Income tax is a mandatory financial contribution imposed by the government on individuals and businesses based on their earnings. It serves as one of the primary sources of revenue for governments worldwide, enabling them to fund essential public services and build and maintain critical infrastructure. From healthcare and education to roads and public transportation, income tax plays a vital role in shaping a functioning and equitable society. Understanding how income tax works and its impact on public services helps you appreciate its importance not only as a financial obligation but also as a contribution to the collective well-being of your community. In this article, you’ll learn about the fundamentals of income tax, its role in public funding, and how it supports infrastructure development.

What is income tax?

Income tax is a financial obligation imposed by the government on the earnings of individuals, businesses, and other entities. It is a primary source of revenue for governments, used to fund essential services and maintain public infrastructure. For individuals, income tax is typically levied on salaries, wages, investments, and other sources of income, while businesses pay taxes on their net profits. Income tax systems can vary, with some countries adopting progressive rates, where higher earners pay a larger percentage, and others using flat or regressive systems. Regardless of the structure, income tax serves as a fundamental tool for governments to ensure economic stability, reduce inequality, and provide public goods such as education, healthcare, and social security programs. Proper compliance with income tax regulations is not only a legal requirement but also a civic responsibility that supports the growth and well-being of society as a whole.

History and Evolution of Income Tax

The concept of income tax dates back centuries, evolving alongside societal and economic changes. The earliest forms of income tax were seen in ancient civilizations, where rulers imposed taxes on crops, property, and trade to finance wars and public projects. In modern history, income tax as we know it was first introduced in 1799 in Great Britain to fund military expenses during the Napoleonic Wars. The United States implemented its first federal income tax in 1861 to support Civil War funding, later formalized with the ratification of the 16th Amendment in 1913, granting Congress the authority to levy taxes on income. Over time, income tax systems have become more structured, incorporating principles of progressive taxation to ensure fairness and equity, where higher earners contribute a larger share. Today, income tax is a cornerstone of national economies worldwide, serving not only as a revenue-generating tool but also as an instrument for wealth redistribution and economic policy. Its evolution reflects changing social, political, and economic priorities, highlighting its critical role in funding public services and infrastructure development.

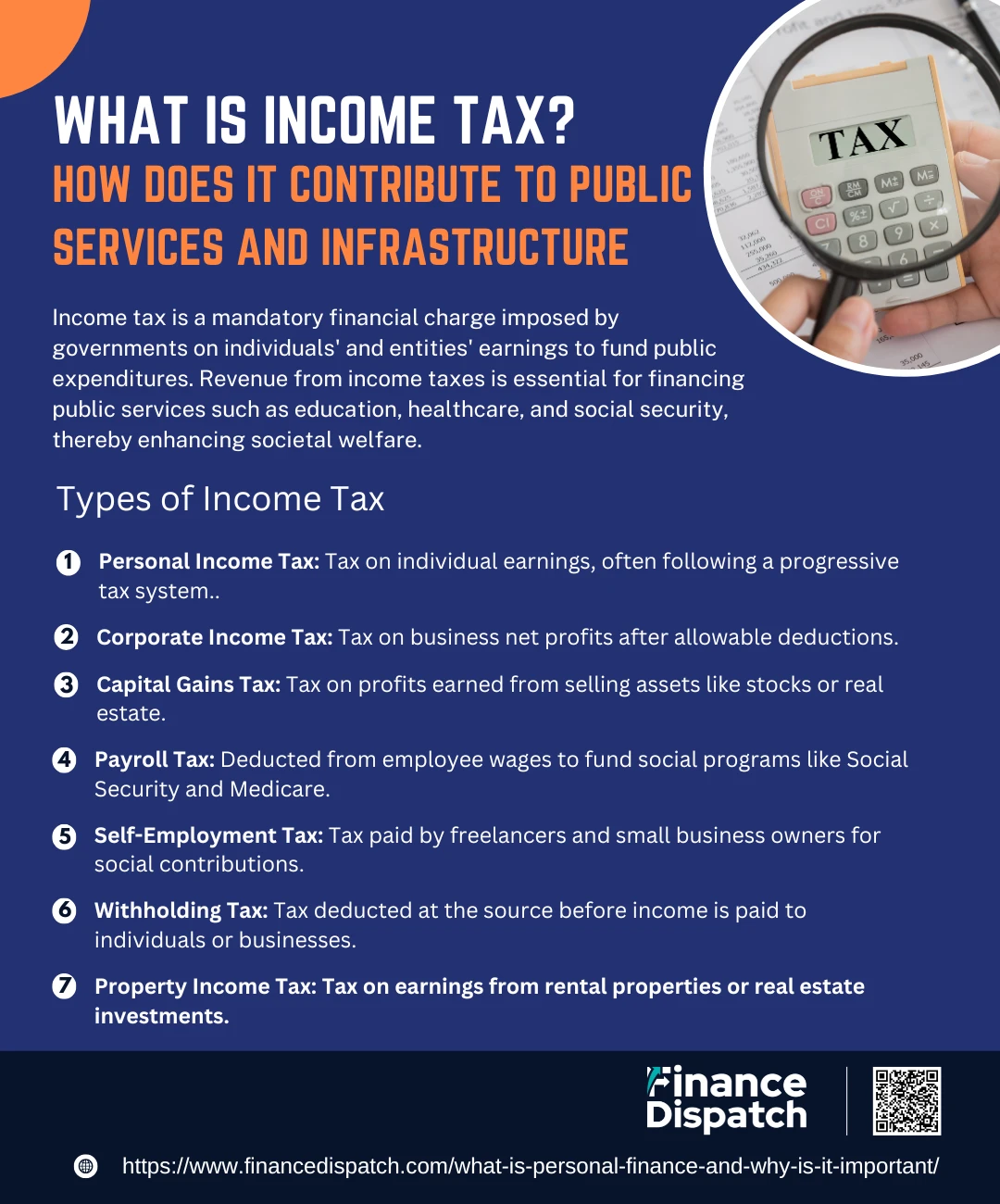

Types of Income Tax

Income tax is a vital tool for governments worldwide, serving as a primary source of revenue to fund public services, social programs, and infrastructure projects. The types of income tax vary depending on the taxpayer and the source of income, each serving a distinct purpose in economic systems. Below, we explore the main types of income tax in more detail:

1. Personal Income Tax

Personal income tax is levied on an individual’s earnings, including wages, salaries, bonuses, commissions, and income from investments. In many countries, this tax follows a progressive system, where higher income levels are taxed at higher rates. Personal income tax is usually deducted directly from salaries through a pay-as-you-earn (PAYE) system, ensuring timely collection. Additionally, self-employed individuals are responsible for calculating and paying their own income tax. Governments often provide deductions and credits for expenses such as healthcare, education, and retirement savings to reduce the taxable income of individuals.

2. Corporate Income Tax

Corporate income tax is imposed on the net profits of businesses after deducting expenses, operating costs, depreciation, and other allowable deductions. This tax is typically applied at a flat rate, although rates may vary based on the size and structure of the corporation. In many jurisdictions, businesses are also required to pay estimated taxes throughout the year to ensure compliance and prevent large end-of-year liabilities. Corporate income tax plays a significant role in generating revenue for governments and is often a subject of debate regarding its impact on investment and economic growth.

3. Capital Gains Tax

Capital gains tax applies to profits made from the sale of assets, such as real estate, stocks, bonds, or other valuable possessions. The tax is categorized into short-term capital gains (assets held for a year or less) and long-term capital gains (assets held for more than a year). Short-term gains are typically taxed at higher rates, while long-term gains often benefit from lower tax rates to encourage long-term investment. Proper documentation and record-keeping are essential to accurately calculate and report capital gains taxes.

4. Payroll Tax

Payroll tax is automatically deducted from employees’ wages by employers and remitted to the government. These taxes fund critical social programs such as Social Security, Medicare, and unemployment insurance in the United States. Payroll taxes consist of both an employee portion (deducted from wages) and an employer portion (matched and paid by the employer). Self-employed individuals are responsible for paying both portions, often referred to as self-employment tax.

5. Self-Employment Tax

Self-employment tax is levied on freelancers, independent contractors, and small business owners to cover contributions to Social Security and Medicare programs. Since self-employed individuals do not have employers to withhold these taxes, they must calculate and pay them directly, often through quarterly estimated payments. Self-employment tax ensures that individuals working independently contribute their fair share to social welfare systems.

6. Withholding Tax

Withholding tax is deducted at the source before income is paid to an individual or business. For example, employers withhold income tax from employee paychecks, and financial institutions may withhold taxes on dividends or interest payments. Withholding tax simplifies the tax payment process, reduces the risk of non-compliance, and ensures timely revenue collection for governments. It also serves as a mechanism for taxing non-residents who earn income within a country.

7. Property Income Tax

Property income tax is levied on earnings generated from rental properties or real estate investments. Property owners must report rental income and pay taxes on the net earnings after deducting expenses such as property maintenance, mortgage interest, and insurance. Governments often have specific guidelines and allowances for property income tax, and failure to declare rental income accurately can result in penalties or audits.

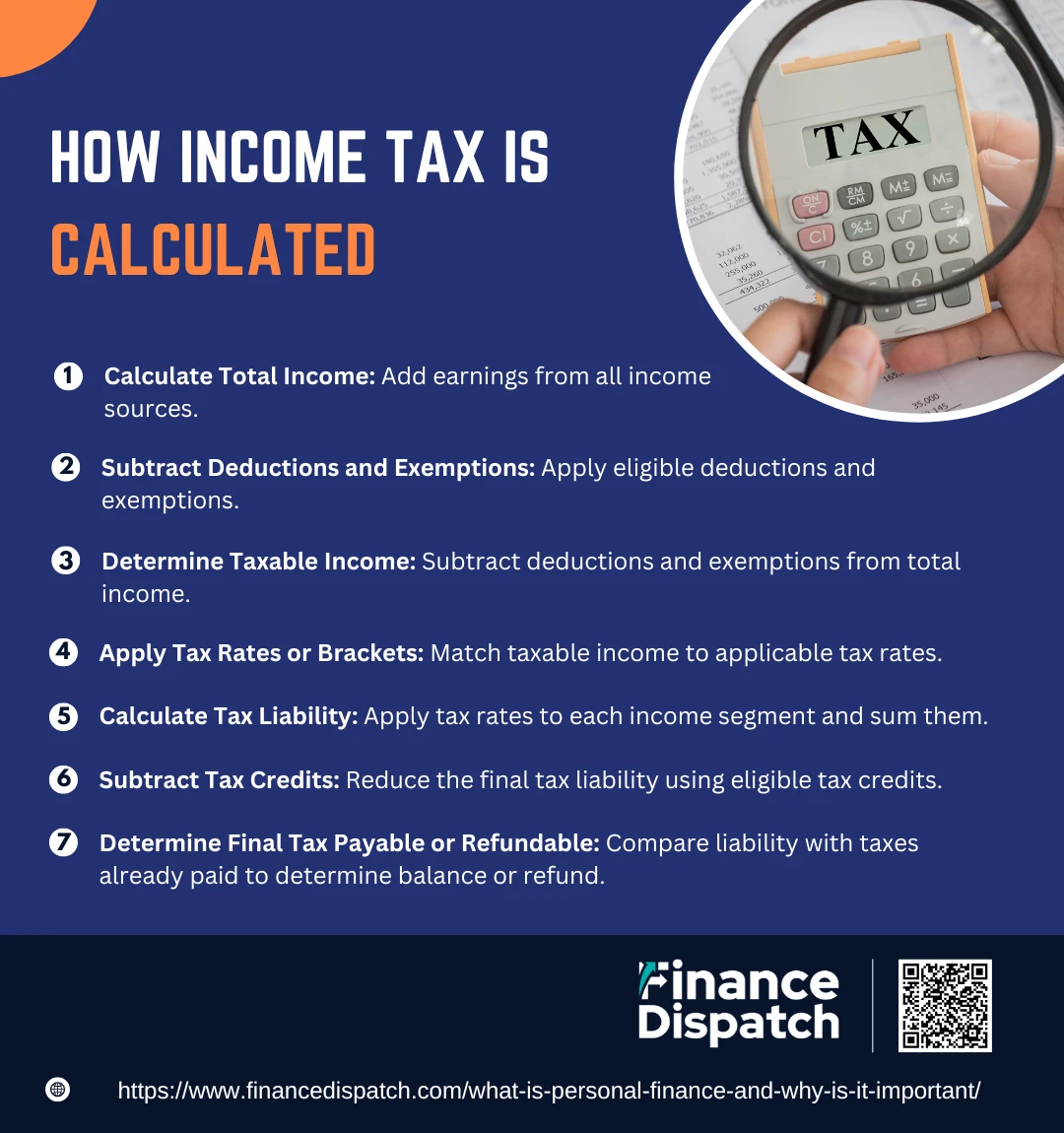

How Income Tax is Calculated

Income tax calculation is a structured process used by governments to determine the amount of tax an individual or business owes based on their earnings. Whether you’re an employee, a freelancer, or a business owner, understanding how your income tax is calculated can help you plan your finances better and avoid penalties. The process involves identifying your total income, applying deductions and exemptions, and using the appropriate tax rates to arrive at the final tax liability. Below are the key steps involved in calculating income tax:

1. Calculate Total Income

The first step in calculating income tax is determining your total income. This includes earnings from various sources, such as wages, salaries, bonuses, rental income, investment profits, and freelance work. Every income source must be accurately reported to ensure correct tax calculation.

2. Subtract Deductions and Exemptions

After calculating the total income, you subtract eligible deductions and exemptions. Deductions may include expenses like mortgage interest, education costs, healthcare expenses, and retirement contributions. Exemptions are often applied for dependents or specific legal allowances.

3. Determine Taxable Income

Once deductions and exemptions are subtracted from your total income, the remaining amount is your taxable income. This is the portion of your income that will be subject to taxation.

Formula:

Taxable Income = Total Income – Deductions – Exemptions

4. Apply Tax Rates or Brackets

Taxable income is then matched against the applicable tax rates or brackets. In a progressive tax system, different portions of income are taxed at increasing rates. For example:

- $0–$20,000 taxed at 10%

- $20,001–$50,000 taxed at 20%

- $50,001 and above taxed at 30%

5. Calculate Tax Liability

The tax liability is calculated by applying the respective tax rates to each segment of taxable income. The sum of these amounts represents the total tax owed to the government.

Example:

If your taxable income is $60,000:

- $20,000 x 10% = $2,000

- $30,000 x 20% = $6,000

- $10,000 x 30% = $3,000

Total Tax Liability = $11,000

6. Subtract Tax Credits

Tax credits are then subtracted from your tax liability. Credits directly reduce the amount of tax owed and may include benefits for dependents, education, or renewable energy investments.

7. Determine Final Tax Payable or Refundable

Finally, compare your total tax liability with the amount of tax already paid through payroll deductions or estimated payments.

- If the amount paid exceeds your liability, you’ll receive a refund.

- If it falls short, you’ll need to pay the remaining balance to the tax authority.

Formula:

Final Tax Payable = Tax Liability – Taxes Already Paid – Tax Credits

Role of Income Tax in Public Services

Income tax plays a crucial role in funding public services that are essential for the well-being and development of society. It serves as one of the primary sources of government revenue, enabling authorities to invest in infrastructure, healthcare, education, and social welfare programs. Without income tax, governments would struggle to provide these services at the scale and efficiency needed to meet the needs of citizens. Every taxpayer contributes to building a stronger, more equitable society through their income tax payments. Below are the key roles of income tax in supporting public services:

1. Healthcare Services: Income tax funds public healthcare systems, hospitals, medical research, vaccination programs, and affordable healthcare initiatives, ensuring citizens have access to essential medical services.

2. Education Systems: A significant portion of income tax revenue is allocated to public education, including schools, universities, teacher salaries, educational materials, and infrastructure.

3. Infrastructure Development: Income tax supports the construction and maintenance of roads, bridges, public transportation systems, water supply facilities, and other critical infrastructure projects.

4. Social Welfare Programs: Programs like unemployment benefits, food assistance, and housing support are often funded through income tax to protect vulnerable populations.

5. Defense and Security: Income tax contributes to national security by funding the military, law enforcement agencies, and emergency response systems.

6. Environmental Protection: Income tax revenue is used for environmental conservation projects, renewable energy initiatives, and pollution control measures.

7. Public Safety: Funding for police, fire departments, disaster management services, and public safety campaigns relies heavily on income tax contributions.

8. Research and Development: Governments use income tax revenue to support scientific research, technological advancements, and innovation projects that drive national progress.

Role of Income Tax in Infrastructure Development

Income tax plays a vital role in funding infrastructure projects that are essential for economic growth, social well-being, and overall national development. The revenue collected from income tax allows governments to invest in building and maintaining critical infrastructure such as roads, bridges, public transportation systems, water supply networks, and energy grids. These projects not only improve connectivity and efficiency but also create jobs and stimulate economic activity. For example, income tax revenue often funds large-scale infrastructure initiatives like highways, airports, and rail networks, ensuring smooth transportation of goods and people. Beyond physical infrastructure, income tax also supports social infrastructure, including schools, hospitals, and affordable housing projects, which are crucial for enhancing the quality of life. Additionally, it provides resources for modern infrastructure solutions, such as renewable energy facilities and smart city projects, which address long-term sustainability goals. Without income tax contributions, governments would struggle to secure adequate funding for these large-scale projects, ultimately slowing down economic progress and affecting citizens’ quality of life.

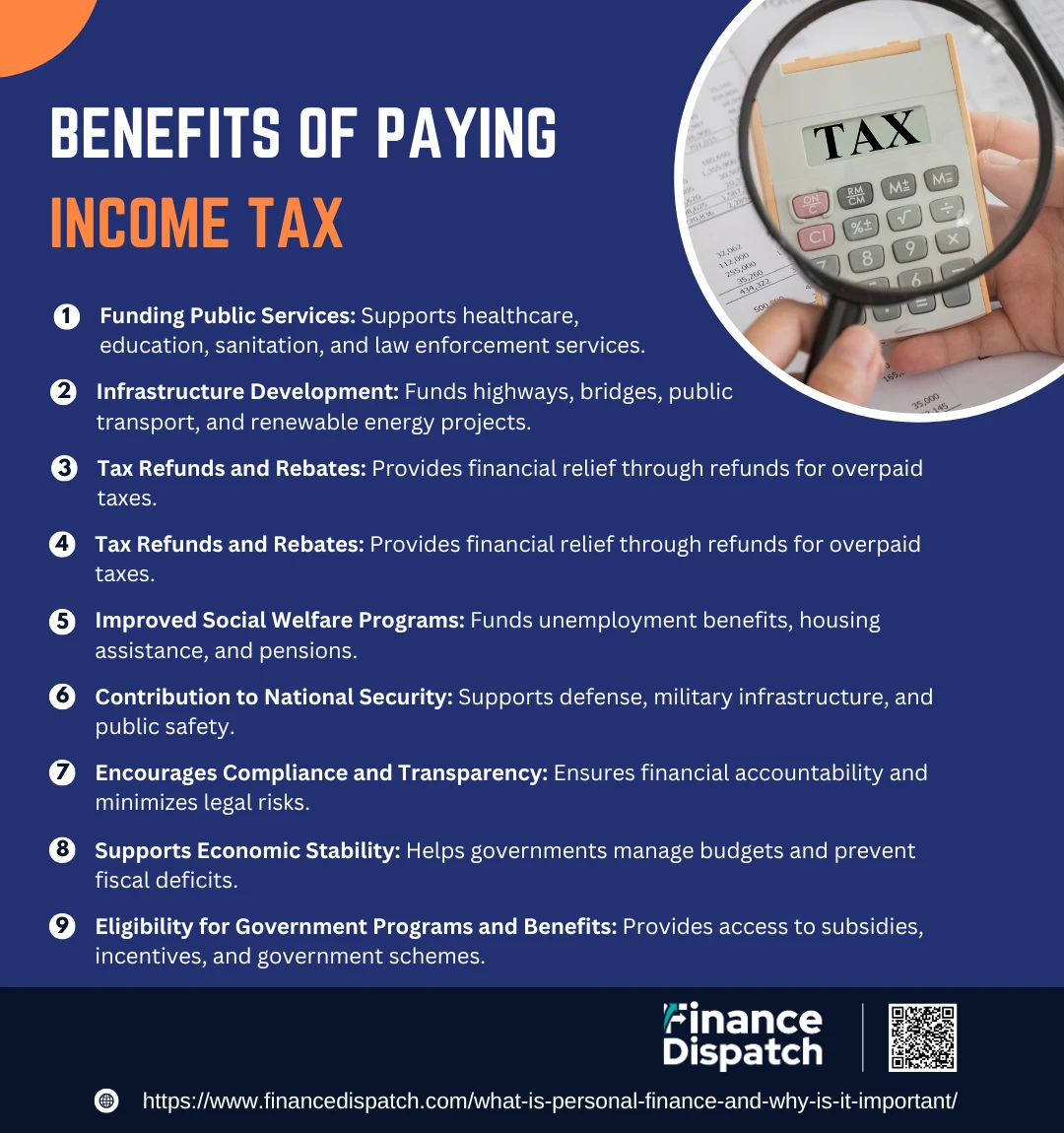

Benefits of Paying Income Tax

Paying income tax is not just a legal obligation but also a significant contribution to the economic and social stability of a nation. Income tax serves as one of the primary revenue sources for governments, allowing them to fund essential public services, improve infrastructure, and invest in programs that uplift society as a whole. It creates a financial foundation for healthcare, education, transportation, and social welfare initiatives that benefit every citizen. Beyond these societal contributions, paying income tax also brings personal advantages, such as eligibility for financial services, tax refunds, and government incentives. Responsible tax compliance fosters a transparent and accountable financial system, reducing the risk of financial penalties and legal complications. Below are the key benefits of paying income tax:

1. Funding Public Services: Income tax revenue is essential for supporting public services such as healthcare, education, sanitation, and law enforcement. These services directly improve the quality of life and create a safer, more functional society for all citizens.

2. Infrastructure Development: Taxes contribute to building and maintaining essential infrastructure, including highways, bridges, public transportation systems, water supply networks, and renewable energy projects. These investments drive economic growth, improve connectivity, and create employment opportunities.

3. Access to Loans and Credit: Filing income tax returns serves as proof of income, which is a critical requirement when applying for loans, mortgages, or credit cards. It demonstrates financial credibility and strengthens trust with financial institutions.

4. Tax Refunds and Rebates: Taxpayers who have overpaid their taxes may be eligible for refunds or rebates. These refunds act as financial relief and can be reinvested or used for personal expenses.

5. Improved Social Welfare Programs: Income tax funds vital social welfare programs, including unemployment benefits, housing assistance, child welfare, and retirement pensions. These programs serve as safety nets for individuals and families in need.

6. Contribution to National Security: Income tax revenue supports defense services, military infrastructure, and national security initiatives, ensuring a safe and secure environment for citizens.

7. Encourages Compliance and Transparency: Regularly filing income tax returns fosters transparency and accountability in personal and business finances. It minimizes the risk of audits, penalties, or legal consequences.

8. Supports Economic Stability: A consistent flow of income tax revenue enables governments to manage budgets effectively, prevent fiscal deficits, and allocate resources efficiently. It also strengthens investor confidence in the country’s economic policies.

9. Eligibility for Government Programs and Benefits: Many government programs, subsidies, and financial incentives require taxpayers to provide proof of income tax payments. Compliance ensures access to these opportunities.

Consequences of Tax Evasion

Tax evasion refers to the illegal practice of intentionally avoiding paying taxes owed to the government. It often involves underreporting income, inflating deductions, or hiding money in offshore accounts. While some may view tax evasion as a way to reduce financial burdens, it has serious consequences not only for the individuals or businesses involved but also for the broader economy. Governments rely on tax revenue to fund essential public services, infrastructure projects, and social welfare programs. When individuals or businesses evade taxes, it creates revenue shortfalls, leading to budget deficits and reduced funding for critical services. Furthermore, tax evasion undermines trust in the financial system and creates an uneven playing field where honest taxpayers bear a disproportionate burden. Below is a table outlining the key consequences of tax evasion:

| Consequence | Description | Impact |

| Financial Penalties | Evaders may face substantial fines, often much higher than the original tax owed. | Increased financial burden on individuals or businesses. |

| Legal Prosecution | Tax evasion is a criminal offense, and those found guilty may face court trials. | Possible imprisonment or long-term legal consequences. |

| Interest on Unpaid Taxes | Governments may impose interest charges on overdue tax payments. | Additional financial strain due to accruing interest. |

| Loss of Reputation | Tax evasion scandals can damage personal or corporate reputations. | Loss of public trust and business credibility. |

| Asset Seizure | Authorities may seize property, bank accounts, or other assets to recover unpaid taxes. | Significant loss of personal or business assets. |

| Restricted Financial Opportunities | Tax evaders may face restrictions on obtaining loans, credit, or government contracts. | Limited access to financial resources and opportunities. |

| Economic Consequences | Widespread tax evasion reduces government revenue, impacting public services and infrastructure projects. | Decline in economic growth and social welfare programs. |

| Increased Tax Burden on Honest Taxpayers | To compensate for lost revenue, governments may increase taxes on compliant taxpayers. | Greater financial burden on law-abiding citizens. |

Common Misconceptions about Income Tax

Income tax is an essential financial obligation, yet it remains one of the most misunderstood aspects of personal and corporate finance. Many taxpayers hold misconceptions about how income tax is calculated, who needs to pay it, and where their money goes. These misunderstandings can lead to poor financial planning, missed opportunities for deductions, and even unintentional non-compliance. Clarifying these misconceptions is crucial to ensure taxpayers fulfill their obligations accurately and benefit from available provisions. Below are some of the most common misconceptions about income tax:

1. “Only High-Income Earners Pay Income Tax”: In most tax systems, individuals across different income levels are required to pay income tax, although the rates may vary.

2. “Filing Taxes Is Only Necessary If You Owe Money”: Even if you don’t owe taxes, filing a tax return may be necessary to claim refunds or credits.

3. “Tax Refunds Are Free Money”: Refunds are not a bonus; they are simply the return of excess taxes you’ve already paid throughout the year.

4. “Self-Employed Individuals Don’t Pay Income Tax”: Self-employed individuals are required to report their earnings and pay taxes, including self-employment tax for Social Security and Medicare.

5. “All Tax Deductions Are Automatic”: Many deductions require taxpayers to actively claim them and provide supporting documentation.

6. “Tax Evasion and Tax Avoidance Are the Same Thing”: Tax avoidance is legally minimizing your tax liability through lawful methods, while tax evasion is the illegal act of hiding income or falsifying information.

7. “Income Tax Only Funds Government Salaries”: Income tax revenue funds a wide range of public services, including healthcare, education, defense, and infrastructure projects.

8. “You Don’t Need to Pay Taxes on Side Income”: Income from freelancing, side gigs, or rental properties must also be reported and taxed.

9. “Tax Professionals Eliminate All Tax Liabilities”: Tax professionals can help reduce your liability legally but cannot eliminate your tax obligations entirely.

How to File Your Income Tax Efficiently

Filing your income tax efficiently is not only about meeting deadlines but also about maximizing deductions, minimizing errors, and ensuring compliance with tax regulations. Whether you’re filing as an individual, freelancer, or business owner, a well-organized approach can save you time, reduce stress, and potentially increase your tax refund. Many taxpayers make the mistake of waiting until the last minute, overlooking key details, or missing out on eligible tax credits and deductions. By preparing in advance and following a structured process, you can simplify the tax filing experience and avoid unnecessary penalties. Below are the essential steps to file your income tax efficiently:

1. Gather All Necessary Documents Early

Before you start filing, collect all essential documents, such as income statements (e.g., W-2, 1099 forms), investment records, mortgage interest statements, and proof of deductible expenses. Having everything organized in one place will streamline the process and reduce errors.

2. Understand Your Tax Filing Status

Identify your correct tax filing status, whether it’s Single, Married Filing Jointly, Married Filing Separately, Head of Household, or Qualifying Widow(er). Your filing status affects your tax brackets, standard deductions, and eligibility for certain credits.

3. Choose the Right Tax Filing Method

Decide whether you’ll file taxes manually, use tax software, or hire a professional tax preparer. Tax software like TurboTax or H&R Block can simplify the process, while professionals can handle more complex returns.

4. Maximize Deductions and Credits

Identify all eligible deductions (e.g., student loan interest, medical expenses, mortgage interest) and credits (e.g., Earned Income Tax Credit, Child Tax Credit). These can significantly reduce your taxable income and overall tax liability.

5. Double-Check Your Tax Return for Accuracy

Errors in your tax return, such as incorrect Social Security numbers, misspelled names, or miscalculations, can cause delays in processing or result in penalties. Review your return carefully before submission.

6. File Electronically for Faster Processing

E-filing is faster, more accurate, and allows you to receive refunds sooner compared to paper filing. Most tax software tools support electronic submission, and many jurisdictions encourage or even require it.

7. Pay Any Taxes Owed on Time

If you owe taxes, ensure you pay them by the deadline to avoid penalties and interest charges. Many tax authorities offer online payment options for added convenience.

8. Keep Records of Your Tax Return

After filing, keep digital or physical copies of your tax return and supporting documents for at least three to five years. These records are essential for audits, amendments, or future reference.

9. Plan Ahead for Next Year’s Taxes

Adjust your tax withholding or estimated tax payments if you owed taxes or received a large refund this year. Proper planning can help you avoid surprises during the next tax season.

10. Seek Professional Help if Needed

If your financial situation is complex, such as owning multiple properties, running a business, or having significant investments, consult a Certified Public Accountant (CPA) or tax advisor to ensure compliance and efficiency.

Conclusion

Filing and paying income tax is not just a legal obligation but a crucial contribution to the development and stability of a nation. The revenue collected from taxes supports essential public services, infrastructure projects, healthcare systems, and social welfare programs, benefiting every citizen. Understanding how income tax is calculated, the benefits of compliance, and the consequences of evasion empowers individuals and businesses to approach their tax responsibilities with confidence and transparency. By staying informed, organizing financial documents, and seeking professional help when needed, taxpayers can efficiently navigate the process, avoid costly errors, and even maximize potential refunds. In the end, paying taxes is more than fulfilling a duty—it’s an investment in a better society, stronger infrastructure, and a brighter future for everyone.