Financial planning is the cornerstone of achieving both stability and prosperity in your financial life. It’s not just about managing money; it’s about creating a well-structured strategy that aligns your current resources with your long-term aspirations. Whether your goals include owning a home, saving for your child’s education, or enjoying a comfortable retirement, financial planning acts as a personalized roadmap to get you there. By evaluating your current financial situation, setting realistic objectives, and implementing actionable steps, you can build a foundation for sustained success. In this article, we’ll explore what financial planning entails and how it helps you chart a clear path toward achieving your life’s financial goals.

What is Financial Planning?

Financial planning is a systematic process that helps individuals and families manage their financial resources effectively to achieve their life goals. It involves evaluating your current financial position, identifying objectives, and crafting a detailed plan to achieve them. This comprehensive approach encompasses budgeting, saving, investing, and risk management while considering future aspirations such as homeownership, retirement, or education funding. By aligning your financial decisions with your personal priorities, financial planning not only provides clarity but also empowers you to navigate life’s uncertainties with confidence. Ultimately, it is about creating a roadmap that ensures financial security and peace of mind.

How Financial Planning Works as a Roadmap

Financial planning functions as a strategic roadmap, guiding you toward your financial aspirations by providing clarity, direction, and actionable steps. It aligns your current financial situation with your future goals, breaking down complex decisions into manageable actions. This structured approach ensures that every financial move contributes to your long-term objectives, much like a GPS system directing you to a destination while accounting for potential detours and changes.

Financial Planning as a Roadmap: Key Elements and Actions

| Key Element | Role in the Roadmap | Action Steps |

| Assessment of Finances | Understands your starting point | Evaluate income, expenses, assets, and liabilities. |

| Goal Setting | Defines your financial destination | Identify specific, measurable, achievable, relevant, and time-bound (SMART) goals. |

| Budget Creation | Ensures proper allocation of resources | Develop a realistic budget to prioritize savings and reduce unnecessary spending. |

| Investment Strategy | Provides growth and wealth accumulation pathways | Choose investments based on risk tolerance, goals, and timelines. |

| Risk Management | Safeguards against uncertainties | Acquire appropriate insurance coverage and establish an emergency fund. |

| Retirement Planning | Prepares for financial independence in later years | Calculate retirement needs and utilize retirement accounts like 401(k)s or IRAs. |

| Periodic Review | Monitors progress and adapts to changes | Review financial plans regularly to adjust for life events and economic shifts. |

| Execution and Discipline | Ensures the roadmap is followed | Implement the plan with consistency and discipline to stay on course. |

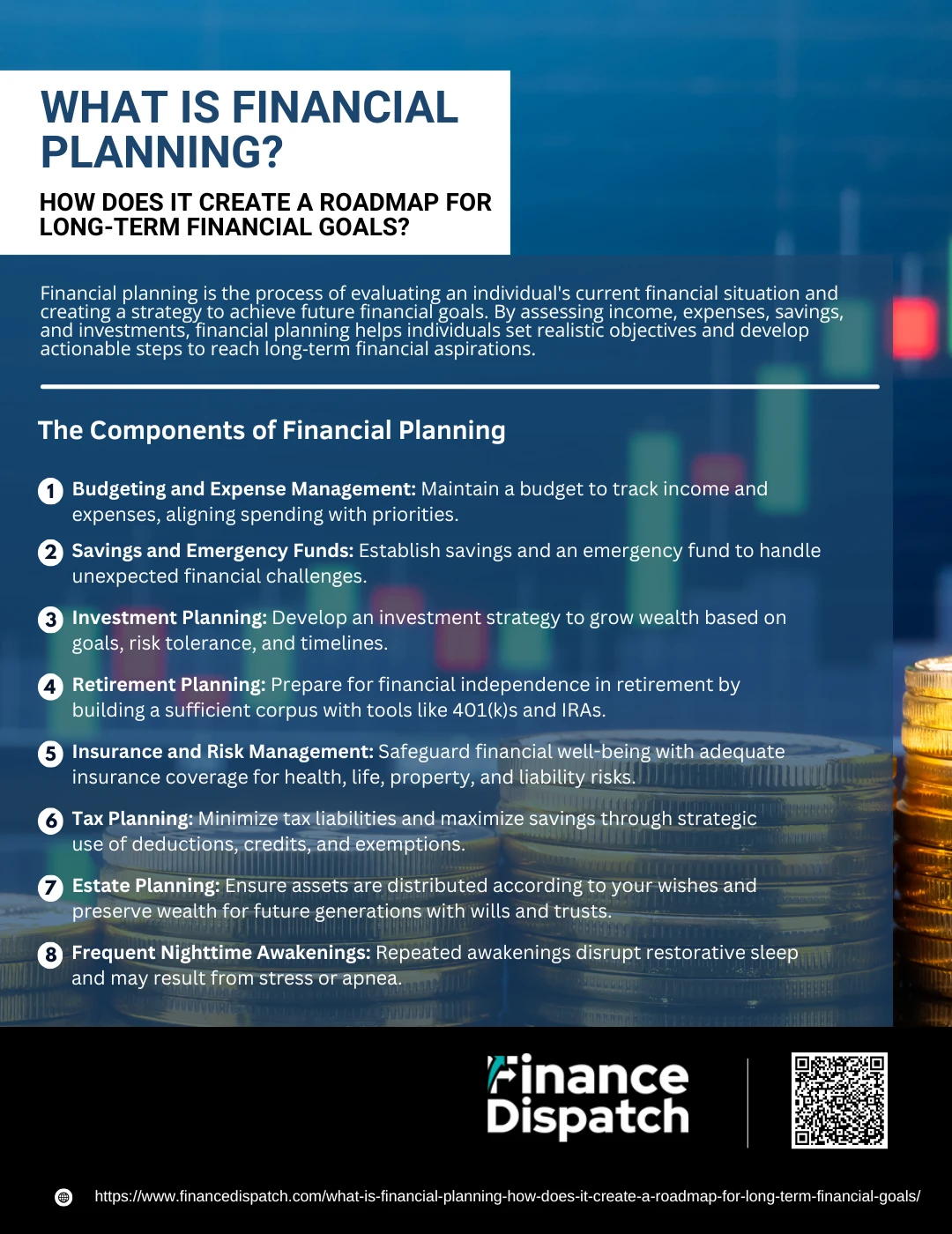

The Components of Financial Planning

Financial planning is the foundation of achieving both short-term and long-term financial goals. It encompasses various aspects of managing your finances, each contributing to building a secure and prosperous financial future. By addressing these components systematically, you can create a clear roadmap that ensures your financial resources are utilized effectively while preparing for uncertainties and achieving aspirations. Here are the key components that make financial planning holistic and result-oriented:

Key Components of Financial Planning:

1. Budgeting and Expense Management

Creating and maintaining a budget helps you track income and expenses. It ensures that your spending aligns with your priorities, enabling you to live within your means while saving for future goals.

2. Savings and Emergency Funds

Establishing a savings plan provides a foundation for financial stability. An emergency fund acts as a safety net, allowing you to manage unforeseen expenses, such as medical emergencies or job loss, without disrupting your long-term plans.

3. Investment Planning

This involves selecting investment vehicles like stocks, bonds, mutual funds, or real estate to grow your wealth over time. A sound investment strategy aligns with your risk tolerance, financial goals, and time horizon, ensuring steady progress toward your objectives.

4. Retirement Planning

Preparing for retirement involves calculating future financial needs and implementing a strategy to build a sufficient retirement corpus. Tools like 401(k)s, IRAs, and pension plans are critical to achieving financial independence in your golden years.

5. Insurance and Risk Management

Protecting yourself and your loved ones against life’s uncertainties is essential. Adequate insurance coverage—health, life, property, and liability—safeguards your financial well-being and ensures peace of mind.

6. Tax Planning

Effective tax planning minimizes your tax liabilities while remaining compliant with regulations. It involves leveraging deductions, credits, and exemptions to maximize disposable income.

7. Estate Planning

This ensures that your assets are distributed according to your wishes after your passing. Proper estate planning involves drafting wills, setting up trusts, and considering inheritance taxes to preserve wealth for future generations.

Benefits of Financial Planning

Financial planning is the cornerstone of a secure and prosperous financial life. It equips you with the tools and strategies needed to align your financial resources with your personal and professional aspirations. By addressing potential risks and seizing opportunities, financial planning creates a roadmap that not only ensures stability but also helps you achieve peace of mind and financial independence. Below are some detailed benefits of embracing financial planning:

Key Benefits of Financial Planning:

1. Clarity in Financial Goals

A financial plan provides a crystal-clear roadmap by defining your short-term and long-term objectives. It helps you prioritize goals like saving for a house, education, or retirement, ensuring you stay focused on what truly matters.

2. Improved Financial Security

Financial planning strengthens your ability to face unexpected challenges, such as medical emergencies or job loss, by building a robust safety net through savings and emergency funds.

3. Efficient Resource Allocation

Understanding your income and expenditure enables you to allocate resources effectively. This eliminates wasteful spending and ensures your money is working toward your priorities, from daily expenses to future investments.

4. Enhanced Investment Opportunities

A well-designed financial plan aligns investments with your goals and risk tolerance. It allows you to explore diversified opportunities, ensuring consistent growth while managing potential risks.

5. Reduced Financial Stress

With a comprehensive plan in place, you can feel confident about your ability to manage bills, save for the future, and handle unforeseen expenses. This reduces anxiety and brings peace of mind.

6. Retirement Readiness

Financial planning ensures you save adequately for retirement, allowing you to maintain your lifestyle and independence even after you stop working. It includes strategies to calculate future needs and maximize retirement accounts like 401(k)s and IRAs.

7. Tax Efficiency

Strategic tax planning minimizes liabilities and optimizes savings. By leveraging tax deductions, credits, and investment strategies, financial planning ensures you retain more of your hard-earned money.

8. Legacy and Estate Planning

Financial planning helps you secure your family’s future by ensuring your wealth is distributed according to your wishes. It also provides solutions to minimize inheritance taxes and protect your assets.

9. Accountability and Discipline

A financial plan keeps you accountable to your goals. Regular reviews and adjustments foster discipline, ensuring you remain on track despite changes in your financial situation or market conditions.

10. Adaptability to Life Changes

Life is full of unexpected twists, from career transitions to economic shifts. A good financial plan evolves with these changes, ensuring your goals remain achievable no matter the circumstances.

Steps to Start Your Financial Planning Journey

Embarking on your financial planning journey is an empowering step toward achieving financial security and independence. This process involves understanding your current financial situation, setting achievable goals, and implementing a strategic plan that evolves with your needs. While the journey requires commitment and regular evaluation, it provides clarity and confidence to navigate life’s uncertainties. Here’s a detailed guide to help you get started:

Steps to Begin Your Financial Planning Journey:

1. Assess Your Current Financial Situation

Begin by taking stock of your financial health. List all your income sources, monthly expenses, debts, and assets. This comprehensive assessment helps you identify your starting point and areas that need improvement.

2. Define Your Financial Goals

Clearly outline what you want to achieve, whether it’s short-term goals like paying off credit card debt or long-term aspirations like buying a home or retiring early. Ensure your goals are SMART (Specific, Measurable, Achievable, Relevant, and Time-bound).

3. Create a Realistic Budget

A budget is the cornerstone of financial planning. Categorize your spending into needs, wants, and savings. This will help you allocate funds effectively and identify areas to cut back on unnecessary expenses.

4. Build an Emergency Fund

Life is unpredictable, and an emergency fund acts as a safety net during tough times. Aim to save at least three to six months’ worth of living expenses to cover unexpected costs like medical bills or job loss.

5. Plan for Debt Management

Debt can hinder financial progress, so it’s crucial to develop a repayment strategy. Focus on paying off high-interest debts first, and consider consolidation or refinancing options for better manageability.

6. Explore Investment Opportunities

Investments are essential for growing your wealth over time. Research options like stocks, bonds, mutual funds, or real estate, and choose investments that align with your risk tolerance and financial goals.

7. Secure Adequate Insurance Coverage

Protect yourself and your family from financial setbacks caused by unforeseen events. Invest in health, life, auto, and home insurance to cover potential risks.

8. Focus on Retirement Planning

It’s never too early to plan for retirement. Calculate how much you’ll need and start contributing to accounts like a 401(k) or IRA. If your employer offers matching contributions, take full advantage of them.

9. Review and Optimize Tax Strategies

Taxes can significantly impact your finances. Explore ways to minimize liabilities by utilizing tax-advantaged accounts, deductions, and credits. Consult with a tax advisor if necessary.

10. Monitor and Adjust Your Plan Regularly

Financial planning is not a one-time activity. Regularly review your plan to ensure it aligns with your current situation and future goals. Adjust your strategies to adapt to changes in income, expenses, or life circumstances.

Common Challenges in Financial Planning and How to Overcome Them

Financial planning is an essential tool for building a secure and prosperous future, but it often comes with its share of challenges. These obstacles can range from a lack of financial knowledge to unpredictable life events, making it difficult to stay on track. By identifying these challenges and addressing them with practical solutions, you can take control of your finances and work towards your goals more effectively. Here’s a closer look at the most common hurdles people face in financial planning and strategies to overcome them:

Common Challenges in Financial Planning and How to Overcome Them:

Common Challenges in Financial Planning and How to Overcome Them:

1. Lack of Financial Knowledge

Understanding financial concepts such as investments, taxes, and retirement planning can feel daunting for many. Without proper knowledge, it’s challenging to make informed decisions.

Solution: Start by educating yourself with reputable financial resources, such as books, online courses, and workshops. Consulting with a certified financial advisor can also provide tailored advice and simplify complex concepts.

2. Inconsistent Budgeting Habits

Maintaining a budget requires discipline, and inconsistent tracking can lead to overspending and financial shortfalls.

Solution: Use budgeting apps or tools to automate expense tracking and categorize spending. Set realistic budgets and regularly review them to ensure you’re staying within your means.

3. Unexpected Expenses

Emergencies, such as medical bills, car repairs, or home maintenance, can disrupt even the most carefully laid financial plans.

Solution: Create an emergency fund with three to six months of living expenses. Prioritize this fund in your budget to safeguard against unexpected costs.

4. Procrastination in Financial Planning

Delaying financial planning often results in missed opportunities to grow wealth and secure financial stability.

Solution: Start small by setting up automatic savings or investment contributions. Commit to specific actions, such as reviewing your financial goals or creating a monthly budget, to build momentum.

5. Unrealistic Financial Goals

Overly ambitious goals can lead to frustration when they aren’t achieved, discouraging further planning.

Solution: Break down larger goals into smaller, manageable steps. Ensure your goals are SMART—Specific, Measurable, Achievable, Relevant, and Time-bound—to maintain focus and motivation.

6. Emotional Spending

Impulse purchases, often driven by emotions, can derail your budget and hinder long-term savings.

Solution: Practice mindful spending by delaying non-essential purchases and reflecting on whether they align with your financial priorities. Set clear limits for discretionary spending.

7. Failure to Plan for Retirement

Many individuals neglect retirement planning, either because they think it’s too early or feel they don’t have enough resources to start.

Solution: Begin contributing to retirement accounts, such as a 401(k) or IRA, as early as possible. Even small contributions can grow significantly over time, especially with compound interest.

8. Overwhelming Debt

High levels of debt, particularly from credit cards or loans, can hinder financial progress and create stress.

Solution: Develop a repayment plan focusing on high-interest debts first. Consider consolidation or refinancing to lower interest rates and make payments more manageable.

9. Market Uncertainty

Economic fluctuations and stock market volatility can make investment decisions intimidating and unpredictable.

Solution: Diversify your investments to spread risk across different asset classes. Stick to a long-term strategy and avoid making emotional decisions during market downturns.

10. Lack of Regular Review

A financial plan that isn’t revisited and updated can quickly become outdated, failing to reflect current goals or changes in circumstances.

Solution: Schedule periodic reviews of your financial plan, ideally annually or after significant life events. Adjust your strategies to reflect changes in income, expenses, or goals.

Conclusion

Financial planning is more than just a tool for managing money; it is a pathway to achieving your life’s aspirations with confidence and clarity. By addressing challenges, setting realistic goals, and creating a structured roadmap, you can navigate the complexities of personal finance and secure a stable future. While the journey may require effort, discipline, and adaptability, the rewards of financial stability, reduced stress, and the ability to achieve your dreams make it worthwhile. Whether you’re just starting or refining an existing plan, remember that each step brings you closer to a life of financial independence and peace of mind. Take charge today, and let financial planning empower you to build the future you deserve.