cost Efficiency | Higher operational costs | Lower costs due to digital infrastructure |

| Bill Payments | Manual or cheque-based | Automated and scheduled online payments |

| Financial Inclusion | Limited to urban areas | Wider reach, including remote locations |

Advantages of Digital Banking

Digital banking has revolutionized the financial sector, offering a seamless blend of technology, convenience, and efficiency. Unlike traditional banking, which often requires physical visits to branches and is limited by business hours, digital banking operates 24/7, giving users the freedom to manage their finances from anywhere in the world. Whether it’s transferring funds, applying for loans, or tracking expenses, digital banking simplifies these processes through user-friendly mobile apps and secure online platforms. Technologies such as artificial intelligence, blockchain, and data analytics have further enhanced digital banking, providing personalized experiences, advanced security features, and smarter financial insights. This shift has not only benefited customers but also allowed financial institutions to reduce operational costs and offer innovative services. Below are some of the most significant advantages of digital banking:

Key Advantages of Digital Banking

- 24/7 Accessibility: With digital banking, you can access your accounts and perform transactions at any time of the day, removing the limitations imposed by traditional banking hours. Whether it’s midnight or a public holiday, your bank is always open online.

- Convenience: Digital banking platforms allow users to manage their finances, pay bills, transfer funds, and check balances directly from their smartphones, tablets, or computers. This eliminates the need to stand in long queues or fill out extensive paperwork.

- Faster Transactions: Online fund transfers, payments, and other financial operations are processed almost instantly, reducing delays caused by manual verification or branch-based processes.

- Cost-Effective: Banks save significantly on operational costs by reducing the need for physical infrastructure and resources. These savings often translate into lower fees and better interest rates for customers.

- Enhanced Security: Digital banking platforms use advanced security measures such as biometric authentication, multi-factor authentication (MFA), and end-to-end encryption to safeguard sensitive financial data from cyber threats.

- Paperless Banking: With digital banking, paperwork is minimized through electronic account statements, online receipts, and digital documentation, contributing to an eco-friendly banking environment.

- Personalized Financial Insights: AI-powered financial tools analyze user spending habits and offer customized insights, helping customers budget better, save smarter, and plan for future financial goals.

- Easy Loan Approvals: Digital banking platforms simplify the loan application process with instant eligibility checks, quick documentation, and faster approvals, reducing the time traditionally spent on paperwork and manual verification.

- Automated Bill Payments: Users can set up recurring payments for utilities, EMIs, and subscriptions, ensuring bills are always paid on time without the hassle of manual reminders.

- Global Access: Digital banking transcends geographical barriers, allowing users to make international transactions, manage overseas accounts, and conduct cross-border financial activities with ease.

- Improved Customer Support: With AI chatbots and virtual assistants, digital banking provides instant support for common queries, transaction troubleshooting, and general account-related assistance, available 24/7.

- Financial Inclusion: Digital banking extends financial services to remote and underserved areas where physical bank branches might not exist, bridging the gap between urban and rural financial access.

Challenges and Security Concerns in Digital Banking

Digital banking has revolutionized how people interact with financial services, offering seamless access to accounts, instant transactions, and advanced tools for managing finances. However, this transformation has brought with it a range of challenges and security concerns that financial institutions must address to ensure a safe and reliable banking experience. As banking services move away from physical branches and into the digital realm, they face increased exposure to cyber threats, fraud, and system vulnerabilities. Financial institutions must balance user convenience with robust cybersecurity measures while navigating complex regulatory environments. Furthermore, customers’ digital literacy and their ability to recognize and avoid online threats play a crucial role in maintaining a secure financial ecosystem. Below are some of the most pressing challenges and security concerns in digital banking today:

Key Challenges and Security Concerns in Digital Banking

- Cybersecurity Threats: As digital banking grows, so does its appeal to cybercriminals. Hackers use advanced techniques, including ransomware, spyware, and Distributed Denial of Service (DDoS) attacks, to exploit vulnerabilities in digital banking platforms, resulting in financial losses and stolen data.

- Phishing Attacks: One of the most common online scams, phishing involves tricking users into revealing their login credentials or financial information through fake emails, websites, or messages disguised as legitimate banking communications.

- Data Breaches: Banks handle vast amounts of sensitive customer data, including account details, Social Security numbers, and financial history. If security protocols are weak or outdated, hackers can breach systems and steal this data, leading to financial fraud and identity theft.

- Identity Theft: Cybercriminals often misuse stolen identities to impersonate account holders, apply for loans, or conduct unauthorized transactions, causing significant financial and emotional distress to victims.

- Lack of Digital Literacy: A significant portion of banking customers, particularly older adults and people in remote areas, lack the knowledge to safely use digital banking tools or recognize online scams, making them vulnerable to exploitation.

- Inadequate Security Measures: Weak passwords, poor encryption standards, and insufficient multi-factor authentication (MFA) mechanisms leave accounts vulnerable to unauthorized access and attacks.

- Third-Party Risks: Digital banking often relies on third-party vendors for payment gateways, software solutions, and security services. A vulnerability in any third-party system can create a backdoor for attackers to infiltrate banking platforms.

- Regulatory Compliance: Banks are required to follow strict data privacy and cybersecurity regulations across different regions. However, keeping up with evolving compliance requirements can be challenging, especially for global financial institutions.

- Fraudulent Transactions: Online platforms are prone to unauthorized transactions caused by malware attacks, social engineering scams, and vulnerabilities in payment systems. Recovering lost funds can be a lengthy and uncertain process.

- User Trust and Transparency: Despite digital banking’s benefits, some users remain hesitant to fully adopt it due to concerns about privacy breaches, fraud risks, and a lack of transparency in data usage.

- System Downtime and Technical Glitches: Frequent server downtimes, failed transactions, and technical bugs can disrupt services and erode customer trust in digital platforms.

- Multi-Device Vulnerabilities: With customers accessing banking services across various devices—smartphones, tablets, and public computers—each device becomes a potential entry point for hackers, especially when connected to unsecured networks.

- Mobile Banking App Vulnerabilities: Poorly developed mobile apps with weak encryption or outdated security patches can be exploited by cybercriminals to gain unauthorized access to customer accounts.

- Social Engineering Scams: Fraudsters often manipulate customers emotionally or psychologically to extract sensitive information, such as OTPs (One-Time Passwords) or login credentials, leading to financial fraud.

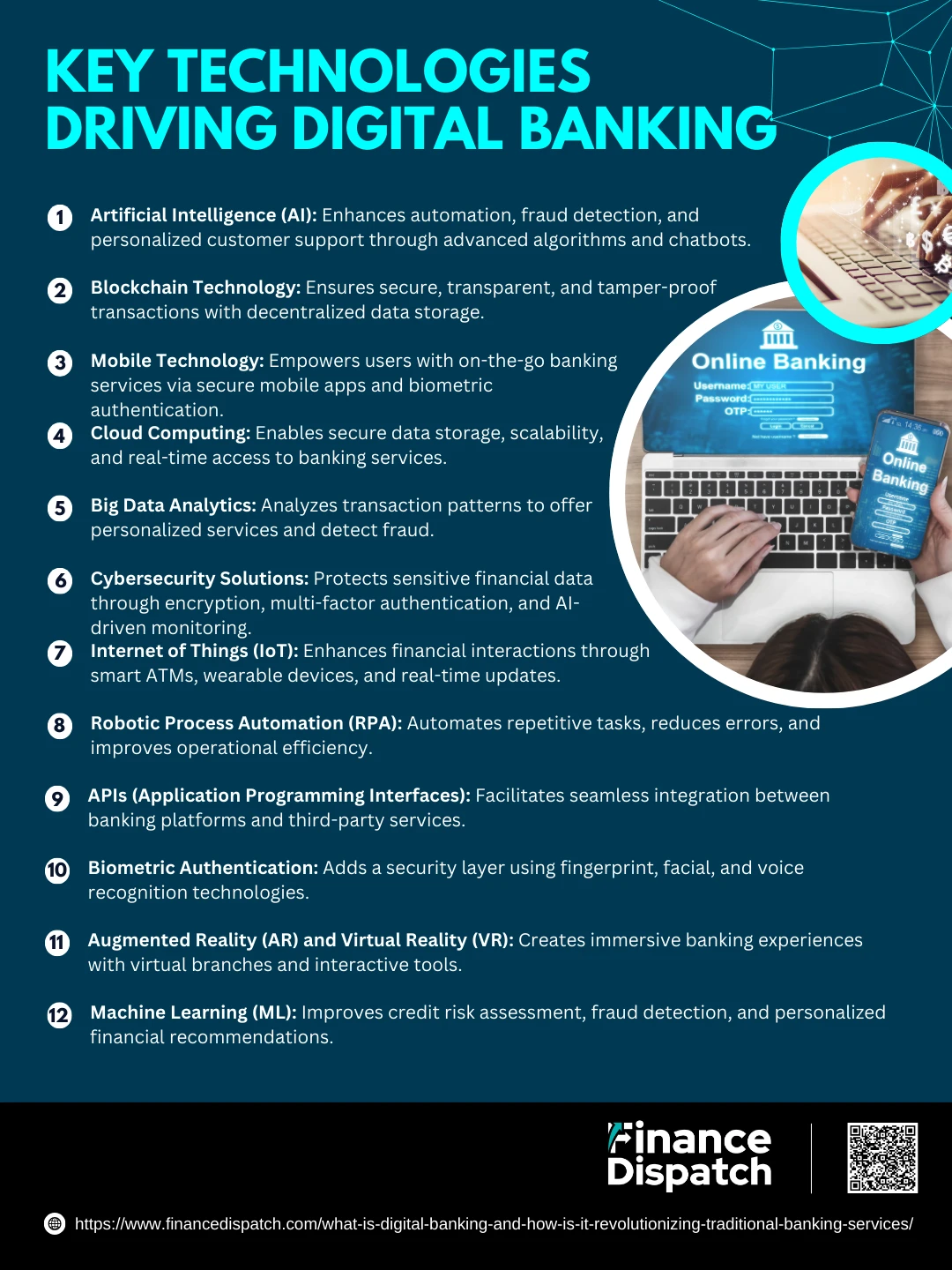

Key Technologies Driving Digital Banking

The transformation of traditional banking into a fully digital experience is driven by powerful technologies that are reshaping how financial services are delivered, managed, and secured. These technologies are not just improving customer experience but also redefining how banks operate internally, manage risks, and stay competitive in a rapidly evolving financial landscape. From advanced Artificial Intelligence (AI) algorithms predicting customer behavior to blockchain ensuring tamper-proof transactions, each technology plays a significant role in driving innovation and addressing complex banking challenges. As customer expectations for seamless, fast, and secure banking grow, financial institutions are investing heavily in integrating these technologies to deliver smarter, safer, and more efficient services. Below are some of the most influential technologies driving the digital banking revolution:

Key Technologies Driving Digital Banking

- Artificial Intelligence (AI)

AI is at the core of digital banking, enabling banks to automate processes, predict customer needs, and detect fraud in real-time. Chatbots powered by AI provide 24/7 customer support, handling queries and resolving issues instantly. Advanced AI algorithms analyze user data to deliver personalized financial advice, optimize investment portfolios, and even predict potential financial risks. - Blockchain Technology

Blockchain ensures transparency, security, and efficiency in digital banking transactions. By decentralizing data storage and using cryptographic encryption, blockchain significantly reduces the risk of fraud and cyber-attacks. It simplifies cross-border payments, lowers transaction costs, and accelerates the processing of international money transfers. - Mobile Technology

Smartphones have become essential tools for banking, offering mobile apps that provide users with on-the-go access to their accounts. Mobile banking enables quick transfers, bill payments, and seamless access to financial tools. Features like biometric authentication and one-tap payments add additional layers of convenience and security. - Cloud Computing

Cloud technology enables banks to store, process, and manage vast amounts of customer data securely while ensuring real-time access. It allows financial institutions to scale their operations, reduce infrastructure costs, and improve operational efficiency. Cloud-based platforms also support data backups and disaster recovery solutions. - Big Data Analytics

Banks process enormous volumes of data daily, and big data analytics helps make sense of this information. By analyzing customer behavior, transaction patterns, and spending habits, banks can offer tailored services, detect fraudulent activities, and predict financial trends. This technology also enhances risk assessment and credit scoring processes. - Cybersecurity Solutions

As cyber threats continue to grow, advanced cybersecurity technologies play a crucial role in protecting sensitive financial data. Techniques like end-to-end encryption, multi-factor authentication (MFA), and AI-powered threat detection systems safeguard transactions and prevent unauthorized access. - Internet of Things (IoT)

IoT devices, including smart ATMs, wearable payment devices, and connected POS systems, have revolutionized financial interactions. IoT enhances user convenience, provides real-time transaction updates, and helps banks monitor device performance remotely. - Robotic Process Automation (RPA)

RPA uses software bots to automate repetitive tasks such as data entry, transaction validation, and compliance checks. This not only reduces operational costs but also minimizes errors and improves process efficiency, allowing human resources to focus on strategic functions. - APIs (Application Programming Interfaces)

APIs enable seamless integration between banking systems and third-party platforms, including fintech services, payment gateways, and digital wallets. Open banking APIs allow customers to access consolidated financial information and make payments securely across different platforms. - Biometric Authentication

Technologies like fingerprint recognition, facial scanning, and voice authentication have strengthened digital banking security. These biometric methods add an extra layer of protection, ensuring that only authorized individuals can access sensitive financial information. - Augmented Reality (AR) and Virtual Reality (VR)

AR and VR technologies are enhancing the customer experience by creating virtual banking branches and interactive financial education tools. They enable customers to visualize their financial goals, explore investment opportunities, and interact with banking services in immersive ways. - Machine Learning (ML)

Machine Learning algorithms analyze historical data to identify patterns, predict future trends, and optimize financial processes. ML is widely used in credit risk assessment, fraud detection, and personalized marketing campaigns to improve overall efficiency and customer engagement.

Future of Digital Banking

The future of digital banking promises to be an era of seamless integration, hyper-personalization, and unparalleled convenience. As technology continues to advance, digital banking will become even more intelligent, secure, and accessible, transforming financial services into an integral part of everyday life. Artificial Intelligence (AI) and Machine Learning (ML) will play a pivotal role in predicting customer needs, offering personalized financial advice, and automating complex processes. Blockchain technology will further enhance transparency and security, making transactions faster and tamper-proof. Mobile banking apps will evolve into comprehensive financial management platforms, offering services ranging from real-time investment tracking to AI-powered financial health checks. Additionally, the rise of Open Banking, supported by APIs, will allow seamless integration between banking platforms and third-party financial services, giving users a consolidated view of their financial data. Biometric authentication, including facial recognition and voice commands, will replace traditional passwords, enhancing both convenience and security. Moreover, financial inclusion will improve as digital banking bridges the gap in underserved and remote regions, bringing banking services to a larger population. As digital banking continues to innovate, it will not only simplify financial transactions but also empower individuals and businesses with smarter, faster, and more secure financial solutions, shaping a future where banking is entirely digital, borderless, and customer-centric.

Conclusion

Digital banking has undoubtedly transformed the financial landscape, offering customers unparalleled convenience, security, and accessibility. By integrating advanced technologies such as Artificial Intelligence, Blockchain, and Big Data Analytics, digital banking has redefined how individuals and businesses interact with financial services. It has moved beyond being just an extension of traditional banking to becoming a fully integrated, customer-centric financial ecosystem. However, with these advancements come challenges, including cybersecurity threats, regulatory compliance, and the need for improved digital literacy. As technology continues to evolve, digital banking will become even more seamless, secure, and intelligent, catering to the growing expectations of tech-savvy customers. Financial institutions must remain proactive, investing in innovation while prioritizing customer trust and security. The future of banking lies in a digital-first approach, where financial services are not just transactions but an integral part of an interconnected, smart, and efficient digital world.