In today’s unpredictable world, legal disputes can arise from even the smallest incidents, whether it’s a slip-and-fall accident at a business or an error in professional advice. The financial repercussions of such disputes can be overwhelming, often leading to costly settlements, legal fees, and reputational harm. This is where liability insurance steps in as a critical safety net. Designed to protect individuals and businesses from the financial burden of lawsuits, liability insurance ensures that you are covered when claims arise due to injuries, damages, or negligence. In this article, we’ll delve into what liability insurance is, explore its key features, and explain how it serves as a financial shield during legal battles.

What is Liability Insurance?

Liability insurance is a type of coverage designed to protect individuals, businesses, and organizations from financial losses stemming from legal claims. These claims often arise from incidents where someone is held responsible for causing bodily injury, property damage, or other harm to a third party. By covering legal costs, settlements, and court-awarded damages, liability insurance provides a crucial safety net in situations where you are found legally liable. Unlike other types of insurance, liability policies focus on protecting against risks to others rather than the insured’s own property or assets. Whether you’re a professional, a business owner, or an individual, liability insurance serves as an essential safeguard against the potentially devastating financial consequences of legal disputes.

How Does Liability Insurance Protect You?

Liability insurance serves as a vital protective barrier, shielding individuals, businesses, and organizations from the potentially devastating financial consequences of legal claims. Whether it’s a slip-and-fall accident at a store, a defective product causing harm, or professional negligence leading to a client’s financial loss, liability insurance ensures you are prepared for the unexpected. By covering legal expenses, settlements, and damages awarded in lawsuits, it minimizes out-of-pocket costs and provides a safety net that enables you to navigate legal disputes with confidence. Here’s a detailed look at how liability insurance protects you:

1. Covers Legal Defense Costs

Lawsuits can involve significant legal fees, even if the claim against you is ultimately unfounded. Liability insurance covers attorney fees, court costs, and other legal expenses, allowing you to mount a robust defense without depleting your resources.

2. Pays for Settlements and Judgments

If you are found liable in a legal dispute, liability insurance pays the agreed-upon settlement or court-ordered judgment, up to your policy’s limit. This ensures you are not left to bear the financial burden alone.

3. Protects Against Third-Party Claims

Liability insurance provides coverage for claims involving third parties—such as customers, clients, or visitors—who may suffer bodily injury or property damage due to your actions or negligence.

4. Mitigates Business Risks

Businesses face a range of risks, from workplace accidents to errors in service delivery. Liability insurance safeguards your business from financial loss, enabling you to maintain operations even during legal disputes.

5. Safeguards Reputation

By enabling you to address claims promptly and professionally, liability insurance helps protect your personal or business reputation, a critical asset in today’s competitive landscape.

6. Offers Customizable Coverage

With a variety of policies available—general liability, professional liability, product liability, and more—you can choose coverage tailored to your unique needs, ensuring comprehensive protection against specific risks.

7. Supports Compliance with Legal and Contractual Requirements

In many cases, liability insurance is legally mandated or required by contracts, such as leases or client agreements, ensuring you meet these obligations without added stress.

Key Features of Liability Insurance

Liability insurance provides crucial financial protection for individuals and businesses against the unpredictable costs of legal claims. Whether it’s a lawsuit involving personal injury, property damage, or negligence, this insurance acts as a safety net, covering expenses that could otherwise strain your finances. With comprehensive coverage, liability insurance ensures that you can manage legal disputes efficiently without significant financial setbacks. Below are the key features that make liability insurance an indispensable part of risk management:

1. Coverage for Legal Expenses

One of the most important features of liability insurance is its ability to cover legal defense costs. This includes attorney fees, court filing fees, and other legal expenses incurred during lawsuits or claims, ensuring you can defend yourself without exhausting your resources.

2. Compensation for Third-Party Claims

Liability insurance is specifically designed to address claims made by third parties. It provides coverage for bodily injuries, property damage, and other losses caused by your actions or negligence, protecting your finances from unexpected liabilities.

3. Policy Limits

Every liability insurance policy includes coverage limits, which define the maximum amount the insurer will pay for a claim or during the policy period. These limits allow you to plan your coverage based on the potential risks associated with your personal or business activities.

4. Customizable Coverage Options

Liability insurance comes in various forms, such as general liability, professional liability, product liability, and more. This flexibility allows individuals and businesses to tailor their coverage to specific needs, ensuring comprehensive protection against relevant risks.

5. Exclusions for Clarity

Policies outline specific exclusions, such as intentional acts or criminal activities, that are not covered. This transparency helps you understand the scope of your coverage and avoid surprises during a claim.

6. Defense and Settlement Support

Insurers often assist in negotiating settlements or defending against claims, helping to minimize legal exposure and financial losses. This support ensures disputes are resolved efficiently and professionally.

7. Worldwide Coverage Options

Depending on the policy, liability insurance can extend to incidents occurring internationally, provided the claim is filed within the designated coverage territory, offering peace of mind for global businesses.

8. Compliance with Legal and Contractual Requirements

Many businesses are required to carry liability insurance to meet legal or contractual obligations. Whether it’s a landlord requiring coverage in a lease agreement or a client contract, liability insurance ensures compliance and smooth operations.

9. Peace of Mind and Reputation Protection

Beyond financial security, liability insurance provides peace of mind by handling unexpected legal challenges. It also safeguards your reputation by enabling you to address claims professionally and responsibly.

Types of Liability Insurance

Liability insurance is a critical component of financial protection, offering coverage for a wide range of risks individuals and businesses may face. Depending on your activities or profession, different types of liability insurance provide tailored protection against specific scenarios, such as accidents, errors, or negligence. Understanding these types helps you choose the right coverage to safeguard your assets and operations. Below are the primary types of liability insurance:

1. General Liability Insurance

This foundational coverage protects businesses against claims involving bodily injury, property damage, and personal or advertising injury. For instance, if a customer slips and falls at your business premises, general liability insurance can cover medical expenses and legal fees.

2. Professional Liability Insurance

Also known as Errors and Omissions (E&O) insurance, this type of coverage is essential for professionals such as doctors, lawyers, and consultants. It protects against claims of negligence, malpractice, or mistakes in professional services that result in financial or physical harm to clients.

3. Product Liability Insurance

Designed for manufacturers, distributors, and retailers, this insurance covers claims arising from injuries or damages caused by defective products. For example, if a product you sell causes harm to a customer due to a design flaw, product liability insurance handles the associated legal and compensation costs.

4. Employer’s Liability Insurance

This mandatory coverage protects businesses from financial losses resulting from employee claims related to workplace injuries or illnesses. It ensures that employees receive compensation for accidents or health issues incurred on the job, while also safeguarding employers from legal repercussions.

5. Cyber Liability Insurance

With the rise of digital threats, cyber liability insurance covers financial losses from data breaches, cyberattacks, or other cybersecurity incidents. This type of insurance is particularly crucial for businesses handling sensitive customer information.

6. Director and Officer (D&O) Liability Insurance

This insurance provides protection for directors and officers of companies, covering claims of wrongful acts, mismanagement, or breaches of duty. It safeguards personal assets and offers legal defense for decisions made in their professional roles.

7. Umbrella Liability Insurance

Offering an extra layer of protection, umbrella liability insurance extends the coverage limits of other liability policies. It acts as a safety net for catastrophic claims that exceed the coverage provided by your primary policies.

8. Public Liability Insurance

This type of insurance focuses on claims involving third-party injuries or property damage due to your business operations. For example, if a visitor is injured at your workplace, public liability insurance helps cover medical expenses and potential lawsuits.

How Does Liability Insurance Work?

Liability insurance acts as a safeguard, stepping in to cover financial losses and legal costs when you are found responsible for causing harm to others or their property. Whether you’re a business owner, professional, or individual, this type of insurance ensures that claims against you are managed effectively, reducing the risk of financial ruin. It operates through a clear process of coverage triggers, investigation, and settlement. Here’s how liability insurance works:

1. Coverage Trigger

A claim is triggered by an incident involving bodily injury, property damage, or negligence that falls within the scope of your policy. For example, a customer slipping on a wet floor at your store could activate your coverage.

2. Claim Notification

Once an incident occurs, you must notify your insurance provider promptly, providing detailed information about the event, damages, and any legal demands from the third party.

3. Insurer’s Investigation

The insurer investigates the claim to determine its validity. This includes gathering evidence, interviewing witnesses, and assessing damages or injuries.

4. Legal Defense

If the claim results in a lawsuit, the insurance provider appoints and funds legal representation to defend you. This ensures that your case is handled professionally without additional financial burden.

5. Settlement or Court Judgment

Depending on the case, the insurer may negotiate a settlement with the claimant or cover damages awarded by a court judgment, up to the policy’s limit.

6. Policy Limits and Deductibles

Every policy has limits on the maximum amount the insurer will pay for a claim. Additionally, a deductible—the amount you pay out of pocket before the policy takes effect—may apply.

7. Exclusions and Conditions

Liability insurance typically excludes coverage for intentional acts, criminal behavior, or specific risks not included in the policy. Understanding these exclusions is essential to ensure proper coverage.

8. Ongoing Claims Management

If a claim extends over a long period, the insurer continues to manage legal and financial responsibilities within the policy period and terms.

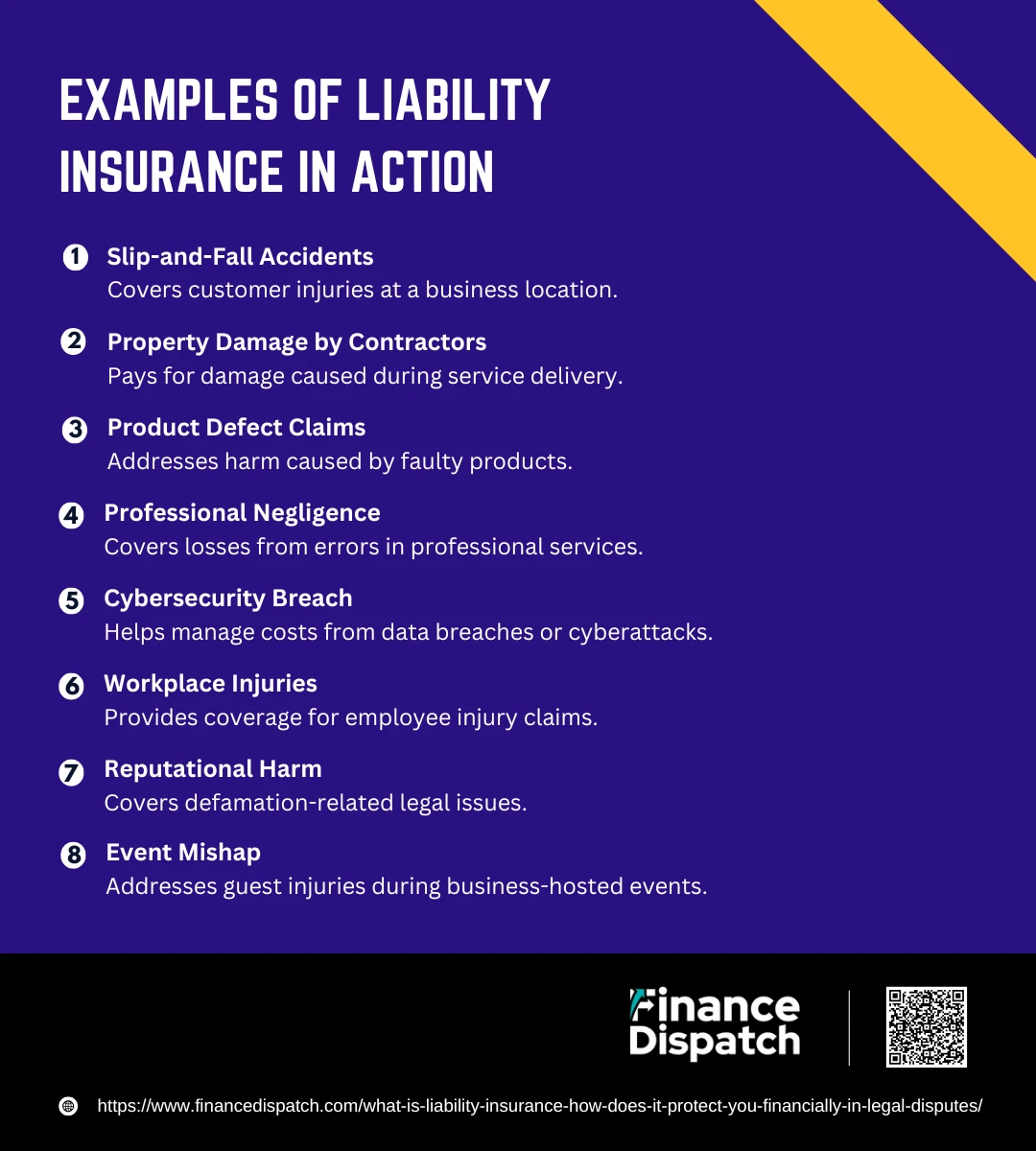

Examples of Liability Insurance in Action

Liability insurance is more than just a financial safety net—it’s a practical solution that protects individuals and businesses when unexpected incidents occur. From slip-and-fall accidents to professional errors, liability insurance steps in to cover legal costs, settlements, and damages. Let’s explore real-world examples of how liability insurance works in different scenarios:

1. Slip-and-Fall Accidents

A customer slips on a wet floor in a store and sustains an injury. The business’s general liability insurance covers their medical expenses and legal fees if the customer sues.

2. Property Damage by Contractors

A contractor accidentally damages a homeowner’s window during renovations. Liability insurance pays for the cost of repairing or replacing the window.

3. Product Defect Claims

A faulty kitchen appliance sold by a retailer causes a fire in a customer’s home. The retailer’s product liability insurance covers the damages and legal settlements.

4. Professional Negligence

An accountant makes an error in preparing a client’s tax return, resulting in financial loss. Professional liability insurance (Errors and Omissions insurance) covers the client’s claim for damages.

5. Cybersecurity Breach

A company experiences a data breach that exposes customer information. Cyber liability insurance helps cover notification costs, legal expenses, and regulatory fines.

6. Workplace Injuries

An employee suffers a back injury while lifting heavy equipment. Employer’s liability insurance covers medical bills and compensation for lost wages.

7. Reputational Harm

A business is sued for making defamatory statements about a competitor in an advertisement. General liability insurance handles the legal defense and any damages awarded.

8. Event Mishap

A piece of equipment falls during a company-organized event, injuring a guest. Public liability insurance covers the medical expenses and potential compensation.

Benefits of Liability Insurance

Liability insurance is a vital component of financial planning, offering protection against the unforeseen costs of legal disputes. Whether you’re managing a business or safeguarding personal assets, liability insurance ensures you’re prepared for potential risks that could lead to lawsuits. From covering legal expenses to safeguarding reputations, this type of insurance plays a crucial role in providing stability and peace of mind. Below are the expanded benefits of liability insurance:

1. Covers Legal Defense Costs

Legal battles can be financially draining, even when you’re not at fault. Liability insurance covers attorney fees, court filing charges, and other legal expenses, ensuring you can defend yourself effectively without jeopardizing your finances.

2. Protects Against Third-Party Claims

Accidents happen, and when they do, liability insurance provides coverage for claims involving bodily injury, property damage, or other harm caused to third parties. This protection extends to situations like slip-and-fall accidents, damaged property, or professional errors.

3. Pays for Settlements and Judgments

If a lawsuit results in a settlement or a court-ordered judgment, liability insurance covers these costs up to your policy limits. This prevents you from having to pay large sums out of pocket, safeguarding your personal or business assets.

4. Ensures Business Continuity

For businesses, lawsuits can disrupt operations and lead to financial instability. Liability insurance helps mitigate the impact by covering legal and compensation costs, allowing your business to continue running smoothly.

5. Safeguards Reputation

Unresolved claims or disputes can damage personal and business reputations. Liability insurance enables you to handle claims promptly and professionally, reducing long-term reputational harm and maintaining trust with clients and stakeholders.

6. Customizable Coverage

Liability insurance offers tailored solutions to meet specific needs. Whether you need general liability for broad protection, professional liability for service-related risks, or product liability for manufacturing concerns, you can customize policies to address unique exposures.

7. Supports Legal and Contractual Compliance

Many industries and contracts require liability insurance as a mandatory safeguard. By maintaining proper coverage, you meet these legal and contractual obligations, ensuring smooth operations and avoiding penalties.

8. Offers Peace of Mind

The unpredictability of legal disputes can create anxiety. Liability insurance provides reassurance that you are financially prepared to handle claims, allowing you to focus on personal or professional priorities without constant worry.

9. Covers Diverse Scenarios

From cyberattacks to workplace injuries, liability insurance adapts to various risks, making it an essential tool for both individuals and businesses operating in today’s complex environment.

Comparison: Liability Insurance vs. Other Insurance Types

When it comes to financial protection, understanding the differences between liability insurance and other insurance types is crucial. Liability insurance focuses on covering claims arising from harm caused to others—be it bodily injury, property damage, or financial losses due to negligence. In contrast, other insurance types, like property or health insurance, primarily protect the policyholder’s own assets, health, or well-being. This distinction shapes their applications and benefits, making it essential to choose the right coverage for your specific needs.

| Aspect | Liability Insurance | Property Insurance | Health Insurance |

| Purpose | Covers legal claims for damages caused to others. | Protects the policyholder’s physical assets, like buildings and belongings. | Covers medical expenses for the policyholder and dependents. |

| Coverage Focus | Third-party bodily injury, property damage, or negligence. | Loss or damage to personal or business property. | Hospitalization, treatments, and preventive care. |

| Beneficiary | Third-party individuals or entities affected by the policyholder’s actions. | Policyholder or named insured. | Policyholder and dependents. |

| Examples of Use | Customer injury on business premises, product defect lawsuits. | Fire or theft of property, natural disasters. | Surgery, hospital stays, regular health check-ups. |

| Legality | Often mandatory for businesses and drivers. | Sometimes required for property loans or leases. | Not legally required but strongly recommended. |

| Customizability | Offers tailored options like general, professional, or product liability insurance. | Customizable for specific risks like floods or earthquakes. | Can include add-ons like dental or vision coverage. |

| Premium Determinants | Risk exposure, business size, and policy limits. | Property value, location, and type of coverage. | Age, medical history, and coverage options. |

How to Choose the Right Liability Insurance

Selecting the right liability insurance ensures you’re protected from potential legal and financial risks. By evaluating your unique needs, understanding policy options, and considering industry requirements, you can choose coverage that aligns with your situation. Here’s how to make the right choice:

1. Assess Your Risks: Identify specific risks in your personal or business activities.

2. Understand Coverage Types: Choose the appropriate insurance type (e.g., general, professional, or product liability).

3. Set Coverage Limits: Ensure your policy limits match potential claim exposures.

4. Check Legal Requirements: Confirm compliance with industry or contract mandates.

5. Review Policy Exclusions: Understand what’s not covered to avoid surprises.

6. Compare Costs: Balance premiums and deductibles with adequate coverage.

7. Research Insurers: Select a reliable company with strong claim support.

8. Consider Bundles: Save with combined liability and other policies.

9. Consult Experts: Seek advice from insurance professionals for tailored solutions.

Conclusion

Liability insurance is an essential safeguard against the financial and legal uncertainties that can arise from accidents, errors, or negligence. Whether you’re an individual, a professional, or a business owner, having the right liability coverage ensures you are protected from potentially devastating costs, such as legal fees, settlements, or court judgments. By understanding your specific risks, exploring the types of liability insurance available, and tailoring a policy to meet your needs, you can achieve financial security and peace of mind. Ultimately, liability insurance is more than just a policy—it’s a strategic investment in protecting your assets, reputation, and future.