Wealth transfer is more than just passing down assets—it’s a strategic process that ensures financial stability for future generations while minimizing tax liabilities. With an estimated $84 trillion set to change hands in the coming decades, this “Great Wealth Transfer” presents both opportunities and challenges for families. Without careful planning, beneficiaries may face significant estate taxes, legal hurdles, and financial complications. However, with the right strategies, such as trusts, gifting, and charitable contributions, individuals can reduce tax burdens and ensure a seamless transition of wealth. This article explores the various methods of wealth transfer and how they can be structured to maximize benefits while minimizing taxes.

What is Wealth Transfer?

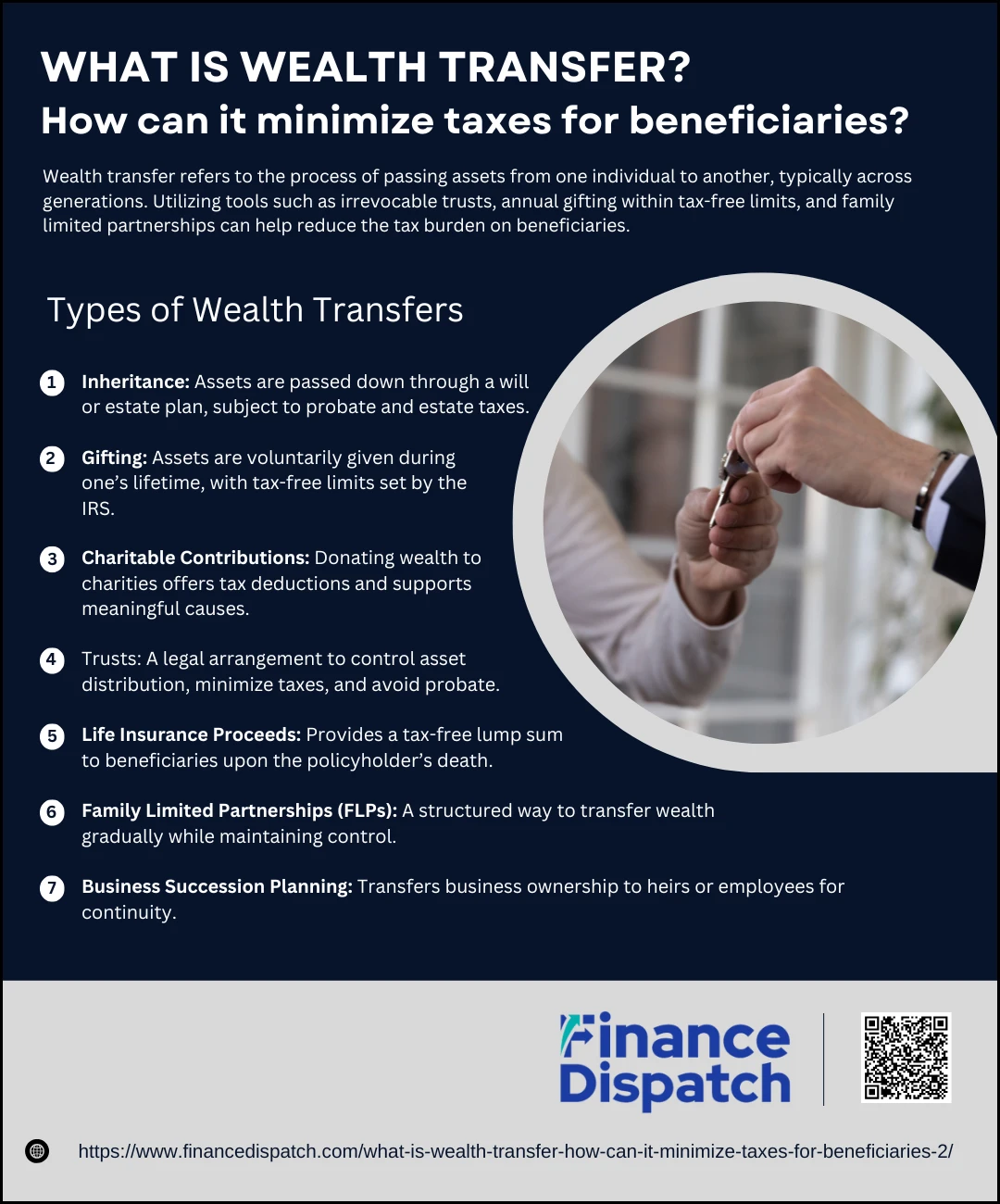

Wealth transfer refers to the process of passing financial assets, property, or other valuables from one individual to another, typically across generations. This transfer can occur through various means, including inheritance, gifting, charitable donations, and the use of legal structures like trusts and wills. While often associated with affluent families, wealth transfer is relevant to anyone looking to secure their financial legacy and support loved ones. Beyond personal benefits, strategic wealth transfer can also influence economic mobility, philanthropy, and long-term financial planning. Properly structured wealth transfers not only ensure a smooth transition of assets but can also minimize tax burdens, protecting the value of an estate for beneficiaries.

Types of Wealth Transfers

Types of Wealth Transfers

Wealth transfer is the strategic movement of assets from one individual to another, often occurring between generations. It plays a crucial role in preserving financial security, reducing tax burdens, and ensuring that wealth is distributed according to an individual’s wishes. There are several ways to transfer wealth, each with its own benefits and considerations. Below are the main types of wealth transfers and how they work.

1. Inheritance

One of the most common forms of wealth transfer, inheritance occurs when assets, such as money, property, or investments, are passed down from one generation to the next through a will or estate plan. This method allows beneficiaries to receive assets after the owner’s death, but it may be subject to estate taxes and probate.

2. Gifting

Gifting involves voluntarily transferring assets to another person during one’s lifetime. It can be done in cash, real estate, or valuable assets. The IRS allows individuals to give up to a certain amount per year, tax-free, which helps reduce the taxable value of an estate.

3. Charitable Contributions

Donating wealth to nonprofit organizations or charitable causes is another form of wealth transfer. This method not only supports meaningful causes but can also provide significant tax deductions, reducing an individual’s taxable estate.

4. Trusts

A trust is a legal arrangement where assets are held and managed by a trustee on behalf of beneficiaries. Trusts offer greater control over how wealth is distributed and can help minimize estate taxes, avoid probate, and protect assets from creditors.

5. Life Insurance Proceeds

Life insurance can be used as a wealth transfer tool, ensuring that beneficiaries receive a lump sum payout upon the policyholder’s death. This transfer is generally tax-free and can help cover estate taxes, debts, or provide financial security for heirs.

6. Family Limited Partnerships (FLPs)

FLPs allow family members to pool and manage wealth collectively. By structuring wealth as a partnership, the older generation can gradually transfer ownership to younger family members while retaining control over key assets and benefiting from tax advantages.

7. Business Succession Planning

For business owners, transferring ownership of a business to heirs or key employees is an important form of wealth transfer. This can be done through buy-sell agreements, stock transfers, or family succession planning to ensure business continuity.

Importance of Planning Wealth Transfer

Wealth transfer is not just about passing assets to the next generation—it’s about ensuring that your financial legacy is protected, distributed according to your wishes, and managed efficiently to minimize taxes and legal complications. Without proper planning, wealth can be significantly reduced due to estate taxes, probate costs, and mismanagement. A well-structured wealth transfer plan provides financial security for beneficiaries and preserves family wealth for future generations. Below are key reasons why planning wealth transfer is essential.

- Avoiding Unnecessary Taxes – Proper estate planning can reduce estate and inheritance taxes, ensuring that beneficiaries receive the maximum value of the assets.

- Preventing Family Disputes – A clear wealth transfer plan minimizes conflicts among heirs by outlining exactly how assets should be distributed.

- Ensuring Financial Security for Heirs – Thoughtful planning helps provide a stable financial future for loved ones, especially dependents who may rely on inherited wealth.

- Avoiding Probate Delays – A structured estate plan, including trusts and beneficiary designations, can help assets transfer quickly without lengthy and costly probate proceedings.

- Preserving Generational Wealth – Proper wealth transfer strategies, such as trusts and family partnerships, help maintain and grow family wealth over multiple generations.

- Supporting Charitable Causes – Strategic charitable giving as part of wealth transfer can provide tax advantages while supporting causes that align with your values.

- Protecting Assets from Creditors – Establishing trusts and structured transfers can shield assets from potential legal claims and creditors.

- Facilitating Business Succession – For business owners, having a plan in place ensures a smooth transition of ownership and continued business operations.

How Taxes Affect Wealth Transfer?

Taxes play a significant role in wealth transfer, influencing how much of an estate or gift beneficiaries actually receive. Without proper planning, taxes such as estate tax, gift tax, and inheritance tax can significantly reduce the value of transferred assets. Different tax structures apply depending on how wealth is transferred, who the recipients are, and the specific laws in place. Understanding these taxes and planning accordingly can help minimize the financial burden on heirs. The table below outlines the key taxes affecting wealth transfers, their impact, and potential strategies to mitigate them.

Taxes Impacting Wealth Transfers

| Tax Type | Description | Who Pays? | Impact on Wealth Transfer | Ways to Minimize Taxes |

| Estate Tax | A tax imposed on the total value of an estate before assets are distributed to heirs. | Paid by the estate before distribution. | Reduces the amount heirs receive if the estate exceeds the exemption limit. | Use trusts, lifetime gifting, and charitable donations to reduce taxable estate. |

| Gift Tax | A tax on financial gifts exceeding the annual exemption limit. | Paid by the giver. | Large gifts may be subject to taxation unless covered under the lifetime exemption. | Stay within the annual gift tax exemption limit ($18,000 per recipient in 2024). |

| Inheritance Tax | A tax imposed on beneficiaries who receive assets. (Not applicable in all states.) | Paid by the recipient (if applicable in their state). | Beneficiaries may owe taxes on inherited assets, reducing their net gain. | Plan inheritance in a tax-friendly manner, consider life insurance to cover tax burdens. |

| Capital Gains Tax | A tax on the profit made from selling inherited assets. | Paid by the beneficiary when selling assets. | If assets appreciate in value, heirs may owe taxes on the gain. | Use the step-up in basis rule, hold assets longer to reduce tax liability. |

| Generation-Skipping Transfer Tax (GSTT) | A tax on transfers made to individuals two or more generations below the giver. | Paid by the donor or estate. | Prevents avoiding estate taxes by skipping a generation. | Use trusts designed to minimize GSTT, apply available exemptions. |

Ways Wealth Transfer Can Reduce Tax Burden on Beneficiaries

Ways Wealth Transfer Can Reduce Tax Burden on Beneficiaries

Strategic wealth transfer planning can significantly reduce the tax burden on beneficiaries, ensuring they receive the maximum value of their inheritance. Without proper planning, estate taxes, gift taxes, and capital gains taxes can deplete a significant portion of transferred assets. However, by utilizing tax-efficient strategies, individuals can minimize these financial burdens and optimize the transfer of wealth. Below are key ways to reduce taxes on wealth transfers.

1. Utilize the Annual Gift Tax Exclusion

The IRS allows individuals to gift up to $18,000 per person per year (as of 2024) without incurring gift taxes. By gifting smaller amounts over time instead of a large lump sum, individuals can gradually transfer wealth while reducing their taxable estate.

2. Establish Irrevocable Trusts

An irrevocable trust removes assets from an individual’s taxable estate, shielding them from estate taxes. Trusts such as Grantor Retained Annuity Trusts (GRATs) and Charitable Remainder Trusts (CRTs) provide structured asset distribution while minimizing tax liabilities.

3. Take Advantage of the Lifetime Estate Tax Exemption

The federal estate tax exemption allows individuals to transfer up to $13.61 million (as of 2024) tax-free. Couples can combine their exemptions, doubling the amount. Proper estate planning ensures assets stay within this exemption limit.

4. Make Direct Payments for Education and Medical Expenses

Payments made directly to educational institutions or healthcare providers on behalf of a beneficiary are not subject to gift tax. This strategy allows individuals to support loved ones while avoiding additional taxation.

5. Use Life Insurance to Cover Estate Taxes

Life insurance proceeds are generally tax-free and can provide heirs with liquidity to cover estate taxes. Placing the policy in an Irrevocable Life Insurance Trust (ILIT) ensures that the payout is excluded from the taxable estate.

6. Set Up a Family Limited Partnership (FLP)

An FLP allows individuals to transfer business or investment assets to family members at a reduced valuation, lowering estate and gift tax liabilities while maintaining control over assets.

7. Consider a Generation-Skipping Transfer Trust (GSTT)

This type of trust allows individuals to transfer wealth to grandchildren or later generations while minimizing estate and gift taxes. The GSTT exemption ensures that assets pass down multiple generations tax-efficiently.

8. Donate to Charitable Organizations

Charitable donations reduce the taxable value of an estate while supporting meaningful causes. Charitable Lead Trusts (CLTs) and Charitable Remainder Trusts (CRTs) offer tax benefits while providing income for heirs or charities.

Strategies to Minimize Taxes on Wealth Transfer

Strategies to Minimize Taxes on Wealth Transfer

Transferring wealth to the next generation is a crucial part of financial planning, but without proper strategies, taxes can significantly reduce the amount beneficiaries receive. Estate taxes, gift taxes, and capital gains taxes can all impact wealth transfer, making it essential to implement tax-efficient methods. By carefully planning the transfer of assets, individuals can ensure their heirs inherit wealth with minimal tax burdens. Below are key strategies to minimize taxes on wealth transfer.

1. Maximize the Annual Gift Tax Exclusion

The IRS allows individuals to gift up to $18,000 per recipient annually (as of 2024) without incurring gift taxes. Spouses can combine their exclusions to gift $36,000 per person, helping to reduce taxable estates over time.

2. Use the Lifetime Estate and Gift Tax Exemption

The federal estate and gift tax exemption is set at $13.61 million per person in 2024. Strategic use of this exemption ensures that individuals can transfer significant assets tax-free during their lifetime or upon death.

3. Establish an Irrevocable Trust

An irrevocable trust removes assets from the taxable estate, shielding them from estate taxes. Popular options include Grantor Retained Annuity Trusts (GRATs) and Charitable Remainder Trusts (CRTs), which allow for tax-efficient asset distribution.

4. Make Direct Payments for Medical and Educational Expenses

Individuals can pay tuition or medical bills directly to institutions on behalf of beneficiaries without triggering gift taxes. This strategy allows for tax-free wealth transfer while providing financial support to loved ones.

5. Set Up a Family Limited Partnership (FLP)

An FLP enables individuals to transfer business or investment assets to family members at a lower tax valuation. By structuring ownership as limited partnership shares, the taxable value of transferred assets can be reduced.

6. Utilize Life Insurance Policies

Life insurance payouts are generally tax-free and can provide liquidity to cover estate taxes. Placing policies in an Irrevocable Life Insurance Trust (ILIT) ensures that proceeds remain outside the taxable estate.

7. Consider a Generation-Skipping Transfer Trust (GSTT)

By using a GSTT, individuals can pass wealth directly to grandchildren or later generations while avoiding estate and gift taxes that would otherwise apply at each generational level.

8. Donate Assets to Charitable Organizations

Charitable contributions reduce the taxable value of an estate while providing tax deductions. Charitable Lead Trusts (CLTs) and Charitable Remainder Trusts (CRTs) allow individuals to support causes while minimizing estate taxes.

9. Convert Traditional IRAs to Roth IRAs

Inherited traditional IRAs are subject to income taxes, while Roth IRAs allow beneficiaries to receive tax-free withdrawals. Converting assets to a Roth IRA can minimize future tax burdens on heirs.

10. Keep Beneficiary Designations Updated

Ensuring retirement accounts, life insurance policies, and financial assets have the correct beneficiary designations prevents unintended tax consequences and avoids probate.

Role of Professionals in Wealth Transfer

Professionals play a crucial role in ensuring a smooth and tax-efficient wealth transfer process. Estate planners, financial advisors, tax professionals, and attorneys help individuals structure their asset distribution to minimize taxes, avoid legal complications, and protect family wealth. Estate planning attorneys draft wills and trusts, ensuring that assets are transferred according to the individual’s wishes while reducing probate delays. Financial advisors develop personalized strategies to preserve and grow wealth, considering investment opportunities and risk management. Tax professionals assist in navigating estate, gift, and inheritance tax laws, helping clients take advantage of exemptions and deductions. Additionally, business succession planners ensure the seamless transfer of family-owned businesses while minimizing financial disruptions. By working with these professionals, individuals can create a comprehensive wealth transfer plan that secures their legacy and benefits future generations.

Conclusion

Wealth transfer is more than just passing down assets—it requires careful planning to ensure financial security for beneficiaries while minimizing tax burdens. Without a well-structured strategy, estate taxes, probate delays, and legal disputes can significantly reduce the value of transferred wealth. By utilizing tools such as trusts, gifting, charitable contributions, and tax exemptions, individuals can preserve their financial legacy and provide long-term benefits for their heirs. Seeking guidance from estate planners, financial advisors, and tax professionals further ensures a smooth transition of assets with minimal complications. Ultimately, a well-executed wealth transfer plan not only protects family wealth but also upholds the values and intentions of the individual, securing a prosperous future for generations to come.