When you think about investing, you likely consider the potential rewards, but it’s just as crucial to understand the risks involved. Among these, unsystematic risk stands out as one that can be managed with the right approach. Unsystematic risk, also known as specific or diversifiable risk, refers to uncertainties tied to a particular company or industry rather than the broader market. Whether it’s a product recall, management shake-up, or industry-specific regulation, these risks can directly impact the performance of individual investments. The good news? By diversifying your portfolio, you can significantly mitigate the effects of unsystematic risk. In this article, you’ll gain a clear understanding of what unsystematic risk is, its key characteristics, and practical ways to manage it effectively.

Understanding Unsystematic Risk

Unsystematic risk refers to the uncertainties or challenges that are unique to a specific company or industry. Unlike systematic risk, which impacts the entire market or economy, unsystematic risk arises from internal factors like management decisions, operational inefficiencies, or financial structure, as well as external factors such as regulatory changes or competitive pressures. For example, a sudden product recall or a new competitor entering the market can create significant disruptions for a company, without affecting the broader industry. This type of risk is often referred to as diversifiable risk because it can be mitigated through strategic portfolio diversification. By spreading investments across various companies and sectors, you can reduce your exposure to these company-specific risks and protect your portfolio from the unpredictable nature of unsystematic events.

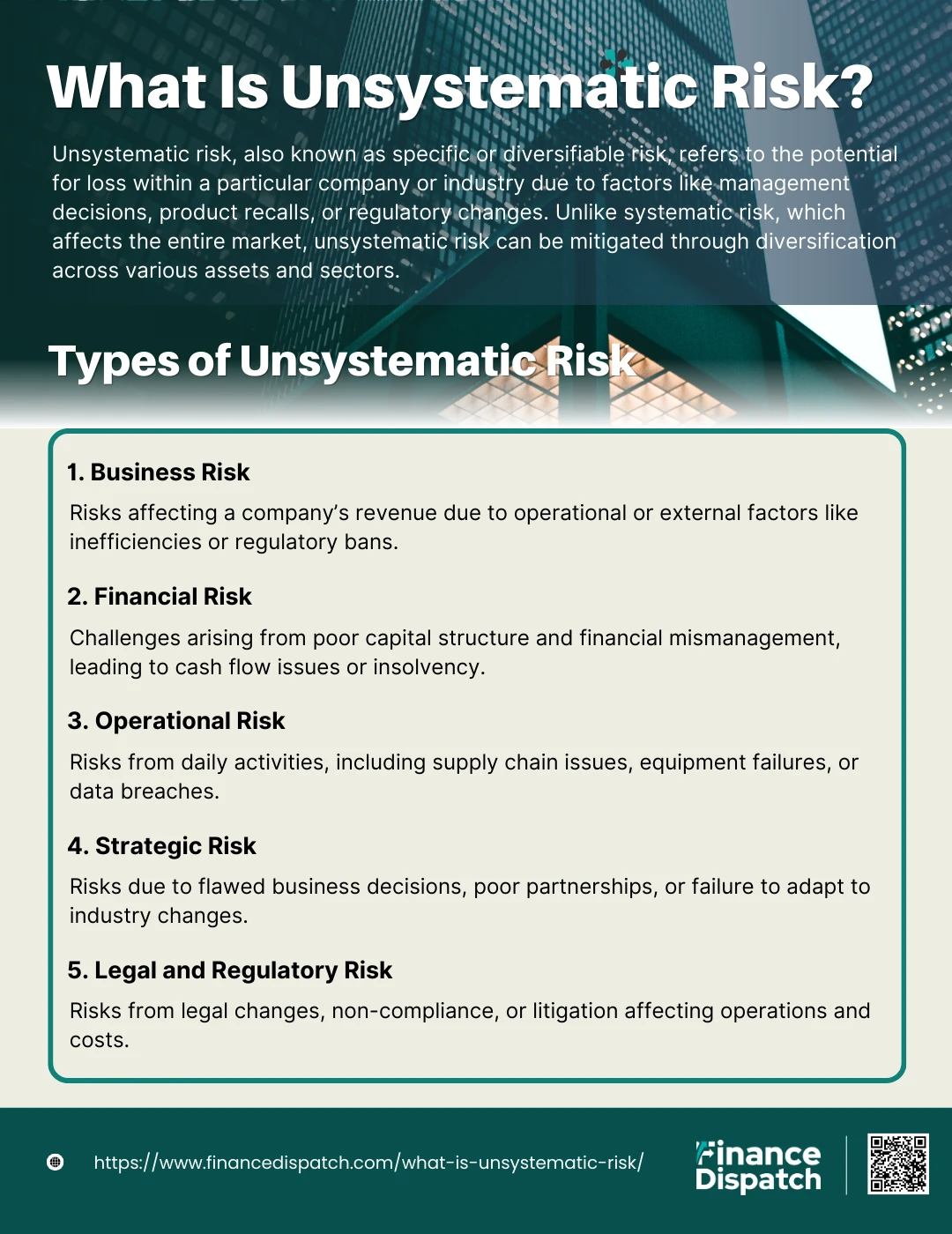

Types of Unsystematic Risk

Unsystematic risk can manifest in various forms, each tied to specific aspects of a company’s operations, strategy, or external environment. Understanding these types is key to identifying vulnerabilities and implementing effective risk management strategies. Below are the primary types of unsystematic risk that investors and businesses encounter:

1. Business Risk

Business risk arises from internal and external factors that impact a company’s revenue and performance. For instance, operational inefficiencies or the failure to secure intellectual property rights can hinder competitiveness, while external factors like regulatory bans on certain products can disrupt operations.

2. Financial Risk

This risk relates to a company’s capital structure and its ability to manage financial obligations. A poorly balanced mix of debt and equity can lead to cash flow problems, reduced earnings, and potential insolvency, especially during periods of economic stress.

3. Operational Risk

Operational risk stems from day-to-day activities and unforeseen events, such as supply chain disruptions, equipment failures, or security breaches. These risks can halt production, compromise data, and lead to significant financial losses.

4. Strategic Risk

Strategic risk occurs when a company makes flawed decisions regarding its direction or partnerships. Examples include entering declining markets, forming alliances with unreliable partners, or failing to adapt to industry trends, such as technological advancements.

5. Legal and Regulatory Risk

Legal and regulatory risk involves changes in laws, policies, or litigation that can increase costs or challenge a company’s operations. For example, non-compliance with environmental regulations or facing lawsuits can lead to hefty fines and reputational damage.

Key Characteristics of Unsystematic Risk

Unsystematic risk, also known as specific or diversifiable risk, is unique to a particular company or industry. Unlike systematic risk, which affects the entire market, unsystematic risk arises from factors that are internal to an organization or specific to its sector. These risks can often be managed or reduced through diversification. Understanding its key characteristics helps in developing strategies to mitigate its impact effectively.

Company or Industry-Specific: Unsystematic risk is limited to a particular company, sector, or industry, and does not affect the broader market.

Diversifiable: This risk can be minimized or eliminated by diversifying investments across different industries or sectors.

Internal or Controllable Factors: Often caused by factors like management decisions, operational inefficiencies, or strategic errors within a company.

External but Targeted Factors: Includes external risks such as regulatory changes or new market competition that specifically impact the company or industry.

Measurable Through Variance: Can be assessed by analyzing the variance in a company’s performance compared to market benchmarks.

Unpredictable: While identifiable, the exact timing or impact of unsystematic risk is difficult to predict.

Advantages and Disadvantages of Unsystematic Risk

Unsystematic risk, while often seen as a challenge, has its own set of advantages and disadvantages that can impact investment and business decisions. Understanding these pros and cons is essential for effective risk management and portfolio strategy. By examining both sides, you can make informed decisions on how to approach and mitigate these risks.

Advantages

1. Specific to Individual Companies or Industries

Unsystematic risk affects only a specific company or industry rather than the entire market. This targeted nature means it can be analyzed and managed more effectively by focusing on the particular factors that influence the company or sector. For example, a product recall for one company in the technology sector doesn’t necessarily impact other companies in the same sector.

2. Diversifiable

One of the most significant advantages of unsystematic risk is that it can be reduced or even eliminated through diversification. By spreading investments across different companies, industries, and asset classes, the negative effects of one investment can be offset by the positive performance of another, creating a more balanced and stable portfolio.

3. Opportunity for Gain

Sometimes, unsystematic risks can create unique opportunities. For instance, if a competitor faces financial difficulties or regulatory challenges, a company in the same industry might gain market share or enhance its reputation. This potential for upside makes unsystematic risk different from systematic risk, which is generally negative.

4. Manageable Through Internal Controls

Many unsystematic risks stem from internal factors such as management decisions or operational inefficiencies. With proper internal controls, such as improving processes, enhancing leadership strategies, or adopting new technologies, businesses can significantly reduce their exposure to these risks.

5. Lower Market-Wide Impact

Since unsystematic risk doesn’t ripple across the entire market, its impact is confined to a smaller scope. This characteristic reduces the chances of widespread economic disruption and allows other unaffected market players to continue operating without major disruptions.

Disadvantages

1. Unpredictable in Nature

Even though unsystematic risks are specific, predicting when they will occur or their exact impact is challenging. Sudden changes, such as a leadership crisis or product failure, can take even well-prepared companies by surprise, making it harder to react swiftly.

2. Limited External Support

Because unsystematic risks are company or industry-specific, they are less likely to attract government or regulatory intervention. Unlike systematic risks that affect broader markets and may trigger support measures like bailouts, companies facing unsystematic risks often have to rely on internal resources to resolve the issue.

3. Potentially High Costs

Managing and mitigating unsystematic risk can be expensive. Companies might need to invest in advanced risk management systems, conduct extensive training, or hire specialized personnel. Additionally, the financial fallout from lawsuits, product recalls, or operational failures can be substantial.

4. Impact on Stakeholders

When unsystematic risk materializes, it doesn’t just impact the company—it can ripple through its stakeholders. Employees might face job insecurity, shareholders could see a drop in stock value, and customers might lose trust in the brand. This broader impact can be difficult to recover from.

5. Requires Constant Monitoring

Effectively managing unsystematic risk demands ongoing vigilance. Companies must continually assess their internal operations, competitive positioning, and regulatory landscape to identify and mitigate potential risks. This effort requires significant resources and can be overwhelming for smaller organizations.

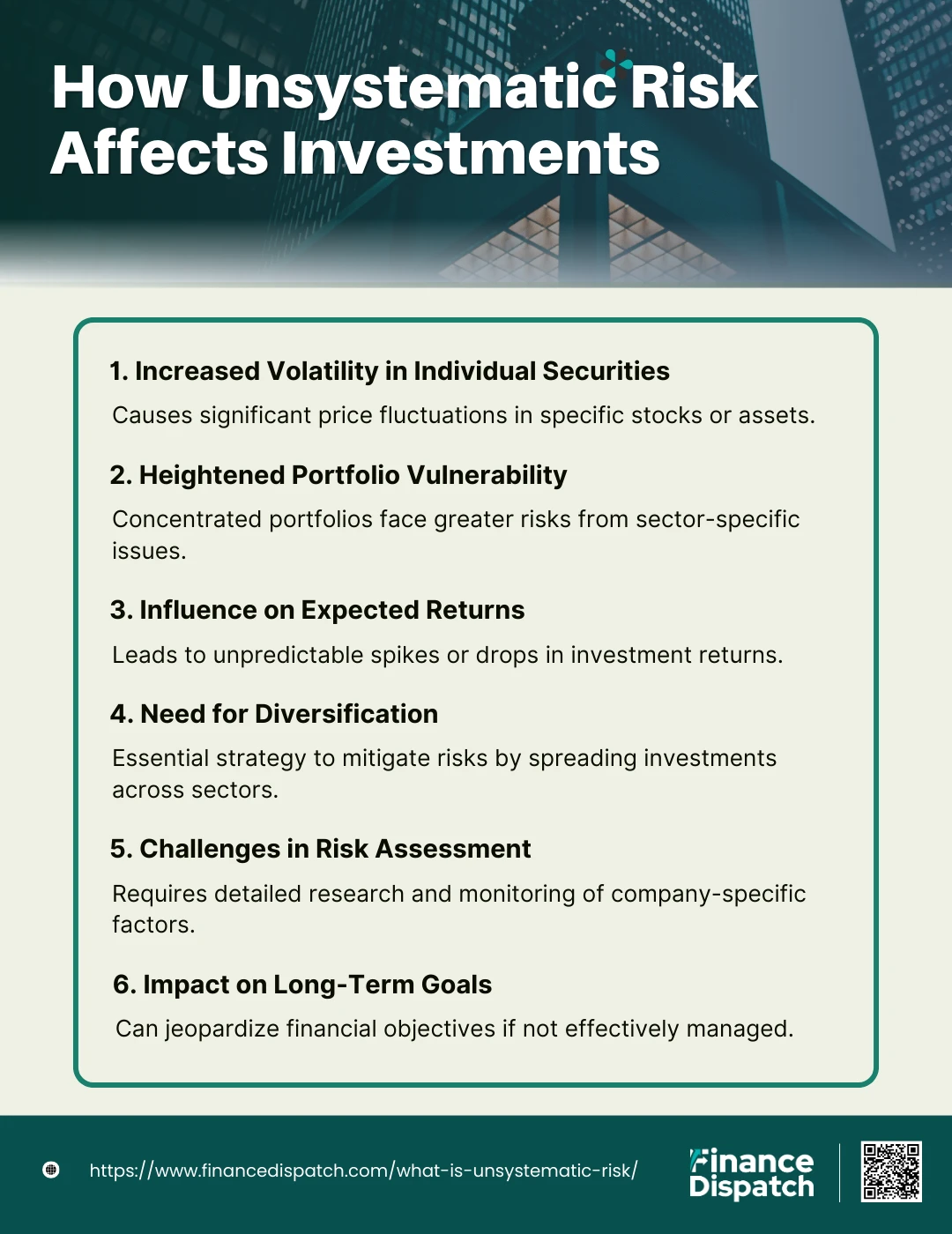

How Unsystematic Risk Affects Investments

Unsystematic risk plays a significant role in shaping the performance of individual investments. Unlike market-wide risks, which affect all securities, unsystematic risks are tied to specific companies or industries. These risks, ranging from management decisions to regulatory changes, can lead to substantial gains or losses, depending on how they are managed or mitigated. Below are the primary ways in which unsystematic risk impacts investments:

1. Increased Volatility in Individual Securities

Unsystematic risks cause fluctuations in the prices of specific stocks or assets. For instance, news about a product recall or financial instability can lead to sudden price drops, affecting the returns of investors holding those assets.

2. Heightened Portfolio Vulnerability

If a portfolio is concentrated in one sector or a few companies, unsystematic risk can significantly impact its overall performance. For example, an investor holding only airline stocks may face steep losses during an industry-wide strike.

3. Influence on Expected Returns

Investors may see returns either spike or plummet due to unsystematic risks, such as successful product launches or corporate scandals. This unpredictability underscores the need for robust risk management.

4. Need for Diversification

Diversification is critical to counteract unsystematic risk. By spreading investments across different sectors and asset classes, the negative impact of one investment can be mitigated by positive performances elsewhere.

5. Challenges in Risk Assessment

Since unsystematic risks are specific to companies or industries, they often require extensive research and monitoring. Understanding factors such as management decisions, competitive landscape, and regulatory changes is essential for mitigating these risks.

6. Impact on Long-Term Goals

Unsystematic risks can derail an investor’s long-term financial goals if they are not adequately managed. A major loss due to such risks can set back plans for retirement, education, or other financial objectives.

Strategies to Manage Unsystematic Risk

Managing unsystematic risk effectively is crucial for protecting your investments and ensuring long-term financial stability. Since unsystematic risk is specific to individual companies or industries, it can often be minimized through proactive strategies. By focusing on diversification, thorough research, and ongoing portfolio management, you can mitigate the impact of these risks and safeguard your financial goals. Below are some key strategies to manage unsystematic risk:

- Diversification: Spread your investments across various industries, sectors, and asset classes to reduce the impact of company-specific risks. A well-diversified portfolio ensures that the negative performance of one investment does not significantly affect your overall returns.

- Thorough Research and Due Diligence: Investigate the financial health, management practices, and competitive position of companies before investing. Understanding the risks and opportunities specific to an investment can help you make informed decisions.

- Regular Portfolio Monitoring: Continuously evaluate the performance of your portfolio to identify potential risks and adjust your investments as needed. This includes staying updated on company news, industry trends, and regulatory changes.

- Risk Transfer Through Hedging: Use financial instruments like options and futures to hedge against potential losses. For example, purchasing put options can protect your investments from sudden price drops in specific stocks.

- Limit Exposure to High-Risk Investments: Avoid over-concentration in high-risk companies or volatile industries. Balance your portfolio with stable, income-generating assets to cushion against unpredictable losses.

- Establish Stop-Loss Orders: Use stop-loss orders to automatically sell an investment if it falls below a predetermined price. This can help minimize losses during unforeseen events.

Examples of Unsystematic Risk in Real-Life Scenarios

Unsystematic risk refers to company or industry-specific events that can significantly impact an organization’s performance and its stakeholders. These risks arise from internal or external factors, such as management decisions, operational failures, or regulatory changes, and are not influenced by broader market trends. Below are some notable real-life examples of unsystematic risks:

- Samsung Galaxy Note 7 Recall (2016): Samsung suffered a substantial financial and reputational hit when it had to recall millions of Galaxy Note 7 smartphones due to defective batteries that caused fires. This operational failure affected its market share and consumer trust.

- Toys “R” Us Bankruptcy (2017): Poor strategic planning and failure to compete with online retailers like Amazon led to the bankruptcy of the iconic toy retailer, causing job losses and impacting creditors.

- Juul Labs Regulatory Challenges (2019): The e-cigarette company faced severe regulatory crackdowns in the U.S., including bans on flavored products, which significantly reduced its sales and market presence.

- Volkswagen Emissions Scandal (2015): Volkswagen faced legal and reputational damage when it was discovered that the company used software to cheat on emissions tests. The scandal resulted in billions of dollars in fines and a loss of consumer trust.

- Peloton Product Safety Issue (2021): Peloton had to recall its treadmills after reports of safety concerns, including injuries and a fatality. The recall not only led to financial losses but also raised questions about its safety standards.

- Boeing 737 MAX Grounding (2019): After two fatal crashes, Boeing’s 737 MAX aircraft was grounded globally. The company faced lawsuits, operational disruptions, and a decline in its stock value.

Conclusion

In conclusion, understanding the distinctions and implications of systematic and unsystematic risks is crucial for effective investment and risk management. Systematic risk, driven by broad market factors, is unavoidable and requires strategies like asset allocation and hedging to mitigate its impact. On the other hand, unsystematic risk, specific to companies or industries, can be managed effectively through diversification and thorough due diligence. By identifying these risks and employing tailored strategies, investors can build more resilient portfolios, navigate uncertainties with confidence, and achieve long-term financial goals. Recognizing that no investment is completely risk-free, proactive management of both types of risk is the key to optimizing returns and minimizing losses.