In today’s fast-paced world, where convenience is king, mobile banking has emerged as a transformative force in the financial sector. At its core, mobile banking allows individuals to manage their finances anytime, anywhere, using just a smartphone or tablet. Gone are the days of standing in long queues at the bank or adhering to restrictive banking hours. With the tap of a screen, users can transfer money, pay bills, check balances, and even invest—all from the comfort of their home or while on the go. Beyond convenience, mobile banking has fundamentally changed how financial transactions are conducted, making them faster, more accessible, and secure. This article delves into the essence of mobile banking and explores its profound impact on the way we handle money in our digital era.

What is Mobile Banking?

Mobile banking refers to the use of smartphones, tablets, or other mobile devices to access and manage financial services provided by banks and other financial institutions. It enables users to perform various tasks, such as checking account balances, transferring funds, paying bills, and even applying for loans, without the need to visit a physical branch. Typically accessed through dedicated mobile apps or secure web portals, mobile banking has evolved to include advanced features like mobile check deposits, budgeting tools, and real-time transaction alerts. By leveraging secure internet connections and innovative technologies, mobile banking provides a seamless and user-friendly way to handle financial transactions, offering unprecedented convenience and accessibility to users worldwide.

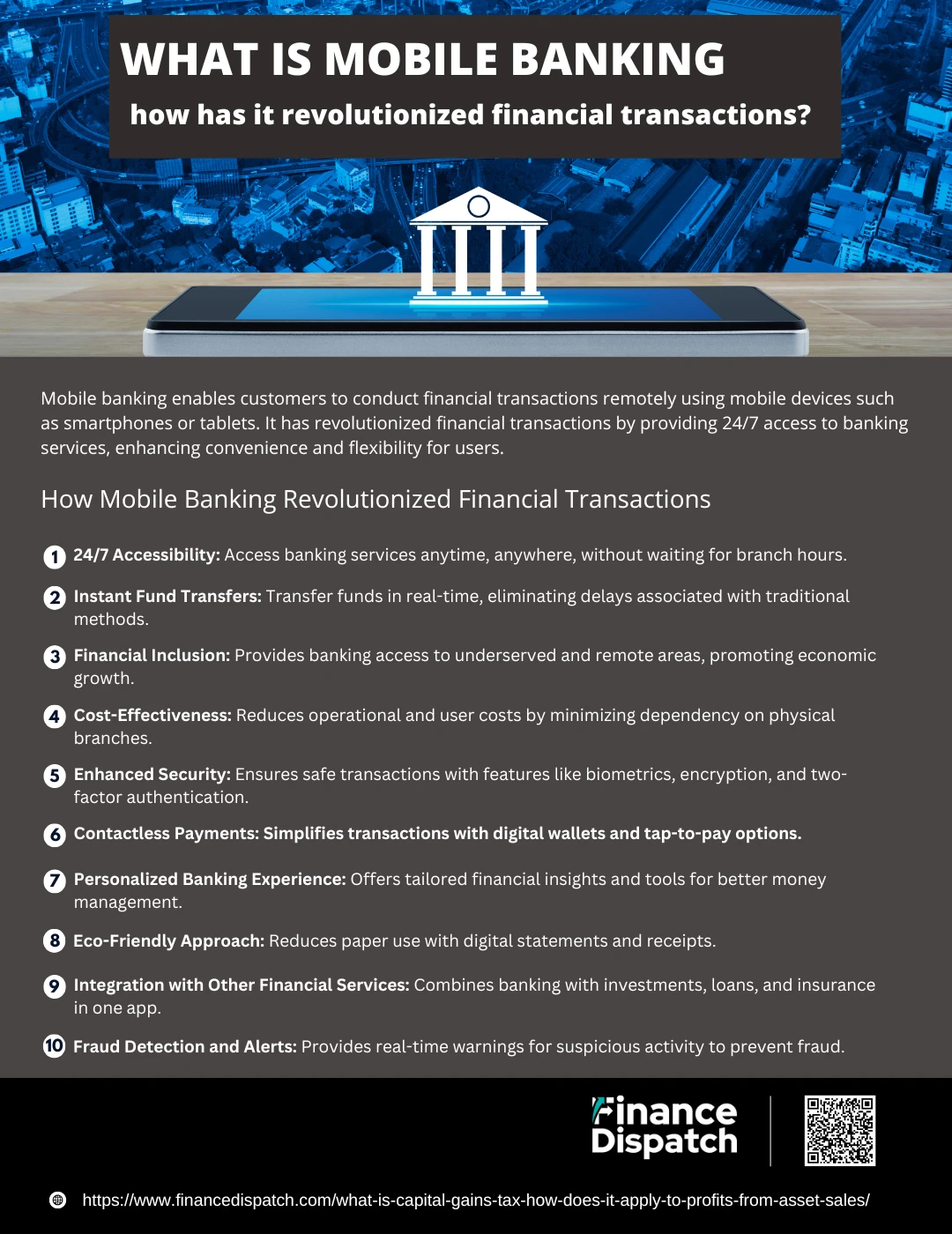

How Mobile Banking Revolutionized Financial Transactions

Mobile banking has fundamentally changed how we manage our finances, making transactions faster, more secure, and more accessible than ever before. It leverages the power of smartphones and internet connectivity to offer a range of services that were once only available at physical bank branches. From instant fund transfers to personalized banking tools, mobile banking has created a seamless experience for millions of users worldwide. Let’s explore the revolutionary impact in detail:

1. 24/7 Accessibility

One of the most significant changes mobile banking has brought is round-the-clock access to financial services. Users no longer have to wait for banks to open; they can check balances, transfer funds, and pay bills anytime, from anywhere. This level of convenience has made banking more user-centric than ever before.

2. Instant Fund Transfers

Traditional methods like writing checks or visiting bank branches often take days to process transactions. Mobile banking eliminates this delay with real-time transfers. Services like NEFT, IMPS, and international wire transfers through mobile apps enable instant movement of funds, saving time and effort.

3. Financial Inclusion

For individuals in remote or underserved areas, accessing traditional banking infrastructure has often been challenging. Mobile banking bridges this gap by bringing banking services to their fingertips. This has opened up financial opportunities for millions, fostering inclusion and economic growth.

4. Cost-Effectiveness

By reducing dependency on physical branches, mobile banking cuts operational costs for banks and minimizes expenses for users. Transactions like fund transfers and bill payments can often be done free of charge or at significantly reduced fees.

5. Enhanced Security

Mobile banking employs advanced security measures such as biometric authentication (fingerprint or facial recognition), two-factor authentication, and encryption. These technologies ensure that user data and transactions remain secure from potential threats like hacking or phishing.

6. Contactless Payments

The integration of mobile banking apps with digital wallets like Google Pay, Apple Pay, and Samsung Pay has transformed how payments are made. Users can now make contactless payments at retail outlets by simply tapping their phones, offering unparalleled convenience and hygiene.

7. Personalized Banking Experience

Modern mobile banking apps analyze user behavior and provide tailored insights. Features like spending categorization, budgeting tools, and savings recommendations help users manage their finances more effectively. This personalization enhances user satisfaction and engagement.

8. Eco-Friendly Approach

With mobile banking, users can opt for digital statements and receipts, significantly reducing the need for paper. This shift towards digital banking helps in reducing the environmental impact of traditional banking methods.

9. Integration with Other Financial Services

Mobile banking apps have evolved beyond basic transactions. They now provide integrated services like investment tracking, loan applications, insurance purchases, and tax management. This one-stop solution simplifies the financial management process.

10. Fraud Detection and Alerts

Real-time monitoring systems in mobile banking apps alert users to suspicious activity, such as unauthorized login attempts or unusual transactions. This early warning system allows users to act swiftly, reducing the risk of fraud and financial losses.

The Evolution of Mobile Banking

Mobile banking has transformed from simple SMS-based services to sophisticated apps offering a wide range of financial solutions. Advancements in technology and customer needs have driven its growth, making banking more accessible, secure, and personalized. Key milestones include:

- SMS Banking: Early text-based alerts and balance inquiries.

- Mobile Apps: User-friendly platforms for transactions and account management.

- Secure Authentication: Introduction of PINs, OTPs, and biometrics.

- Digital Wallet Integration: Seamless contactless payments with Apple Pay and Google Pay.

- AI Personalization: Customized financial insights and budgeting tools.

- Blockchain Features: Support for cryptocurrency transactions.

- Financial Inclusion: Extending services to underserved regions.

- Future Trends: IOT integration and super apps consolidating multiple services.

Core Features of Mobile Banking

Mobile banking has become an indispensable tool for modern financial management, providing a range of services designed to make banking more accessible, efficient, and secure. With just a few taps on a smartphone or tablet, users can perform essential tasks, manage their finances, and stay updated on their account activities. Below are the core features that define mobile banking:

1. Fund Transfers

Mobile banking allows users to transfer money between their own accounts or to others with just a few taps. Whether it’s sending funds to friends and family or making payments to vendors, mobile banking supports domestic and international transfers. Real-time processing ensures that transactions are completed instantly, eliminating delays.

2. Bill Payments

Gone are the days of standing in line to pay utility bills. Mobile banking apps provide a centralized platform for users to pay electricity, water, internet, or mobile bills. Many apps also allow users to set up automatic bill payments to avoid missing deadlines.

3. Account Balance and Transaction History

With mobile banking, users can access their account balance at any time. Detailed transaction histories provide insights into spending patterns, making it easier to monitor finances. These features help users stay informed and make financial decisions with confidence.

4. Mobile Check Deposits

This feature uses a smartphone’s camera to deposit checks without visiting a bank branch. By capturing images of the check, users can upload them securely through the banking app. This saves time and streamlines the check deposit process.

5. Secure Login and Authentication

Mobile banking apps prioritize security with features like biometric authentication (fingerprint or facial recognition), PIN codes, and two-factor authentication. These measures ensure that only authorized users can access the account, reducing the risk of fraud.

6. Investment Management

Many mobile banking platforms offer tools to manage investments. Users can monitor stock performance, trade shares, or track mutual fund investments. These features bring financial markets closer to users and simplify investment management.

7. Budgeting and Financial Tools

Mobile banking apps often include built-in budgeting tools that help users track expenses, categorize spending, and set financial goals. These tools provide personalized insights to encourage better financial habits and savings.

8. Alerts and Notifications

Instant alerts and notifications keep users updated about account activities, such as withdrawals, deposits, and bill payment confirmations. These real-time updates also serve as an early warning system for fraudulent activity, enhancing account security.

9. Digital Wallet Integration

Mobile banking seamlessly integrates with digital wallets like Apple Pay, Google Pay, or Samsung Pay. This allows users to make contactless payments at stores, ensuring convenience and compatibility with modern payment technologies.

10. Customer Support

Modern mobile banking apps include built-in customer support features. Whether it’s through live chat, email, or direct calling, users can get assistance anytime. Some apps also incorporate AI-driven chatbots for instant query resolution.

Benefits of Mobile Banking

Mobile banking has revolutionized the way individuals manage their finances, offering unmatched convenience, accessibility, and efficiency. By leveraging smartphones and internet connectivity, mobile banking enables users to perform a wide range of financial tasks anytime, anywhere. Its numerous advantages have made it an essential tool for modern financial management. Below are the key benefits of mobile banking:

1. Convenience

Mobile banking eliminates the need for physical branch visits, allowing users to perform banking tasks like checking balances, transferring funds, or paying bills at any time, from anywhere.

2. Time Efficiency

Transactions that traditionally required significant time, such as depositing checks or transferring funds, can now be completed in seconds with just a few taps.

3. Cost Savings

By enabling paperless and remote transactions, mobile banking reduces costs for users by eliminating the need for transportation, checks, or traditional banking fees.

4. Enhanced Security

Advanced security measures like fingerprint or facial recognition, encrypted data transfers, and two-factor authentication ensure that your financial information and transactions remain protected.

5. Accessibility

Mobile banking has bridged the gap for people in remote or underserved areas by providing easy access to banking services via smartphones and basic internet connectivity.

6. Real-Time Alerts

Instant notifications for transactions, low balance warnings, or fraudulent activity allow users to stay informed and take immediate action when necessary.

7. Personalized Financial Tools

Many mobile banking apps include tools to track spending, create budgets, and set savings goals, helping users make informed financial decisions.

8. Paperless Transactions

Users receive digital statements, transaction receipts, and other documents, contributing to environmental sustainability while reducing clutter.

9. Integration with Digital Wallets

Mobile banking seamlessly integrates with digital wallets like Apple Pay, Google Pay, and Samsung Pay, enabling fast and secure contactless payments.

10. Multi-Functionality

Beyond standard banking, mobile apps now offer features like investment tracking, loan applications, insurance purchases, and even utility management, making them comprehensive financial hubs.

Challenges and Risks of Mobile Banking

Mobile banking has significantly enhanced the ease and efficiency of financial transactions, but it also comes with its own set of challenges and risks. These issues, if not adequately addressed, can impact user trust, operational efficiency, and overall security. Here’s a closer look at the primary challenges and risks associated with mobile banking:

1. Security Threats

Mobile banking apps are frequent targets for cybercriminals who exploit vulnerabilities through phishing, malware, and unauthorized access. These attacks can lead to data breaches, theft of personal and financial information, and significant financial losses.

2. Fraud and Scams

Fake banking apps and deceptive schemes trick users into sharing sensitive data like passwords or account numbers. Even tech-savvy users can fall victim to cleverly designed scams that mimic legitimate apps or communications.

3. Technical Glitches

Issues such as server downtime, app crashes, or poor internet connectivity can disrupt transactions. This can be particularly inconvenient during critical financial operations, such as bill payments or fund transfers.

4. Device Dependency

Mobile banking relies on smartphones or tablets, which may not be accessible to everyone. Those without updated devices or living in areas with poor internet infrastructure are often excluded from these services.

5. Lack of Digital Literacy

Many users, especially older generations or those in rural areas, may not be familiar with using mobile banking apps. This can lead to errors in transactions or an increased vulnerability to scams.

6. Privacy Concerns

Mobile banking apps collect a significant amount of user data to improve functionality and provide personalized experiences. However, this raises concerns about how this data is stored, used, and protected against unauthorized access.

7. Transaction Limitations

Some mobile banking platforms impose restrictions on transaction amounts, daily transfer limits, or types of transactions, which can be inconvenient for businesses or users requiring high-value operations.

8. Regulatory Challenges

Regulatory inconsistencies across different countries or regions can create barriers for international mobile banking services, complicating compliance for users and financial institutions alike.

9. Over-Reliance on Technology

Dependence on mobile banking can pose a problem during technology failures, cyberattacks, or prolonged outages, leaving users unable to access their funds or perform transactions.

10. Encouragement of Overspending

The ease and immediacy of mobile banking transactions can lead to impulsive financial decisions. Users may find it harder to track spending, leading to potential budgeting challenges.

Future of Mobile Banking

The future of mobile banking is set to be defined by cutting-edge technologies, enhanced user experiences, and increased accessibility. As artificial intelligence (AI) and machine learning become integral to financial services, mobile banking apps will offer more personalized and predictive financial tools, such as expense tracking, tailored investment advice, and automated savings plans. The integration of blockchain technology is expected to enhance security and transparency, enabling seamless international transactions and cryptocurrency management. With the rise of the Internet of Things (IoT), mobile banking could extend to wearables and smart devices, making financial management even more convenient. Additionally, super apps combining banking, e-commerce, and lifestyle services into a single platform are likely to dominate the market, offering a comprehensive digital ecosystem. These innovations will ensure mobile banking continues to evolve, empowering users with smarter, faster, and more secure financial solutions.

Conclusion

Mobile banking has revolutionized the way we interact with financial services, transforming complex processes into seamless, accessible, and efficient experiences. From instant fund transfers to personalized financial tools, it has empowered users with unprecedented control over their finances. Despite its challenges, the continuous advancements in technology and security measures ensure that mobile banking remains a safe and reliable option for millions worldwide. As we look to the future, mobile banking will continue to evolve, integrating innovative technologies like AI, blockchain, and IoT to further enhance convenience, security, and functionality. It is not just a tool for managing finances but a gateway to a more connected and empowered financial future.