Life is unpredictable, and accidents or lawsuits can happen when you least expect them. While your home, auto, or renters insurance provides liability coverage, these policies have limits—meaning you could still be financially responsible for damages beyond their coverage. This is where umbrella insurance comes in. An umbrella policy acts as an extra layer of protection, covering high-cost liability claims that exceed your existing insurance limits. Whether it’s a major car accident, a lawsuit for defamation, or an injury on your property, umbrella insurance helps safeguard your savings, home, and other valuable assets. In this article, we’ll explore what umbrella insurance is, how it works, and how it provides extra liability protection in unexpected situations.

What is Umbrella Insurance?

Umbrella insurance is a type of liability insurance that provides additional coverage beyond the limits of your existing policies, such as auto, home, or renters insurance. It serves as a financial safety net, stepping in when the liability limits of your primary insurance policies are exhausted. This coverage helps protect you from significant financial losses in cases of bodily injury, property damage, or lawsuits—such as a severe car accident, a slip-and-fall incident on your property, or even a defamation claim. Unlike standard liability insurance, umbrella insurance also covers certain situations that typical policies exclude, including libel, slander, and false imprisonment. In short, it offers broader protection and higher coverage limits, ensuring that unexpected legal and financial burdens do not put your personal assets at risk.

How Does Umbrella Insurance Work?

How Does Umbrella Insurance Work?

Umbrella insurance acts as an extra layer of liability protection when the coverage limits of your home, auto, or other insurance policies are exceeded. It provides financial security by covering the remaining balance of claims that surpass your primary insurance limits. Additionally, it offers protection for certain risks not included in standard policies, such as defamation, false imprisonment, and landlord liability. This extended coverage helps safeguard your personal assets, ensuring that you are not forced to pay out of pocket for expensive legal claims or settlements.

How Umbrella Insurance Works: Step-by-Step

1. Your Primary Insurance Pays First

When an accident occurs, your homeowners or auto insurance will be the first to pay for damages or liability claims. Each policy has a coverage limit, and once that limit is reached, you would normally be responsible for the remaining costs.

2. When Limits Are Exceeded, Umbrella Insurance Kicks In

If a lawsuit or claim surpasses the limits of your primary insurance, umbrella insurance steps in to cover the excess amount. For example, if your auto policy covers up to $250,000, but a serious accident leads to a $750,000 claim, your umbrella policy would cover the remaining $500,000, preventing financial hardship.

3. Covers Legal Fees and Settlements

In the event of a lawsuit, umbrella insurance does not just cover damages but also pays for legal defense costs, including attorney fees, court expenses, and settlements. Even if the lawsuit is dismissed, legal expenses can be significant, and having umbrella coverage ensures that these costs do not drain your savings.

4. Protects You from Uncovered Risks

While auto and home insurance policies cover standard liability claims, they do not protect against certain lawsuits, such as defamation, libel, slander, or wrongful eviction. Umbrella insurance extends coverage to these unique risks, offering comprehensive liability protection beyond what traditional policies provide.

5. Extends Protection to Household Members

An umbrella policy often includes coverage for your spouse, children, or other dependents living in your home. If your child is involved in a lawsuit—such as being accused of cyber bullying on social media—umbrella insurance can help cover legal expenses and settlement costs.

6. Applies Globally

Unlike many standard insurance policies that apply only within the country, umbrella insurance provides liability protection worldwide. Whether you are traveling abroad and accidentally cause property damage or face legal claims in another country, your policy can still provide coverage.

How Does Umbrella Insurance Provide Extra Liability Protection?

How Does Umbrella Insurance Provide Extra Liability Protection?

Umbrella insurance provides an additional layer of financial protection when your home, auto, or other liability policies are not enough to cover the costs of an accident or lawsuit. Standard insurance policies have coverage limits, and if you are held responsible for damages that exceed these limits, you may have to pay the remaining amount out of pocket. Umbrella insurance steps in to cover the excess liability, ensuring that your assets, savings, and future income are not at risk. In addition, it covers certain risks that standard policies exclude, such as defamation, landlord liability, and certain legal expenses. Here’s how it provides extra liability protection in different situations:

Ways Umbrella Insurance Provides Extra Liability Protection

1. Covers Liability beyond Primary Insurance Limits

If you are found responsible for an accident that results in significant injuries or property damage, your home or auto insurance will cover damages up to its policy limit. However, if the total cost exceeds that limit, umbrella insurance covers the remaining balance, preventing you from paying out of pocket.

2. Pays for Legal Fees and Settlements

Lawsuits can be expensive, even if the claim against you is false. Umbrella insurance covers attorney fees, court costs, and settlements, ensuring that legal battles do not drain your financial resources.

3. Provides Protection against Uncommon Risks

Standard liability policies do not cover certain legal risks such as defamation, libel, slander, false imprisonment, or wrongful eviction. Umbrella insurance extends liability coverage to these situations, offering a broader scope of protection.

4. Safeguards Personal Assets and Future Income

In a lawsuit, if your insurance coverage is insufficient, you may be forced to pay damages from your savings, home equity, investments, or even future earnings. Umbrella insurance prevents personal assets from being used to settle claims, helping you maintain financial stability.

5. Extends Coverage to Household Members

Umbrella insurance often covers family members, including your spouse and children, even if they do not have their own insurance policies. If your child faces a lawsuit for cyberbullying or defamation, umbrella insurance can provide coverage for legal expenses.

6. Applies to Multiple Policies and Situations

Unlike standard liability coverage, which applies only to specific policies, umbrella insurance extends protection across multiple policies—including homeowners, auto, rental property, and sometimes even watercraft insurance. This means that no matter where an incident occurs, your umbrella policy may still provide coverage.

7. Offers Global Liability Protection

Most standard liability policies only provide coverage within the country where the policy was issued. Umbrella insurance, however, offers worldwide protection, ensuring that you remain covered even if you cause an accident or face a lawsuit while traveling abroad.

What Does Umbrella Insurance Cover?

Umbrella insurance provides broad liability coverage beyond the limits of your home, auto, or other primary insurance policies. It helps protect you from major financial losses by covering legal fees, medical expenses, and damages when you are held liable for an accident or lawsuit. Additionally, umbrella insurance covers certain risks that standard policies typically exclude, such as libel, slander, false imprisonment, and landlord liability. Whether it’s a severe car accident, a personal injury claim, or a legal dispute, umbrella insurance ensures that your assets and future income are not jeopardized.

Coverage under Umbrella Insurance

| Coverage | Description |

| Bodily Injury Liability | Covers medical bills, rehabilitation costs, and legal claims if you are responsible for injuring someone in a car accident or on your property. |

| Property Damage Liability | Pays for repairs or replacements if you damage someone else’s property, such as a vehicle, home, or business. |

| Legal Defense Costs | Covers attorney fees, court costs, and settlements, even if the lawsuit is false. |

| Defamation (Libel & Slander) | Protects you from lawsuits if you are sued for damaging someone’s reputation through spoken or written statements. |

| False Arrest, Imprisonment & Malicious Prosecution | Provides coverage if you are accused of wrongfully detaining someone and face legal action. |

| Landlord Liability | Covers liability claims related to rental properties, such as tenant injuries due to unsafe conditions. |

| Injuries Caused by Dependents | Extends protection if your child or another household member is responsible for an accident or lawsuit. |

| Worldwide Coverage | Provides liability protection for incidents that occur while traveling outside the country. |

Who Needs Umbrella Insurance?

Umbrella insurance is not just for the wealthy—it is essential for anyone who wants to protect their assets, savings, and future income from costly lawsuits. If you are found liable for an accident, property damage, or a legal claim, your standard home or auto insurance may not be enough to cover all expenses. In such cases, umbrella insurance steps in to cover the excess liability, preventing financial ruin. Whether you own property, have significant savings, or are at higher risk of being sued, an umbrella policy can offer valuable protection.

People Who May Need Umbrella Insurance

1. Homeowners1: If someone gets injured on your property and sues for medical expenses or damages, an umbrella policy helps cover costs beyond your home insurance limits.

2. Drivers with Teenagers: Young and inexperienced drivers are more likely to cause accidents, increasing the risk of expensive liability claims.

3. Landlords: Owning rental property comes with legal risks, including tenant injuries and lawsuits over property conditions.

4. High-Income Earners: If you earn a high salary, you are more likely to be targeted in lawsuits, and your income could be at risk if damages exceed your insurance coverage.

5. People with High-Value Assets: Those with significant savings, investments, or multiple properties need extra protection to avoid losing their wealth due to legal claims.

6. Pet Owners: If your pet injures someone, you could be held liable for medical expenses and legal fees.

7. Boaters and Recreational Vehicle Owners: Owning boats, jet skis, or ATVs increases the risk of accidents, and standard policies may not provide sufficient liability coverage.

8. Frequent Hosts or Party Throwers: If you regularly host guests, you could be held responsible for accidents, injuries, or damages that occur on your property.

9. Public Figures or Social Media Users: Those with an online presence may be at higher risk of being sued for defamation, slander, or libel.

10. People Who Participate in High-Risk Activities: Activities like skiing, hunting, or extreme sports increase the likelihood of lawsuits if you accidentally injure someone.

How Much Umbrella Insurance Do You Need?

How Much Umbrella Insurance Do You Need?

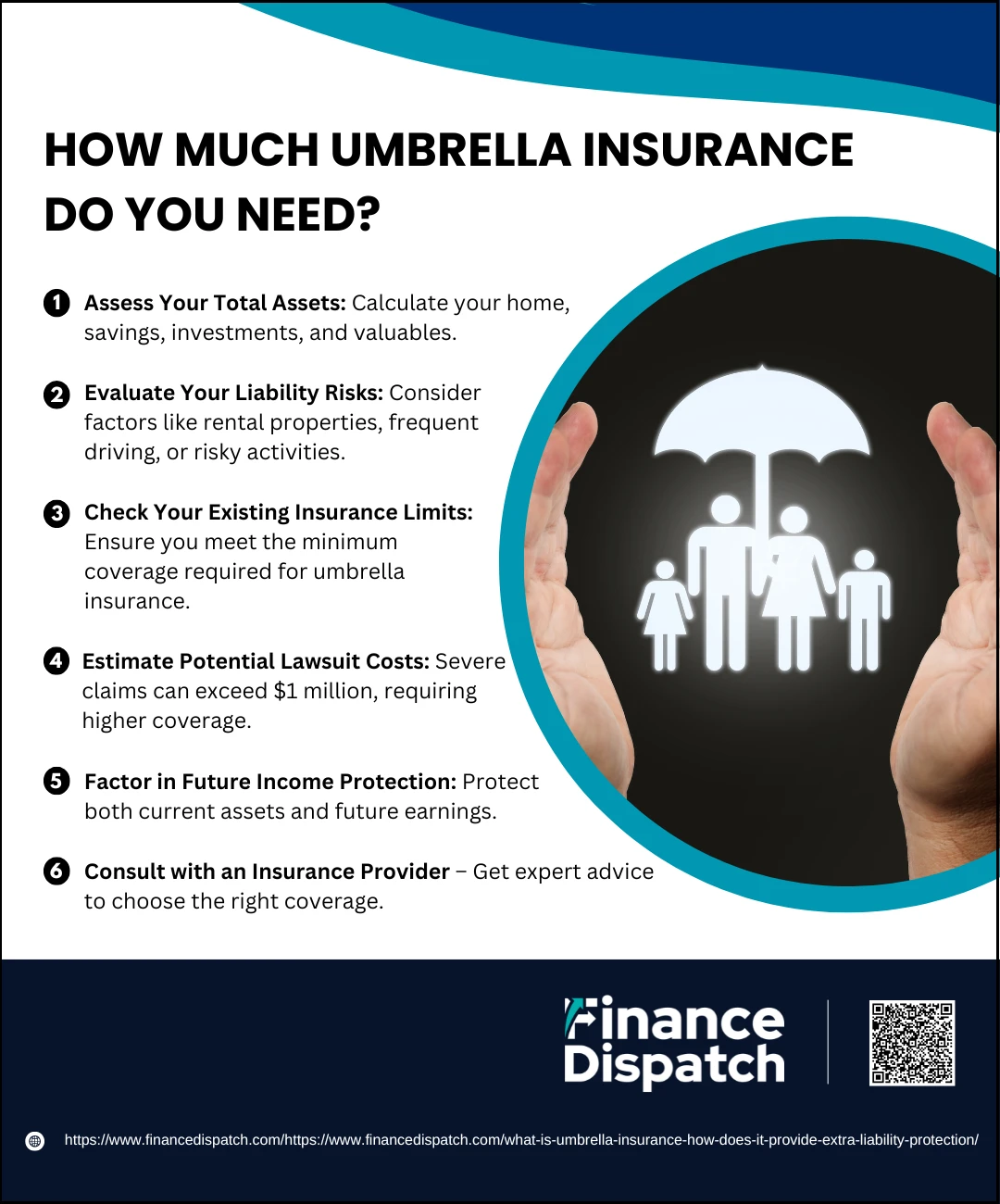

Determining the right amount of umbrella insurance depends on your assets, risk exposure, and potential lawsuit costs. The goal of an umbrella policy is to protect your wealth and future earnings from liability claims that exceed your existing insurance coverage. If you are found liable for a severe accident, property damage, or a lawsuit, the costs could be substantial. Since umbrella insurance is available in million-dollar increments, it’s essential to evaluate your financial situation to ensure you have adequate protection. Here’s how to calculate the right coverage amount:

Steps to Determine How Much Umbrella Insurance You Need

1. Assess Your Total Assets

Add up your home, savings, investments, retirement accounts, vehicles, and other valuables. Your umbrella policy should at least cover the total value of these assets to prevent financial loss in a lawsuit.

2. Evaluate Your Liability Risks

Consider your lifestyle and potential risks. If you own rental property, have a swimming pool, drive frequently, or participate in high-risk activities, your likelihood of facing a lawsuit is higher.

3. Check Your Existing Insurance Limits

Review your homeowners, auto, and other insurance policies to see how much liability coverage they provide. Most insurance companies require you to have at least $250,000 in auto liability and $300,000 in homeowners liability before purchasing umbrella insurance.

4. Estimate Potential Lawsuit Costs

Legal claims can exceed $1 million in severe cases, especially if bodily injury, property damage, or defamation lawsuits are involved. If you have high earnings or significant assets, consider purchasing at least $2 million to $5 million in umbrella coverage.

5. Factor in Future Income Protection

If a court awards damages that exceed your current assets, your future wages and investments could be at risk. Choose an umbrella policy that protects not just your current wealth but also your earning potential.

6. Consult with an Insurance Provider

Speak with an insurance expert to understand your risk exposure and determine the right coverage level. They can help tailor an umbrella policy that aligns with your financial situation and liability concerns.

How Much Does Umbrella Insurance Cost?

The cost of umbrella insurance is relatively affordable compared to the financial protection it provides. On average, a $1 million policy costs between $200 and $500 per year, depending on factors such as your assets, risk exposure, and the number of properties or vehicles you own. If you need additional coverage, the cost increases incrementally, with each extra $1 million in coverage typically adding $100 to $200 to the annual premium. Your insurance rates may also be influenced by your driving history, homeownership status, and whether you have high-risk factors like a swimming pool, rental properties, or a teenage driver in your household. While umbrella insurance is an optional policy, its relatively low cost makes it a smart investment for those who want to protect their assets from costly lawsuits and liability claims.

Umbrella Insurance vs. Excess Liability Insurance

Many people assume that umbrella insurance and excess liability insurance are the same, but they have key differences. Both policies provide additional liability coverage beyond standard home, auto, or other primary insurance policies, but they function in different ways. Umbrella insurance offers broader protection, covering additional risks such as libel, slander, and false imprisonment, which are not included in standard liability policies. In contrast, excess liability insurance simply extends the coverage limits of an existing policy without adding any new types of coverage. Understanding these distinctions can help you choose the right type of additional liability protection based on your specific needs.

Comparison of Umbrella Insurance and Excess Liability Insurance

| Feature | Umbrella Insurance | Excess Liability Insurance |

| Coverage Scope | Expands coverage to additional risks such as defamation, false imprisonment, and landlord liability. | Only increases liability limits of an existing policy without expanding coverage types. |

| Applies to Multiple Policies | Covers claims under multiple policies (auto, home, boat, rental property, etc.). | Only extends the coverage of a single underlying policy. |

| Legal Expenses | Pays for attorney fees, court costs, and settlements beyond standard insurance limits. | Covers only legal costs related to the extended primary policy. |

| Protection Against Lawsuits | Covers personal injury lawsuits, such as libel, slander, or invasion of privacy. | Only covers legal claims that are already included in the underlying policy. |

| Coverage Amounts | Typically starts at $1 million, with options to increase coverage up to $10 million or more. | Follows the structure of the primary insurance policy but increases its payout limits. |

| Cost | Costs $200–$500 per year for $1 million in coverage, with small increases for higher limits. | Premiums vary but tend to be slightly lower than umbrella insurance since coverage is more limited. |

| Who Needs It? | Ideal for those with multiple assets, higher liability risks, or significant wealth. | Best for individuals who only need to extend the coverage of a single policy. |

Pros and Cons of Umbrella Insurance

Pros and Cons of Umbrella Insurance

Umbrella insurance serves as an extra layer of protection that goes beyond the limits of your standard home, auto, or other liability insurance policies. It is designed to shield your personal assets and future income from costly lawsuits or liability claims that could arise from accidents, defamation, or other unexpected situations. While it offers extensive coverage and peace of mind, it’s not a one-size-fits-all solution. Some individuals may not need the extra coverage, while others with high-value assets or higher risk exposure may find it essential. Below, we break down the key advantages and disadvantages of umbrella insurance to help you determine if it’s the right choice for you.

Pros of Umbrella Insurance

1. Extends Liability Coverage

If you’re found legally responsible for an accident or lawsuit, umbrella insurance provides additional financial protection beyond the limits of your homeowners, auto, or renters insurance policies. This ensures that you don’t have to pay out of pocket for damages, medical expenses, or legal settlements.

2. Covers Legal Costs and Settlements

Lawsuits can be extremely expensive, even if the case is dismissed. Umbrella insurance helps cover attorney fees, court costs, and settlements, ensuring that you are not financially burdened by legal proceedings.

3. Protects Against Unique Risks

Unlike standard liability insurance, umbrella policies cover claims that are typically excluded from auto and home policies. This includes libel, slander, defamation, false arrest, wrongful eviction, and landlord liability—making it an excellent choice for those in high-risk professions or with strong public visibility.

4. Applies to Multiple Policies and Situations

Umbrella insurance extends coverage across multiple policies, meaning it protects you regardless of whether the claim originates from your home, vehicle, rental property, or even a recreational asset like a boat or ATV. This flexibility makes it a versatile option for broad liability protection.

5. Affordable Compared to Coverage Amount

Despite its high coverage limits (typically starting at $1 million and increasing in $1 million increments), umbrella insurance is relatively inexpensive, costing around $200 to $500 per year for the first $1 million in coverage. Each additional million dollars in coverage typically costs only $100 to $200 more, making it a cost-effective way to protect substantial assets.

6. Covers Household Members

Most umbrella policies extend protection to spouses, children, and other dependents who live in your home. If your teenager causes a major car accident or is sued for cyberbullying, an umbrella policy can help cover the legal costs and damages.

7. Provides Worldwide Coverage

Unlike standard liability insurance, which is usually limited to domestic claims, umbrella insurance offers global protection. Whether you’re traveling abroad and cause an accident or face a lawsuit in another country, your policy can still provide coverage.

Cons of Umbrella Insurance

1. Does Not Cover Personal Injuries or Property Damage

Umbrella insurance only covers liability claims against you. This means it won’t pay for your own injuries or damage to your personal property—you’ll need health insurance, auto insurance, or homeowners insurance for those expenses.

2. Requires Minimum Underlying Insurance Coverage

Before you can purchase umbrella insurance, most insurers require you to already have certain levels of liability coverage on your auto and home insurance. For example, you may need to carry at least $250,000 in auto liability insurance and $300,000 in homeowners liability insurance before qualifying for an umbrella policy.

3. Not Necessary for Everyone

If you have minimal assets and a low risk of being sued, umbrella insurance may not be worth the additional cost. People with fewer financial assets and lower exposure to liability claims might be better off increasing their standard liability limits instead.

4. Higher Costs for High-Risk Individuals

While umbrella insurance is affordable for most people, the price can increase based on risk factors. If you own rental properties, have teenage drivers, frequently entertain guests, or own a pool or trampoline, you may face higher premiums.

5. Bundling May Be Required

Some insurance providers require you to bundle umbrella coverage with your existing home and auto insurance policies. This means you may not be able to shop around for the best rates across different insurers.

Is Umbrella Insurance Worth It?

Whether umbrella insurance is worth it depends on your financial situation, lifestyle, and risk exposure. If you have significant assets, high earnings, or a greater likelihood of facing lawsuits, an umbrella policy can provide essential protection against unexpected liability claims. Without it, you could be forced to pay out of pocket for damages, legal fees, or settlements that exceed your auto or homeowners insurance limits—potentially putting your savings, home, and future income at risk. Given that a $1 million policy typically costs between $200 and $500 per year, umbrella insurance is a cost-effective way to secure financial peace of mind. While not everyone may need this extra coverage, individuals with rental properties, teenage drivers, high-risk hobbies, or public exposure are more likely to benefit. In the end, the decision comes down to how much protection you want against life’s unpredictable and costly accidents.

Conclusion

Umbrella insurance provides an extra layer of financial protection that goes beyond the limits of your existing home, auto, or other liability policies. It acts as a safety net, ensuring that a lawsuit or major accident doesn’t wipe out your savings, assets, or future earnings. While not everyone may need it, those with high-value assets, rental properties, young drivers, or an increased risk of legal claims can benefit significantly. Given its affordable cost relative to the coverage it provides, umbrella insurance is a smart investment for anyone looking to safeguard their financial future. By evaluating your risks and existing coverage, you can determine whether an umbrella policy is the right choice to provide peace of mind and long-term financial security.