If you’re planning your dream vacation – a trip across the Atlantic to explore the vibrant streets of London, followed by a relaxing cruise around the Caribbean. You’ve booked your flights, found a chic Virgin Hotel to stay at, and you’re ready to set sail with Virgin Voyages. Now, picture earning points on every dollar you spend throughout this journey, from your flights to your hotel and even onboard your cruise. That’s exactly what the Virgin Red Rewards Mastercard can help you do. With this card, not only do you earn points, but you also unlock exclusive bonuses that can enhance your travel experience. This is a card that truly rewards those who live for travel, especially if you’re a fan of everything Virgin.

The Virgin Red Rewards Mastercard is a co-branded credit card designed for U.S. consumers, issued in partnership with Synchrony Bank. This card is part of the Virgin Red loyalty program, which connects all Virgin brands, including Virgin Atlantic, Virgin Hotels, and Virgin Voyages. For an annual fee of $99, cardholders can earn Virgin Points across various categories, including travel, dining, groceries, and more. With benefits like no foreign transaction fees, bonus points for adding authorized users, and exclusive travel perks, the Virgin Red Rewards Mastercard is tailored to help you make the most out of your spending while enjoying the world of Virgin.

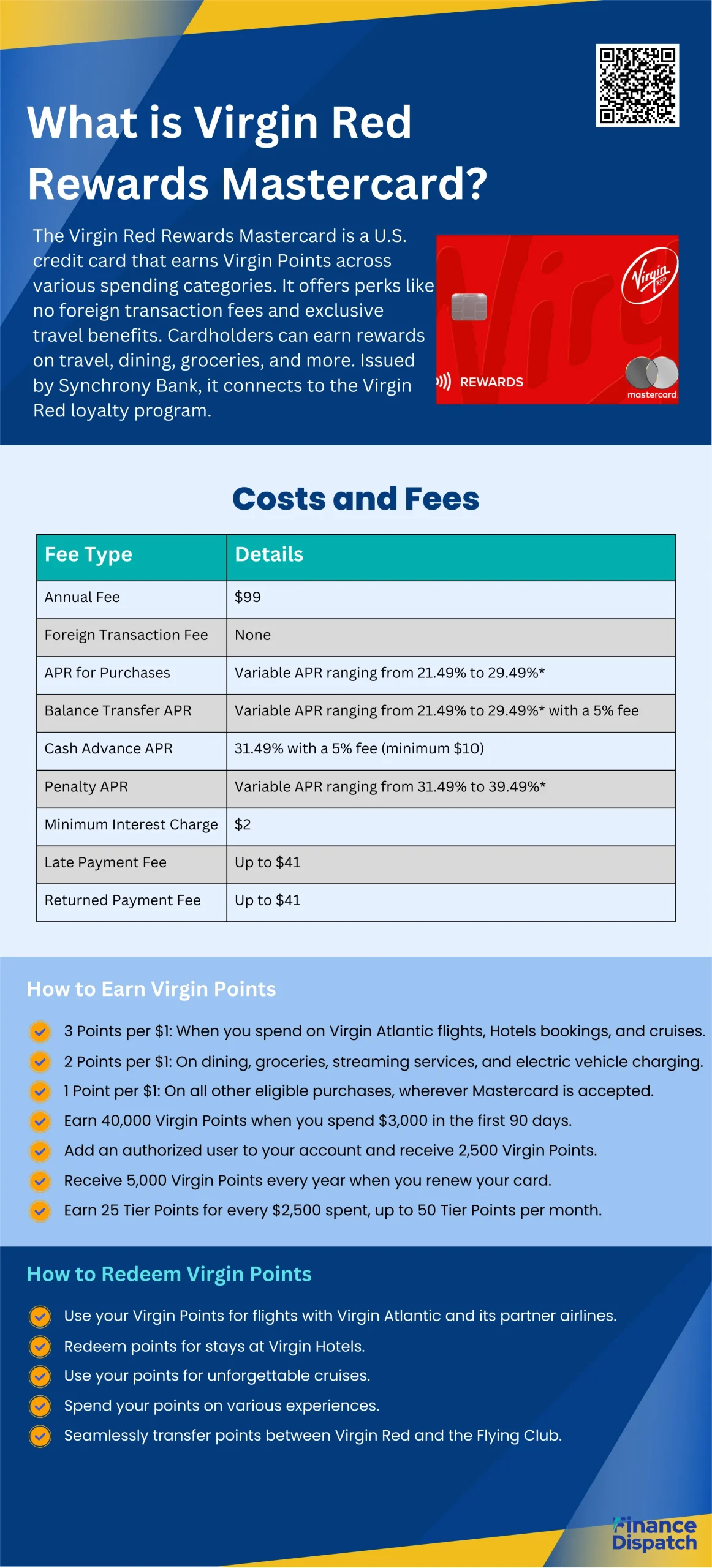

Costs and Fees

Below is a breakdown of the key costs you should know about before applying.

| Fee Type | Details | ||

| Annual Fee | $99 | ||

| Foreign Transaction Fee | None | ||

| APR for Purchases | Variable APR ranging from 21.49% to 29.49%* | ||

| Balance Transfer APR | Variable APR ranging from 21.49% to 29.49%* with a 5% fee (minimum $5) | ||

| Cash Advance APR | 31.49% with a 5% fee (minimum $10) | ||

| Penalty APR | Variable APR ranging from 31.49% to 39.49%* | ||

| Minimum Interest Charge | $2 | ||

| Late Payment Fee | Up to $41 | ||

| Returned Payment Fee | Up to $41 |

How to Earn Virgin Points

Here’s how you can maximize your points earnings and make the most out of your rewards:

- Earn Points on Purchases

- 3 Points per $1: When you spend on Virgin Atlantic flights, Virgin Hotels bookings, and Virgin Voyages cruises.

- 2 Points per $1: On dining, groceries, select streaming services, and electric vehicle (EV) charging.

- 1 Point per $1: On all other eligible purchases, wherever Mastercard is accepted.

- Welcome Bonus

- Earn 40,000 Virgin Points when you spend $3,000 in the first 90 days after opening your account.

- Additional Points for Authorized Users

- Add an authorized user to your account and receive 2,500 Virgin Points (up to four users, maximum 10,000 points).

- Anniversary Bonus

- Receive 5,000 Virgin Points every year when you renew your card, just for being a loyal cardholder.

- Flying Club Tier Points

- Earn 25 Tier Points for every $2,500 spent, up to 50 Tier Points per month. This helps you move closer to achieving elite status with Virgin Atlantic.

How to Redeem Virgin Points

- Flights

- Use your Virgin Points for flights with Virgin Atlantic and its partner airlines. You can also transfer points between Virgin Red and the Virgin Atlantic Flying Club for more flexibility.

- Hotel Stays

- Redeem points for stays at Virgin Hotels, enjoying a comfortable experience at properties around the world.

- Virgin Voyages Cruises

- Use your points for unforgettable cruises, covering everything from short getaways to extended voyages.

- Unique Experiences

- Spend your points on various experiences, including food tours, wine tastings, spa days, movie tickets, and more through the Virgin Red rewards program.

- Transfer Points

- Seamlessly transfer points between Virgin Red and the Flying Club, allowing you to use your balance across multiple Virgin brands and partners.

How to Apply for the Virgin Red Rewards Mastercard

Here’s a step-by-step guide on how to apply for this card and begin earning rewards.

Steps to Apply

- Join the Virgin Red Program

- To apply for the card, you must be a member of Virgin Red. If you aren’t already a member, visit the Virgin Red website or download the app to create an account. Membership is free, and it allows you to earn and redeem Virgin Points across various Virgin brands.

- Log In to Your Virgin Red Account

- Once you have an account, log in to your Virgin Red profile. If you are already a member, simply enter your login details to proceed.

- Access the Credit Card Application

- After logging in, navigate to the Virgin Red Rewards Mastercard section. Click on the “Apply Now” or “Find Out More” button, which will direct you to the application form hosted by Synchrony Bank, the card issuer.

- Fill Out the Application Form

- Complete the online application by providing your personal information, including your name, address, income details, and Social Security number. Make sure all information is accurate to avoid any delays in processing.

- Agree to the Terms and Submit

- Review the terms and conditions carefully, including information on interest rates, fees, and rewards. If everything looks good, agree to the terms and submit your application.

- Wait for Approval

- After submitting, you will receive a decision. In some cases, approval may be instant, but if further review is required, you may be notified via email within a few business days.

- Link Your Virgin Red Account

- Once approved, make sure to link your new Virgin Red Rewards Mastercard to your Virgin Red account. This will enable you to start earning and redeeming points seamlessly across Virgin brands.

Who Should Consider the Virgin Red Rewards Mastercard?

Here’s a look at who might get the most value out of this card:

Ideal Candidates for the Virgin Red Rewards Mastercard

- Loyal Virgin Brand Customers

- If you frequently travel with Virgin Atlantic, stay at Virgin Hotels, or cruise with Virgin Voyages, this card is a perfect fit. You’ll earn more points on these purchases and enjoy perks like free hotel nights and bar tabs on cruises.

- Frequent Travelers

- The card’s rewards structure and benefits, such as no foreign transaction fees, make it ideal for those who travel often, especially internationally. Plus, you can earn Tier Points that help you reach elite status with Virgin Atlantic.

- Everyday Spenders Looking for Rewards

- Even if you don’t travel frequently, you can still benefit from the card’s rewards on everyday purchases like dining, groceries, and streaming services. You can save up points for a big trip or use them for other experiences.

- High Spenders Seeking Custom Perks

- For those who spend $15,000 or more annually, the card offers customizable perks such as a companion flight, room upgrades, or a $300 bar tab on cruises. If you regularly make large purchases, these rewards can add significant value.

- Individuals Looking for Flexibility in Reward Redemption

- The ability to transfer points between Virgin Red and the Flying Club means you have more flexibility in how you use your points. Whether it’s for flights, hotel stays, or unique experiences, the Virgin Red Rewards Mastercard gives you versatile options.

- People Seeking a Low-Cost Travel Rewards Card

- With an annual fee of $99 and no foreign transaction fees, this card offers a cost-effective way to earn travel rewards without breaking the bank. Plus, the welcome bonus can provide excellent value for new cardholders.

Conclusion

The Virgin Red Rewards Mastercard is an excellent choice for those who want to maximize their spending while enjoying exclusive travel benefits. With its generous earning rates, no foreign transaction fees, and valuable perks like free hotel nights and customizable rewards for high spenders, this card offers a well-rounded package for frequent travelers and loyal Virgin customers. The ability to earn and redeem points across Virgin Atlantic, Virgin Hotels, and Virgin Voyages makes it a versatile option, while the 40,000-point welcome bonus provides a strong motivation to get started. If you’re looking for a card that turns everyday purchases into meaningful rewards, the Virgin Red Rewards Mastercard could be the perfect fit.

FAQs about the Virgin Red Rewards Mastercard

To help you get a clearer picture, here are some of the most frequently asked questions about this card:

Frequently Asked Questions

- What is the annual fee for the Virgin Red Rewards Mastercard?

- The card has an annual fee of $99. Despite the fee, the rewards and perks can easily outweigh the cost, especially for frequent Virgin customers.

- How do I earn Virgin Points with this card?

- You can earn points based on your spending categories: 3 points per $1 on Virgin Atlantic flights, Virgin Hotels bookings, and Virgin Voyages; 2 points per $1 on dining, groceries, select streaming services, and EV charging; and 1 point per $1 on other purchases.

- Is there a welcome bonus for new cardholders?

- Yes, new cardholders can earn 40,000 Virgin Points after spending $3,000 within the first 90 days of opening the account.

- Are there any foreign transaction fees?

- No, the Virgin Red Rewards Mastercard does not charge foreign transaction fees, making it a great option for international travelers.

- Can I transfer points between Virgin Red and Virgin Atlantic Flying Club?

- Yes, points are interchangeable between Virgin Red and Flying Club. This flexibility allows you to use your points for flights, hotels, cruises, and more.

- What are the benefits of adding an authorized user?

- You can earn 2,500 Virgin Points for each authorized user added to your account (up to four users, maximum 10,000 points). This can help boost your points balance quickly.

- How can I redeem my Virgin Points?

- Virgin Points can be redeemed for a variety of rewards, including flights, hotel stays, cruises, and unique experiences. You can manage and redeem your points through the Virgin Red app or website.

- What are the customizable perks for high spenders?

- If you spend $15,000 annually, you can choose one perk, and if you spend $30,000, you can choose two. Options include a companion seat or cabin upgrade on Virgin Atlantic, free nights or upgrades at Virgin Hotels, or a $300 bar tab on Virgin Voyages.

- How do I apply for the Virgin Red Rewards Mastercard?

- You can apply online through the Virgin Red website by logging into your account and accessing the credit card application. Make sure to be a Virgin Red member before applying.