Sarah, a busy professional, found herself juggling multiple bank accounts, loan payments, and investment plans. Every month, she spent hours managing her finances, moving money between accounts, and stressing over missed opportunities to save more. Frustrated by the time and effort it took, she decided to switch to a bank that offered smart banking solutions. Suddenly, things changed. She was able to track her spending, set up automated transfers, and even earn higher interest rates with minimal effort. By using smart banking features, Sarah not only saved time but also maximized her savings effortlessly. This real-life transformation is a testament to how smart banking can simplify financial management for anyone.

Smart banking is a modern approach to banking that combines technology with traditional banking services to make managing your money easier, more efficient, and more rewarding. With smart banking, you can access a variety of digital tools like mobile applications, artificial intelligence (AI), machine learning, and automation, all designed to help you get the most out of your money. It’s all about leveraging technology to streamline your financial tasks, offering you more convenience, better savings opportunities, and greater control over your finances.

How Technology is Redefining Traditional Banking

In recent years, technology has drastically changed the way we approach banking, turning what was once a time-consuming and often boring process into a seamless, user-friendly process. Traditional banking used to mean long queues, filling out paperwork, and limited access to your accounts outside of business hours. However, with the arrival of digital banking, these inconveniences are becoming a thing of the past. Today, you can open an account, transfer funds, apply for a loan, or even invest with just a few clicks on your smartphone or computers. This transformation has not only made banking more accessible but also more efficient, giving people the ability to manage their finances whenever and wherever they choose.

One of the most significant ways technology is redefining traditional banking is through automation and artificial intelligence (AI). Automated systems can handle routine tasks like processing payments, analyzing spending habits, and even flagging suspicious transactions, all in real-time. AI-powered chatbots are now capable of answering customer queries instantly, providing a level of support that was once only available in-person at a branch. Additionally, the rise of mobile banking apps has given users access to features like budget tracking, automated savings, and investment recommendations. These tools empower customers to take control of their finances with a level of convenience and personalization that traditional banking simply couldn’t match. As a result, banks are not just places to store money anymore; they are becoming financial partners that help customers make smarter decisions and grow their wealth.

Key Features of Smart Banking

Here are some of the key features of smart banking that make it an essential tool for today’s financial world:

- Automated Savings and Payments

Smart banking allows you to set up automated transfers for savings and bill payments. This ensures that you consistently save a portion of your income and never miss a due date for bills, helping you avoid late fees and build a strong financial foundation effortlessly. - High-Yield Savings Accounts

Many smart banking platforms offer high-interest savings accounts that let your money grow faster than traditional accounts. By taking advantage of these accounts, you can earn more interest, helping you reach your savings goals quicker. - Real-Time Alerts and Notifications

Stay on top of your finances with instant alerts about transactions, account balances, and suspicious activities. These notifications keep you informed and help protect your account from unauthorized use. - Budgeting Tools and Expense Tracking

With built-in budgeting tools, you can easily track your spending, categorize expenses, and set monthly budgets. This helps you see exactly where your money is going and identify areas where you can cut back to save more. - Mobile Banking Apps

Access your accounts anytime, anywhere through user-friendly mobile apps. Whether you need to check your balance, transfer funds, or make a payment, everything is available at your fingertips, providing unmatched convenience. - Seamless Integration with Financial Apps

Smart banking platforms often integrate with other financial apps and services, allowing you to connect all your financial accounts in one place. This holistic view helps you manage your investments, savings, and debts more efficiently. - Secure Digital Wallets

Digital wallets linked to your smart banking account make payments quick, easy, and secure. You can store your debit and credit card information, pay for goods and services with just a tap, and manage your funds without carrying physical cards. - Personalized Financial Insights

Using data analytics, smart banking can provide personalized recommendations on how to save more, reduce spending, or make better investments. These insights can be invaluable in helping you improve your financial habits and reach your financial goals faster. - Easy Access to Loans and Credit

Many smart banking services simplify the process of applying for loans and credit by offering streamlined online applications, instant approvals, and competitive rates. This makes it easier for you to get the funds you need without the usual hassle.

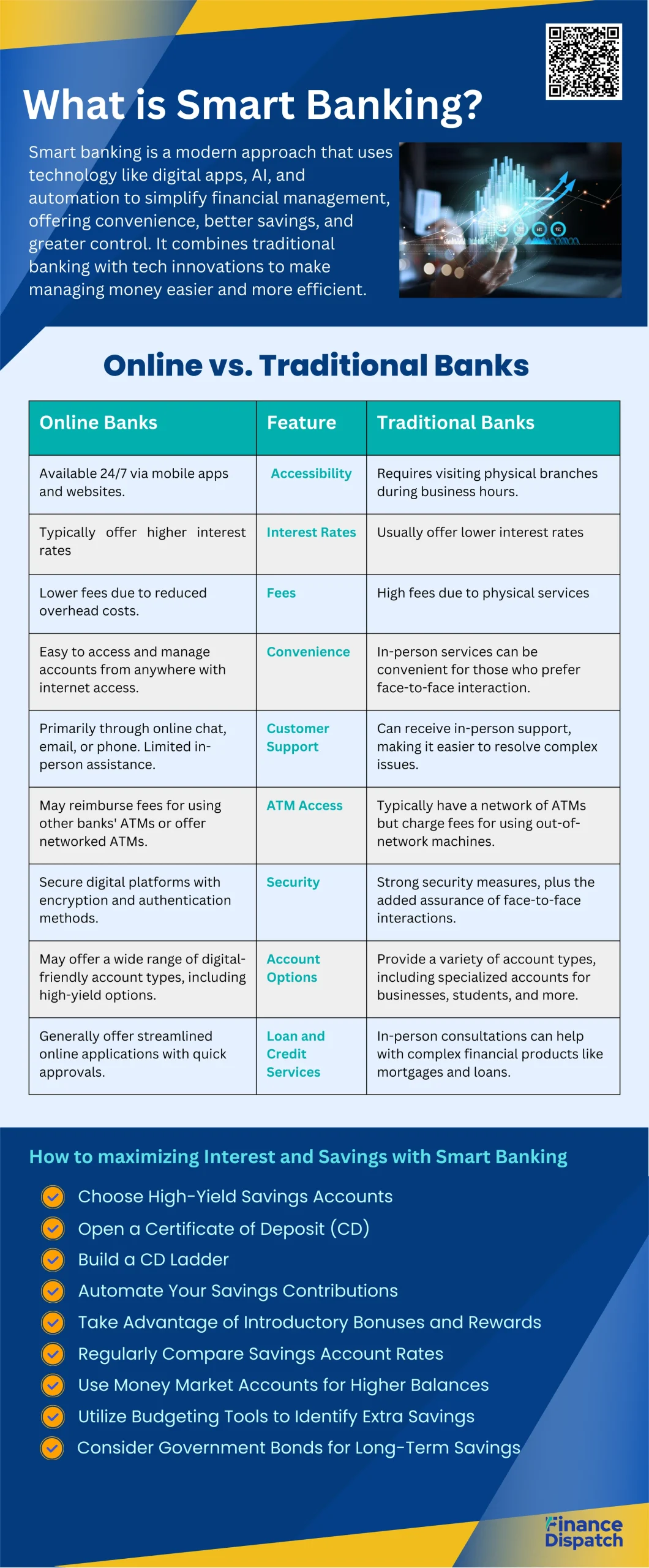

Online vs. Traditional Banks: Pros, Cons, and Key Differences

Choosing between online and traditional banks can be a tough decision, especially since both offer unique benefits. To help you decide which one suits your needs, let’s compare the pros, cons, and key differences between online and traditional banks.

| Feature | Online Banks | Traditional Banks |

| Accessibility | Available 24/7 via mobile apps and websites. No need to visit a branch. | Requires visiting physical branches during business hours for most services. |

| Interest Rates | Typically offer higher interest rates on savings accounts and CDs. | Usually offer lower interest rates on savings accounts compared to online banks. |

| Fees | Often have lower fees due to reduced overhead costs. | May charge higher fees for services like overdrafts, maintenance, and ATM usage. |

| Convenience | Easy to access and manage accounts from anywhere with internet access. | In-person services can be convenient for those who prefer face-to-face interaction. |

| Customer Support | Primarily through online chat, email, or phone. Limited in-person assistance. | Can receive in-person support, making it easier to resolve complex issues. |

| ATM Access | May reimburse fees for using other banks’ ATMs or offer networked ATMs. | Typically have a network of ATMs but charge fees for using out-of-network machines. |

| Security | Secure digital platforms with encryption and authentication methods. | Strong security measures, plus the added assurance of face-to-face interactions. |

| Account Options | May offer a wide range of digital-friendly account types, including high-yield options. | Provide a variety of account types, including specialized accounts for businesses, students, and more. |

| Loan and Credit Services | Generally offer streamlined online applications with quick approvals. | In-person consultations can help with complex financial products like mortgages and loans. |

How to maximizing Interest and Savings with Smart Banking

How to maximizing Interest and Savings with Smart Banking

Maximizing interest and savings is a key aspect of smart banking, and it involves more than just saving your money in a regular account. By taking advantage of high-yield savings accounts, Certificates of Deposit (CDs), and other financial tools, you can grow your savings faster while keeping your funds secure. Smart banking empowers you to make strategic choices about where to put your money so that it works harder for you. Here are some practical ways to maximize your interest and savings:

- Choose High-Yield Savings Accounts

Traditional savings accounts often offer minimal interest rates, but high-yield savings accounts can give you significantly better returns. Look for banks, particularly online ones, that offer competitive rates with no or low fees to help your savings grow faster. - Open a Certificate of Deposit (CD)

CDs usually offer higher interest rates than standard savings accounts, especially if you are willing to lock in your money for a specific period. By choosing the right CD term, you can secure a good rate and earn more interest without risking your principal. - Build a CD Ladder

A CD ladder involves opening multiple CDs with staggered maturity dates, which provides better flexibility while still earning higher interest rates. This strategy ensures that you have access to portions of your savings regularly, avoiding the need for early withdrawals. - Automate Your Savings Contributions

Setting up automatic transfers to your savings account can help you save consistently without having to think about it. This approach ensures that a portion of your income is always going into your savings, helping you build wealth over time. - Take Advantage of Introductory Bonuses and Rewards

Some banks offer special promotions, such as bonus interest rates for new customers or rewards checking accounts that give cashback on purchases. These bonuses can provide an extra boost to your savings, especially if you meet the requirements easily. - Regularly Compare Savings Account Rates

Interest rates can vary widely between banks, so it pays to shop around. Regularly check and compare rates from different financial institutions to ensure you’re getting the best deal. You might find that switching to a new account with a higher rate could be more beneficial. - Use Money Market Accounts for Higher Balances

If you have a larger amount of money to save, consider a money market account. These accounts often offer higher interest rates than standard savings accounts and come with the added benefits of check-writing and debit card access, making them a versatile option for savers. - Utilize Budgeting Tools to Identify Extra Savings

Smart banking involves using digital tools to track your spending and identify where you can cut back. By finding areas where you can save more, you’ll have additional funds to put into high-interest accounts, further maximizing your savings potential. - Consider Government Bonds for Long-Term Savings

If you are looking for a safe investment option with decent returns, consider purchasing government bonds. They are low-risk, and some types, like Series I Bonds, adjust their rates based on inflation, helping to protect your purchasing power over time.

Conclusion

In conclusion, smart banking and financial automation have revolutionized the way we manage our money, offering greater convenience, efficiency, and control. Whether it’s through high-yield savings accounts, automated bill payments, or integrated budgeting tools, smart banking allows you to make informed financial decisions without the constant stress of manual tracking. By embracing these modern solutions, you can save more effectively, invest wisely, and reach your financial goals with ease.

The key to successful financial management lies in making smart, automated choices that align with your personal goals. From setting up recurring transfers to monitoring your spending through digital apps, each step helps build a more secure and stable financial future. With the right mix of automation and strategic planning, you can eliminate the guesswork and focus on what truly matters—growing your wealth, preparing for the future, and enjoying the peace of mind that comes with knowing your finances are in order.